By the Numbers

North American Freight Begins Long Road to Recovery

AJOT | June 16, 2020 | Intermodal | By The Numbers

The freight market seems to have bottomed out in April, but May didn't fare much better, showing only a 1.6% increase from April. Shipping volumes were down 23.6% compared to last year.

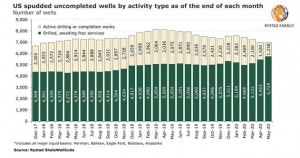

US fracking slowdown set to add at least two years of backlog work as DUC wells pile up

AJOT | June 15, 2020 | Energy | Conventional | By The Numbers

The backlog, which will likely increase in June, is equivalent to about two years of fracking at the current pace.

Cargo Volumes Continue Slide in May; Trend Could Last Through August

AJOT | June 15, 2020 | Ports & Terminals | Ports | By The Numbers

The Port of Virginia’s cargo volumes are continuing to reflect the impact of the COVID- 19 pandemic on commercial shipping as the port, in May, experienced its biggest one-month volume drop since the virus began slowing the global economy.

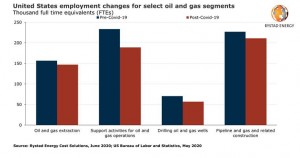

More than 100,000 oil and gas jobs already lost in the US, wages seen falling at least 8-10% in 2021

AJOT | June 12, 2020 | Energy | Conventional | By The Numbers

The US oil and gas labor market is amongst the world’s most severely hit by the downturn that the Covid-19 pandemic has brought, a Rystad Energy analysis of the latest data from the US Bureau of Labor Statistics (US BLS) reveals.

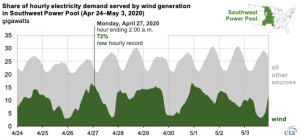

The central United States set several wind power records this spring

AJOT | June 12, 2020 | Energy | Alternative | By The Numbers

Earlier this year, the Southwest Power Pool (SPP), the regional transmission organization that manages the electric grid for much of the central United States, set records for the highest share of electricity demand supplied by wind power in both a single-hour period (72%) and a full day (62%).

U.S. fuel ethanol production and inventory changes have largely followed motor gasoline

AJOT | June 08, 2020 | Energy | Conventional | By The Numbers

U.S. fuel ethanol production fell dramatically during late March and in April 2020, driven by significant reductions in motor gasoline demand as a result of mitigation efforts for the 2019 novel coronavirus disease (COVID-19).

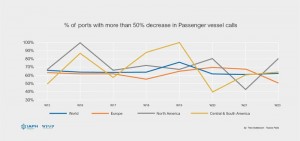

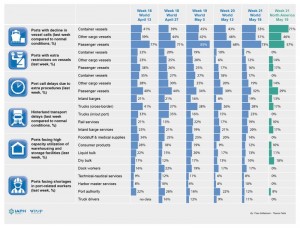

Ports report regional transshipments on the rise with cargo call volumes flat-lining or falling - WPSP

AJOT | June 08, 2020 | Ports & Terminals | Ports | By The Numbers

With a record response of 104 ports from around the world, the summary of the latest IAPH-WPSP Port Economic Impact Barometer for weeks 22 and 23 highlights the following trends

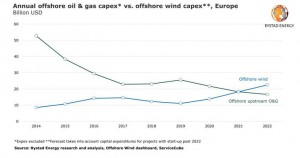

Offshore wind expenditure set to match upstream oil and gas in Europe in 2021, surpass it in 2022

AJOT | June 08, 2020 | Energy | Alternative | By The Numbers

The oil market collapse caused by the Covid-19 pandemic is set to delay several oil and gas developments in Western Europe, putting capital expenditure in the offshore sector on a continued downwards trajectory through 2022.

China’s Soybean Imports Surged in May on Buying From Brazil

Bloomberg | June 07, 2020 | International Trade | Commodity | By The Numbers

Soybean imports by China rose 27% in May from a year earlier, after crushers increased purchases from Brazil to take advantage of cheap supplies amid strong crush margins.

China’s Copper Imports Drop as Overseas Lockdowns Tighten Supply

Bloomberg | June 07, 2020 | International Trade | Commodity | By The Numbers

China, the world’s largest copper consumer, imported less metal and concentrate last month as pandemic-driven lockdowns in overseas mining regions disrupted supplies.

Oil rises again on renewed OPEC+ meeting hopes - Rystad

AJOT | June 05, 2020 | Energy | Conventional | By The Numbers

Rystad Energy’s daily market comment from our Head of Oil Markets Bjornar Tonhaugen: It’s all about the OPEC+ meeting. As it was initially intended to happen on Thursday, when that did not materialize, prices fell because traders sensed a lack of agreement between the extended group’s producing countries. Now the mood has changed again and prices rose, following news that a consensus may have been reached and a meeting is across the corner. It now seems very likely that OPEC+ will meet tomorrow to hash out a deal to extend the current May-June deep cuts for one more month. Rumors have it that a breakthrough was reached with Iraq last night and crude prices resumed gains this morning, both for Brent and WTI. Iraq has struggled to comply fully with their 1.061 million bpd target cut, delivering only around a 400,000 bpd cut for the first month of May 2020. Assurances and agreements with IOCs operating in Iraq has now been reached, and Iraq has a higher chance of being able to reduce production from the giant IOC-operated fields in the Basrah region than ever before. However, we are still skeptical that Iraq will be able to deliver the 1 million bpd cuts in full, and for now see an additional cut of 100,000-200,000 bpd in July as more likely. The more interesting question for the oil market right now is what happens from August onwards. As long as the demand recover stays intact, we believe the crude market will be in deficit also in August and onwards, despite cuts being tapered by 2 million bpd to the scheduled 7.7 million bpd level. That will ensure a fundamental support for prices, while also spurring a quicker reactivation of curtailed US oil production, and eventually frac crews ending their holidays early. Indications show that a bit more than 300,000 bpd from shut US production is actually coming back online already from June as a result of the current price levels. OPEC+ is fully aware of this balancing act as they prepare to meet virtually over the weekend. And the producers are not just interested only at reactivating production, they have a stock build that they want to trim as well. The deficit will help reduce that burden and bring back healthier price levels sooner than it was maybe thought. So, even if demand exceeds supply for a while, that does not mean that we really have a problem to source oil. Oil is there, lots of it, waiting to be drawn from storage facilities.

The Global Forest Industry First Quarter 2020

AJOT | June 05, 2020 | International Trade | Commodity | By The Numbers

There were relatively few price changes for sawlogs throughout the world in the 1Q/20 despite interruptions in trade and uncertainty in short-term lumber demand in many of the key markets.

FTR Reports North American Class 8 Net Orders Remain Subdued in May at 6,600 Units

AJOT | June 03, 2020 | Intermodal | Trucking | By The Numbers

FTR reports preliminary North American Class 8 net orders for May remained subdued at 6,600 units. While up 61% from the dismal April activity, the May orders were down 37% y/y. Class 8 net orders for the last twelve months total 155,000 units.

FIS Air Freight Report June 2, 2020

AJOT | June 02, 2020 | By The Numbers

The China to USA route begins a very sharp slide into weaker territory, down -22.44% in one week to a still relatively high level of $7.12. China to Europe, supported by price strength out of Hong Kong, drops out a shallower 6.97% or 55 cents.

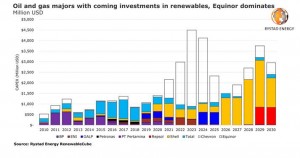

Among oil majors promising renewable investments, only one is putting serious money on the table

AJOT | May 29, 2020 | Energy | Conventional | By The Numbers

Investments in solar and wind energy projects by the world’s oil majors over the next five years are expected to reach $17.5 billion, a Rystad Energy analysis finds.

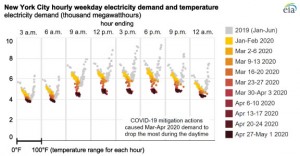

Daytime electricity demand in New York City most affected by COVID-19 mitigation actions

AJOT | May 22, 2020 | Energy | Conventional | By The Numbers

Actions to mitigate the 2019 novel coronavirus disease (COVID-19) have caused daily weekday electricity demand in New York City to decrease by 16% in April compared with expected demand, after accounting for seasonal temperature changes.

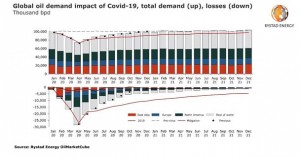

Road fuels get a small boost, US oil demand revised higher, Europe’s lower

AJOT | May 22, 2020 | Energy | Conventional | By The Numbers

Rystad Energy’s weekly comprehensive Covid-19 report calculates the effect of the novel coronavirus on our lives and offers updated estimates for global fuel markets.

Global Survey on impact of COVID19 on ports: regional differences becoming more pronounced

AJOT | May 22, 2020 | Ports & Terminals | Ports | By The Numbers

IAPH-WPSP Port Economic Impact Barometer for week 21 also confirms global trend towards decreasing capacity utilization of liquid and dry bulk storage at ports

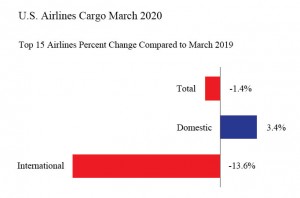

March 2020 U.S. Airline Cargo Data (Preliminary): International Cargo Weight Down 14%

AJOT | May 21, 2020 | Air Cargo | Freighters | By The Numbers

U.S. airlines carried 1.4% less cargo by weight in March 2020 than in March 2019, according to preliminary data filed with the Bureau of Transportation Statistics (BTS) by 15 of the leading cargo airlines.

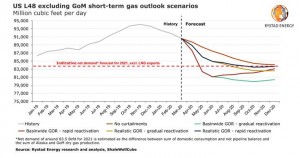

US gas production set to hit bottom in November due to Covid-19-related shut-ins and drilling decline

AJOT | May 19, 2020 | Energy | Conventional | By The Numbers

The Covid-19 pandemic has forced oil and gas producers to slash budgets and reduce drilling activity, which in the US always affects future hydrocarbon output as existing fields naturally decline.

© Copyright 1999–2025 American Journal of Transportation. All Rights Reserved