By the Numbers

March 2024 U.S. Airline Traffic Data Up 6.3% from the same month last year

AJOT | June 13, 2024 | Air Cargo | General | By The Numbers

U.S. airlines carried 84.8 million systemwide (domestic and international) scheduled service passengers in March 2024, according to the Bureau of Transportation Statistics (BTS)...

Fraport Traffic Figures – May 2024: Increase in passenger numbers and cargo volumes

AJOT | June 13, 2024 | Air Cargo | General | By The Numbers

Frankfurt Airport welcomed 5.5 million passengers – Increase of 6.9 percent year-on-year – Passenger growth of 6.3 percent achieved across Fraport Group...

US importers caught in a vicious circle with labor union strike threat

AJOT | June 12, 2024 | Ports & Terminals | Ports | By The Numbers

Labor union strike threat raises fears of soaring freight rates and massive disruption at US East and Gulf Coast ports.

American Metals Supply Chain Institute: June 2024 Market Update

AJOT | June 11, 2024 | Logistics | Supply Chain | By The Numbers

The combination of elevated inflation and a strong labor market continues to push lower interest rates further away...

Shell Plc First Quarter 2024 Euro and GBP equivalent dividend payments

AJOT | June 10, 2024 | By The Numbers

The Board of Shell plc today announced the pounds sterling and euro equivalent dividend payments in respect of the first quarter 2024 interim dividend, which was announced on May 2, 2024 at US$0.344 per ordinary share...

London P&I Club reports strong financial results for the 2023/24 financial year

AJOT | June 10, 2024 | Maritime | By The Numbers

The London P&I Club has today announced its financial results for 2023/24, reporting an operating surplus of US$36.3m, strengthening its free reserves to US$149.8m...

May 2024 U.S. Transportation Sector Unemployment (5.5%) rises above the May 2023 level (3.6%) and pre-pandemic May 2019 level

AJOT | June 07, 2024 | By The Numbers

The unemployment rate in the U.S. transportation sector was 5.5% (not seasonally adjusted) in May 2024 according to Bureau of Labor Statistics (BLS). These data have been updated on the Bureau of Transportation Statistics’ (BTS) Unemployment in Transportation dashboard...

Finnair Traffic Performance in May 2024

AJOT | June 06, 2024 | Air Cargo | General | By The Numbers

Number of passengers increased due to additional capacity whereas PLF declined year-on-year, increase in cargo figures continued...

Mid-term analysis shows global air cargo on its way to double-digit growth in 2024

AJOT | June 05, 2024 | Air Cargo | General | By The Numbers

The global air cargo market is on a pathway to double-digit growth in volumes in 2024 after a +12% year-on-year jump in demand in May, according to the latest data analysis by Xeneta...

WorldACD Weekly Air Cargo Trends (week 21) - 2024

AJOT | June 03, 2024 | Air Cargo | General | By The Numbers

Global rates stabilize above last year's levels...

CMA CGM: First-quarter 2024 financial results

AJOT | May 17, 2024 | Maritime | By The Numbers

A solid Group pursuing its transformation in a volatile market environment...

FTR’s Trucking Conditions Index falls in March mostly due to rates

AJOT | May 15, 2024 | Trucking | By The Numbers

FTR’s Trucking Conditions Index fell in March to -7.25 – the most negative reading since September 2023. The February reading was -5.31. Highly unfavorable freight rates were the principal headwind for the trucking industry in March as the market remains soft for trucking companies...

Seanery Maritime reports strongest first quarter in company’s history with income of $10.2 million

AJOT | May 15, 2024 | Maritime | By The Numbers

Seanergy Maritime reports record financial results for the quarter ending March 31, 2024 and declares cash dividends of $0.15 per share...

Hapag-Lloyd with good start to 2024 in first quarter of year

AJOT | May 15, 2024 | Maritime | By The Numbers

Hapag-Lloyd concluded the first quarter of 2024 with a Group EBITDA of USD 942 million (EUR 868 million). Compared to the same quarter of the previous year, the Group EBIT decreased to USD 396 million (EUR 365 million) and the Group profit to USD 325 million (EUR 299 million)...

Fraport Traffic Figures – April 2024: Passenger and freight volumes continue to grow

AJOT | May 15, 2024 | Air Cargo | Airports | By The Numbers

Frankfurt Airport welcomed about 5.1 million passengers in April – Increase of 5.6 percent year-on-year – Passenger growth of 7.0 percent achieved across all Fraport Group airports...

XPO Reports First Quarter 2024 Results

AJOT | May 03, 2024 | Trucking | By The Numbers

XPO announced its financial results for the first quarter 2024. The company reported diluted earnings from continuing operations per share of $0.56, compared with $0.15 for the same period in 2023, and adjusted diluted earnings from continuing operations per share of $0.81, compared with $0.56 for the same period in 2023.

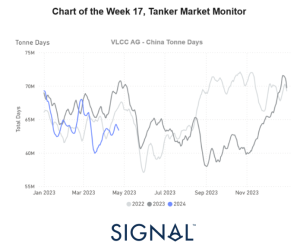

Tanker - Weekly Market Monitor - Week 17

AJOT | April 26, 2024 | Energy | Maritime | By The Numbers

Chart of the Week: VLCC AG-Far East tonne days. A downward revision in the growth of VLCC tonne days from AG to the Far East from March onwards...

What’s the future for ocean carrier alliances?

George Lauriat | April 22, 2024 | Maritime | Liner Shipping | By The Numbers

In 2025 Maersk and Hapag will begin their Gemini Cooperation alliance while MSC will go it alone. So with all these domino changes, what’s the future of ocean carrier alliances?

Port of Corpus Christi announces first quarter 2024 volumes

AJOT | April 19, 2024 | Ports & Terminals | Ports | By The Numbers

The Port’s customers saw a slight increase in crude oil shipments during this period to 30.2 million tons, and a significant increase in agricultural shipments, but that was outweighed by decreases in refined products and shipments of LNG...

Cathay Pacific releases traffic figures for March 2024

AJOT | April 19, 2024 | Air Cargo | General | By The Numbers

Cathay Pacific today released its traffic figures for March 2024, which showed strong demand for travel from Hong Kong driven by the Easter holiday period, and travel to Hong Kong supported by the various exhibitions and events held in the city...

© Copyright 1999–2025 American Journal of Transportation. All Rights Reserved