By the Numbers

Solar power and batteries account for 60% of planned new U.S. electric generation capacity

AJOT | March 08, 2022 | Energy | Alternative | By The Numbers

Power plant developers and operators expect to add 85 gigawatts (GW) of new generating capacity to the U.S. power grid from 2022 to 2023, 60% (51 GW) of which will be made up of solar power and battery storage projects, according to data reported in our Preliminary Monthly Electric Generator Inventory. In many cases, projects combine these technologies.

Gas markets hit record highs on Russia sanctions fear – Rystad Energy

AJOT | March 08, 2022 | Energy | Conventional | By The Numbers

The conflict in Ukraine and speculation over sanctions in Russia have caused gas prices to reach record highs today, while LNG imports to Europe are down marginally month-over-month.

U.S. to release 30 million barrels of crude oil from its Strategic Petroleum Reserve

AJOT | March 08, 2022 | Energy | Conventional | By The Numbers

On March 1, the U.S. Department of Energy committed to releasing 30 million barrels of crude oil from the U.S. Strategic Petroleum Reserve (SPR) to ensure an adequate supply of petroleum in response to Russia’s further invasion of Ukraine.

U.S. transportation sector unemployment rate increases to 5.4% in February 2022

AJOT | March 04, 2022 | International Trade | By The Numbers

Remains above pre-pandemic level of 3.8% in February 2020

WorldACD trends for the past 5 weeks (wk 8)

AJOT | March 04, 2022 | Air Cargo | Freighters | By The Numbers

WorldACD views on air cargo market developments, covering each of the last 5 weeks up till Sunday 27 February.

Crude oil prices increase above $100 per barrel following Russia’s invasion of Ukraine

AJOT | March 04, 2022 | Energy | Conventional | By The Numbers

Following reports that Russian forces invaded Ukraine on Thursday, February 24, the front-month futures price of both Brent and West Texas Intermediate (WTI) crude oil have increased to more than $100 per barrel (b).

US sanctions begin to bite, while Russian LNG vessels still headed for W.Europe ports - Rystad Energy

AJOT | March 04, 2022 | Energy | Conventional | By The Numbers

Gas and LNG prices continue to rise. US sanctions begin to bite, Russian LNG vessels headed for Western European ports and Ukraine suspends exports of its domestic supply of gas.

Valencia Containerised Freight Index (VCFI) falls by 0.19% in February

AJOT | March 04, 2022 | Ports & Terminals | Ports | By The Numbers

The VCFI stands at 4,254.52 points. Geopolitical tensions over Russia's war with Ukraine and fuel prices will drive freight rates in the coming months

WorldACD: Trends for the past 5 weeks (wk 6)

AJOT | February 18, 2022 | Air Cargo | Freighters | By The Numbers

WorldACD's latest views on air cargo market developments, covering each of the last 5 weeks up till Sunday 13 February.

Fitch affirms TTX ratings at ‘A’

AJOT | February 18, 2022 | Intermodal | Rail | By The Numbers

Fitch Ratings has affirmed TTX Company's (TTX) Long-Term Issuer Default Rating (IDR) and senior unsecured debt rating at 'A'. The Rating Outlook is Stable.

Don’t call it a comeback: Coal power increased in Europe in 2021 on gas supply concerns and limited alternatives

AJOT | February 18, 2022 | Energy | Conventional | By The Numbers

Following several years of strategic de-carbonization of the European power market, preliminary numbers suggest coal-generated electricity increased in the region last year for the first time in almost a decade, rising 18% from 470 terawatt-hours (TWh) in 2020 to 579 TWh, Rystad Energy research shows.

Port of LA handles record 865,595 container units

AJOT | February 18, 2022 | Ports & Terminals | Ports | By The Numbers

The Port of Los Angeles processed 865,595 Twenty-Foot Equivalent Units (TEUs) in January, a 3.6% increase compared to last year. It was the Port’s busiest January in its 115-year history and a new milestone for a Western Hemisphere port.

Top 100 North American Importers 2021

AJOT | February 14, 2022 | International Trade | By The Numbers

Top 100 North American Importers using data from Descartes / Datamyne consolidated by AJOT

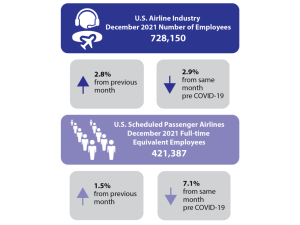

U.S. cargo and passenger airlines add 20,049 jobs in December 2021

AJOT | February 09, 2022 | Air Cargo | Airlines | By The Numbers

Reaching COVID-19 pandemic high however employment remains 2.9% below pre-pandemic December 2019

Rail Traffic for the Week Ending February 5, 2022

AJOT | February 09, 2022 | Intermodal | Rail | By The Numbers

For this week, total U.S. weekly rail traffic was 458,152 carloads and intermodal units, down 7.6 percent compared with the same week last year.

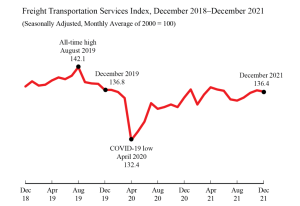

BTS December 2021 Freight Transportation Services Index (TSI)

AJOT | February 09, 2022 | International Trade | By The Numbers

The Freight Transportation Services Index (TSI), which is based on the amount of freight carried by the for-hire transportation industry, fell 0.2% in December from November, falling for the first month after three consecutive months of growth, according to the U.S. Department of Transportation’s Bureau of Transportation Statistics’ (BTS).

GPA handles 479,000 TEUs in January

AJOT | February 09, 2022 | Ports & Terminals | Ports | By The Numbers

The Port of Savannah handled a record 479,700 twenty-foot equivalent container units of cargo in January, an increase of 4 percent over the same month a year ago, a month in which cargo volumes had expanded by 22 percent.

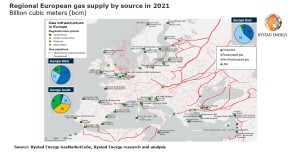

Russia-Ukraine tensions could jeopardize 30% of European gas demand

AJOT | February 09, 2022 | Energy | Conventional | By The Numbers

An escalation of military tensions between Russia and Ukraine could put up to 155 billion cubic meters per year of natural gas imports to Europe at risk, if the conflict causes Russia to halt deliveries, Rystad Energy research estimates. The figure corresponds to 30% of Western Europe’s annual gas demand.

OCBC Bank extends sustainability-linked loan to U-Ming Marine

AJOT | February 09, 2022 | Maritime | Bulk | By The Numbers

The loan demonstrates U Ming’s strong commitment to decarbonising its fleet to meet the International Maritime Organisation’s (IMO) target of achieving a 70% reduction in carbon intensity of international shipping by 2050, compared to 2008.

South Carolina Ports has record January for containers

AJOT | February 09, 2022 | Ports & Terminals | Ports | By The Numbers

South Carolina Ports had a record January for containers handled at the Port of Charleston, following an unprecedented amount of cargo handled in 2021.

© Copyright 1999–2024 American Journal of Transportation. All Rights Reserved