By the Numbers

Robust April volume breaks another record at Port of Los Angeles

AJOT | May 14, 2021 | Ports & Terminals | Ports | By The Numbers

he Port of Los Angeles handled 946,966 Twenty-Foot Equivalent Units (TEUs) in April, a spike of 37% compared to last year. It was the best April in the Port’s 114-year history, and the ninth consecutive month of year-over-year increases.

Rail Traffic for April and the Week Ending May 1, 2021

AJOT | May 05, 2021 | Intermodal | Rail | By The Numbers

U.S. railroads originated 951,840 carloads in April 2021, up 23.7 percent, or 182,060 carloads, from April 2020. U.S. railroads also originated 1,173,952 containers and trailers in April 2021, up 33.8 percent, or 296,758 units, from the same month last year.

US shale pre-hedge revenues are set for an all-time high in 2021 if WTI prices remain strong

AJOT | May 05, 2021 | Energy | Conventional | By The Numbers

The US shale industry is set to achieve a significant milestone in 2021: If WTI futures continue their strong run and average at $60 per barrel this year and natural gas and NGL prices remain steady, producers can expect a record-high hydrocarbon revenue of $195 billion before factoring in hedges, a Rystad Energy analysis shows.

Drewry: Reefer container freight rates soar but remain outgunned by dry box rates

AJOT | May 05, 2021 | Maritime | Liner Shipping | By The Numbers

Reefer container freight rates have risen sharply this year but remain far outgunned by the inexorable rise in dry box pricing, according to Drewry’s newly launched Reefer Shipping Forecaster report.

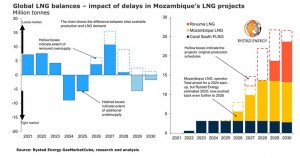

Global LNG market faces supply deficit, higher prices from decade-long impact of Mozambique delays

AJOT | May 05, 2021 | Energy | Conventional | By The Numbers

The global liquefied natural gas (LNG) market, which was set to be constantly loose in the second part of this decade, is instead set to get tighter and could even see annual supply deficits as a result of likely delays in the development of LNG projects in Mozambique due to the country’s worsening security situation, a Rystad Energy report reveals.

Big Oil could see proven reserves run out in less than 15 years as output is not replaced by discoveries

AJOT | May 05, 2021 | Energy | Conventional | By The Numbers

The proven oil and gas reserves of the group of major companies called “Big Oil” are falling at an alarming rate, as produced volumes are not being fully replaced with new discoveries.

European Road Freight Rate Benchmark Q1 2021: average rates increase 0.5% q-on-q in spite of 3rd Covid wave

AJOT | May 05, 2021 | Intermodal | Trucking | By The Numbers

Ti and Upply’s European Road Freight Rate Benchmark Q1 2021 shows that rates have increased amid the disruption of Brexit and new lockdowns across Europe as businesses work to keep moving under pressure.

Air cargo volumes bounce back in April as the air cargo system remains under ‘significant strain’

AJOT | May 05, 2021 | Air Cargo | Freighters | By The Numbers

Global air cargo demand bounced back into growth in April after a -3% dip in March, with high load factors keeping the international airfreight system under significant strain as the traditional surge in summer capacity has so far failed to materialise for a second consecutive year, say industry analysts CLIVE Data Services and TAC Index.

Rystad Energy’s daily market comment from our Oil Markets Analyst Louise Dickson

AJOT | May 05, 2021 | Energy | Conventional | By The Numbers

The bullish momentum for oil prices looks like it’s here to stay as traders stand by their solid expectations that global demand is going to grow very soon, outpacing supply.

FTR reports preliminary North American Class 8 Net orders remain strong in April at 34,600 units

AJOT | May 05, 2021 | Intermodal | Trucking | By The Numbers

FTR reports preliminary North American Class 8 net orders for April were 34,600 units, continuing to exhibit strength above normal trends. It was the best April order activity since 2018. Orders were down 15% m/m but 30,500 units above April 2020. Class 8 orders now total 403,000 units for the previous 12 months.

DAT: Spot rates are in a very different place compared to a year ago

AJOT | May 04, 2021 | Intermodal | Trucking | By The Numbers

It's been one year since the protests in Washington, DC, when distressed truckers descended on the Capitol to protest low freight rates. The average spot market van rate is now almost $1.00 higher per mile than it was back then. Van rates cooled last week, but reefer continues to heat up and flatbed is on fire. In what can only be described as an unprecedented flatbed rate rally, the national average rate continued climbing last week, moving up another 4 cents.

U.S. imports of biomass-based diesel increased 12% in 2020

AJOT | May 04, 2021 | Energy | Conventional | By The Numbers

U.S. imports of biomass-based diesel, which include biodiesel and renewable diesel, grew 12% in 2020 to more than 31,000 barrels per day (b/d), increasing for the second consecutive year.

Rystad Energy’s daily market comment from our Oil Markets Analyst Louise Dickson

AJOT | May 04, 2021 | Energy | Conventional | By The Numbers

After last week’s cautious approach, the oil market this week is getting increasingly optimistic that an oil demand uptick is getting closer in Europe and the US, where Covid-19 restrictions are in the process, or just about to be lifted, and as gasoline consumption is on the rise.

Rystad Energy’s daily market comment from our Oil Markets Analyst Louise Dickson

AJOT | May 03, 2021 | Energy | Conventional | By The Numbers

Expectations that global oil demand will rise by millions of barrels daily from the summer onwards have been fueling the recent price rally but the oil market is beginning to lift the lid on the black box of Indian oil demand, and doesn’t like the demand destruction it sees.

Hardwood fiber costs for pulp mills worldwide increased modestly at the end of 2020

AJOT | May 03, 2021 | International Trade | Commodity | By The Numbers

Costs were still substantially lower in many markets compared to late 2019

Rystad Energy’s daily market comment from our Head of Oil Markets Bjornar Tonhaugen:

AJOT | April 30, 2021 | Energy | Conventional | By The Numbers

Oil prices are trimming some value on Friday, reducing some risk and taking some profit from earlier gains as the end of a good week approaches.

ExxonMobil earns $2.7 billion in First Quarter 2021

AJOT | April 30, 2021 | Energy | Conventional | By The Numbers

First quarter capital and exploration expenditures were $3.1 billion, $4 billion lower than the first quarter of 2020.

IANA: Intermodal continues comeback in first quarter

AJOT | April 30, 2021 | Intermodal | By The Numbers

Total intermodal volumes rose 10.5 percent year-over-year in the first quarter of 2021, according to the Intermodal Association of North America’s Intermodal Quarterly report. International containers gained 14.8 percent from 2020; domestic shipments, 4.4 percent; and trailers, 20.0 percent

Taiwan posts fastest growth since 2010 on export-fueled boom

Bloomberg | April 30, 2021 | International Trade | By The Numbers

Taiwan’s economy grew the fastest in more than 10 years in the first quarter as companies scrambled to build new production lines in an effort to keep up with an insatiable overseas appetite for computer chips and other electronic goods.

Airline gives surprise profit outlook even as planes remain grounded

Bloomberg | April 30, 2021 | Air Cargo | Airlines | By The Numbers

ANA Holdings Inc. issued a surprise profit outlook for the fiscal year, even as international air travel to and from Japan remains limited and countries across the globe recover from the pandemic at different speeds.

© Copyright 1999–2024 American Journal of Transportation. All Rights Reserved