By the Numbers

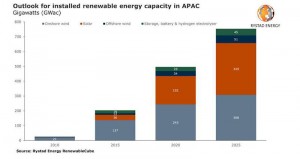

Rystad: Asia-Pacific’s renewable energy capacity set for 50% growth over five years, driven by solar

AJOT | October 20, 2020 | Energy | Alternative | By The Numbers

Installed capacity of renewable energy in the Asia-Pacific region is set for a major boost in the next five years, to 754 gigawatts (GW) in 2025 from 497 GW this year, a Rystad Energy analysis shows.

Rystad Energy’s daily market comment from our Head of Oil Markets Bjornar Tonhaugen

AJOT | October 19, 2020 | Energy | Conventional | By The Numbers

Despite today’s mild decline, thinking that oil prices are still managing to keep their 40+ dollar levels in a market that is getting a daily bearish beating, we have to admit that oil has been resilient lately.

Japan’s exports fall at much slower pace as trade improves

Bloomberg | October 18, 2020 | International Trade | By The Numbers

Japan’s exports fell by the smallest margin in seven months in September in another sign that the pandemic’s hit on global trade is easing.

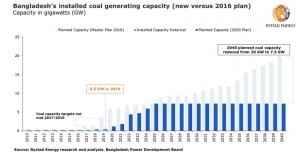

Once coal’s future haven, Bangladesh is now set to leave developers and importers in hot water

AJOT | October 08, 2020 | Energy | Conventional | By The Numbers

Bangladesh’s 2016 energy plan showed some 20 gigawatts (GW) of coal power capacity to be developed in the next two decades.

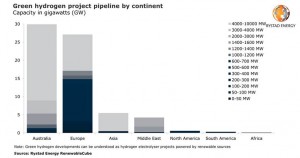

Green hydrogen plans already top 60 GW, but less than half is likely to operate by 2035 as costs bite

AJOT | October 08, 2020 | Energy | Alternative | By The Numbers

Proposed green hydrogen projects are surging across the globe as governments seize opportunities afforded by post-pandemic green stimulus packages.

Rail Traffic for September and the Week Ending October 3, 2020

AJOT | October 07, 2020 | Intermodal | Rail | By The Numbers

U.S. railroads originated 1,119,546 carloads in September 2020, down 9.7 percent, or 119,909 carloads, from September 2019. U.S. railroads also originated 1,423,883 containers and trailers in September 2020, up 7.1 percent, or 94,351 units, from the same month last year.

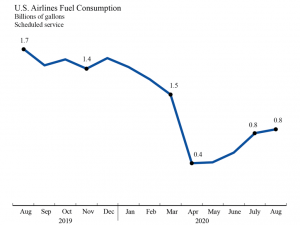

U.S. Airlines August 2020 Fuel Use Up 5% from July

AJOT | October 07, 2020 | Air Cargo | Airlines | By The Numbers

The Department of Transportation’s Bureau of Transportation Statistics (BTS) today released U.S. airlines’ August Fuel Cost and Consumption numbers.

China-US rates steady, but strong demand expected to return [FBX Weekly]

AJOT | October 07, 2020 | Maritime | Liner Shipping | By The Numbers

Breathe a sigh of relief. China-US ocean rates went unchanged this week, marking only the second time since the end of May that a scheduled General Rate Increase (GRI) was not introduced. But record levels of capacity into November indicate that carriers expect demand to be strong post-Golden Week.

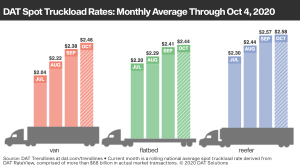

DAT Freight Trends on the Spot Market – Sept 28-Oct 4, 2020

AJOT | October 07, 2020 | Intermodal | By The Numbers

The national average spot van rate hit a record high of $2.46 per mile during the week ending Oct. 4 and the overall number of available loads increased 5% compared to the previous week as supply chain disruptions push freight to the spot market, according to DAT Freight & Analytics, which operates the industry’s largest load board network.

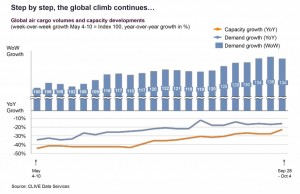

‘Boring is good’ as global air cargo market takes another step to recovery in September

AJOT | October 07, 2020 | Air Cargo | Freighters | By The Numbers

A record ‘dynamic loadfactor’ and high airfreight rates on the world’s premier trade lanes in September showed the global air cargo market edging towards a sustainable recovery at the start of the traditional peak season, say leading industry analysts CLIVE Data Services and TAC Index.

Rystad Energy’s daily market comment from our Head of Oil Markets Bjornar Tonhaugen

AJOT | October 07, 2020 | Energy | Conventional | By The Numbers

Today’s oil price move has Donald Trump’s name written all over it. And it’s a bizarre day as Donald-Trump-related news sit on both sides of the scale.

U.S. Trade Deficit Widened in August to Largest Since 2006

Bloomberg | October 06, 2020 | International Trade | By The Numbers

The U.S. trade deficit widened in August to the largest since 2006 as the nation imported a record amount of consumer goods amid a pickup in demand ahead of the holiday-shopping season.

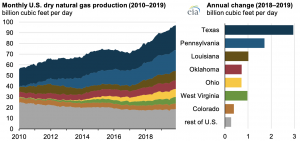

U.S. natural gas production, consumption, and exports set new records in 2019

AJOT | October 05, 2020 | Energy | Conventional | By The Numbers

The U.S. Energy Information Administration’s (EIA) Natural Gas Annual shows that the United States set new records in natural gas production, consumption, and gross exports in 2019.

Hurricane Laura shut in more Gulf of Mexico crude oil production than any storm since 2008

AJOT | October 02, 2020 | Energy | Conventional | By The Numbers

According to daily estimates from the U.S. Bureau of Safety and Environmental Enforcement (BSEE), Hurricane Laura reduced crude oil production in the Federal Offshore Gulf of Mexico by an estimated 14.4 million barrels over a span of 15 days, the most of any hurricane since the combined effect of Hurricanes Gustav and Ike in 2008.

Xeneta Reports Spot rates on Trans-Pacific -2% while Far-East to N.Europe +2.4% WoW

AJOT | October 02, 2020 | Maritime | Liner Shipping | By The Numbers

"Xeneta sees early indications that carriers are not ready to break the psychological barrier on the trans-Pacific eastbound but upwards pressure remains on the European counterpart during Golden week. TP Eastbound is WoW down USD 70 per 40' and Far East - North Europe main ports is up WoW USD 50 per 40'.”

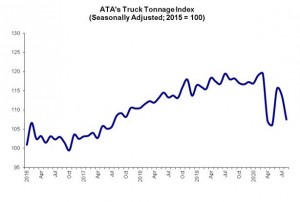

ATA Truck Tonnage Index Fell 5.6% in August

AJOT | September 22, 2020 | Intermodal | Trucking | By The Numbers

American Trucking Associations’ advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index decreased 5.6% in August after declining 1.4% in July. In August, the index equaled 107.5 (2015=100) compared with 113.9 in July.

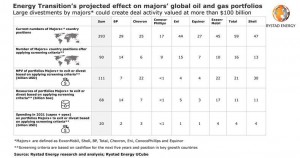

Rystad: Energy transition could push oil majors to sell or swap oil and gas assets of more than $100 billion

AJOT | September 22, 2020 | Energy | Conventional | By The Numbers

The global energy market is on the brink of a major transition to cleaner sources of energy. To adjust and transform, the world’s largest oil and gas firms are revising their long-term oil price and demand outlook, and need to streamline their portfolios significantly to improve cash flow, cost efficiency and competitiveness. As a result, several billions of dollars in assets are about to change hands.

Fleet Advantage’s TLDI shows continued fuel savings & carbon reduction

AJOT | September 22, 2020 | Intermodal | Trucking | By The Numbers

Asset lifecycle plan helped one fleet preserve 848,575 gallons of diesel

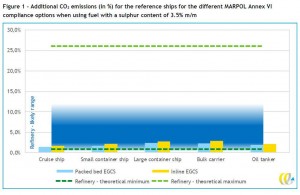

Scrubbers beat compliant fuel in race to reduce CO2 emissions

AJOT | September 22, 2020 | Maritime | By The Numbers

As part of their ongoing commitment to support greener shipping, Yara Marine has jointly commissioned a report to quantify the climate impact of scrubbers compared to low sulphur fuel oil.

August / mid-September 2020: air cargo before the “second wave”

AJOT | September 22, 2020 | Air Cargo | Freighters | By The Numbers

Based on the data for over 1.5 million shipments, August showed a year-over-year (YoY) drop of 17.2% in worldwide volume and of 29% in shipments carried, but a YoY increase in revenues (USD) of 37%, thanks to rates in USD that were 65% higher than the year before (2.83 vs 1.71).

© Copyright 1999–2025 American Journal of Transportation. All Rights Reserved