By the Numbers

Oil bounces back with boost from rising equities and technicals

Bloomberg | September 09, 2020 | Energy | Conventional | By The Numbers

Oil rebounded as broader markets clawed back some losses from Tuesday’s swift selloff.

DAT: Spot rates hit new highs heading into holiday

AJOT | September 09, 2020 | Intermodal | Trucking | By The Numbers

Aug 31 - Sept 6 - The average linehaul rate for dry van freight set an all-time record high in August (all-in spot rates were higher in June 2018 due to higher fuel surcharges).

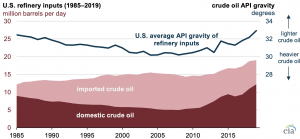

The U.S. continued to produce more light crude oil in 2019 and import less heavy crude oil

AJOT | September 09, 2020 | Energy | Conventional | By The Numbers

This increase in production was led by relatively light, less dense crude oil and was largely the result of the growth in crude oil production from shale and tight rock formations.

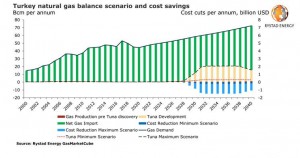

Turkey’s hooked Tuna gas discovery could save it up to $21 billion in import costs

AJOT | September 09, 2020 | Energy | Conventional | By The Numbers

The future development of Turkey’s giant Tuna-1 gas discovery could save the country up to $21 billion in import costs, Rystad Energy estimates, depending on the field’s peak output, which remains to be determined pending appraisal drilling and further testing. Actual savings could be even higher as global gas prices and import costs are expected to rise in coming years.

Rystad Energy’s daily market comment from our Senior Oil Markets Analyst Paola Rodriguez-Masiu

AJOT | September 09, 2020 | Energy | Conventional | By The Numbers

After registering on Tuesday the worst one-day drop since late-June, oil prices finally ticked up a bit this morning with Brent breaking back to 40+ dollar territory. The gains today, so far below a dollar in both grades, are indeed a rectification of the massive blow the market took yesterday. But the real overall correction is the price decline itself which started last week and continued until this morning. The balances outlook has been tight and we have been expecting a bearish correction for a while, but in the last days it came like a blow to shock the market. The persistence of Covid-19 infections globally and in key oil-consuming markets in particular has been asking for a price squeeze since some time. The market really worries and has been worrying about stalling demand, and bearish news keep emerging. One of the latest bearish signals came yesterday from Abu Dhabi after the country announced cuts to its official selling price. Abu Dhabi followed Saudi Arabia's price cuts from Saturday and is the first trimming done to prices in about four months. When strong Middle Eastern producers are willing to sell-off in lower prices it is normal that the global market panics and follows suit. The panic is what registered the massive losses yesterday and that is why we see the minor uptick this morning. But make no mistake, it may take a while to see the return of 45-dollar levels that oil prices have been enjoying recently. The real correction happened and it was a bearish one. The market is fragile and if traders have been enjoying a summer utopia, they finally woke up to the reality of the oil demand recovery’s prospects. Our liquids balances now point to a just-balanced market that could very quickly tip over if OPEC+ members start to reduce compliance, or if fears of a worsening demand outlook become a reality. In addition, our current balances outlook shows that the market will fall short of the titanic task of eliminating the surplus that was accumulated during the first half of the year. As a result, inventories are expected to remain at high levels for longer, pressuring prices well into 2021. Looking at the bigger picture, the current bearish price correction was inevitable. It is not only the demand-side of the equation that is looking increasingly worrying. There is also the threat of supply coming back quicker than anticipated due to mounting economic pressure in OPEC+ economies, which are currently suffering from a double whammy: lower volumes and lower prices.

Oil extends losses after first sub-$40 close since mid-June

Bloomberg | September 09, 2020 | Energy | Conventional | By The Numbers

Oil extended losses after its biggest one-day drop in more than two months as growing doubts over the strength of the global demand recovery along with continued weakness in stocks soured market sentiment.

Airline travel over Labor Day surges to most since March

Bloomberg | September 08, 2020 | Air Cargo | Airlines | By The Numbers

On Friday, 968,673 people passed through security screening portals at U.S. airports, the Transportation Security Administration said on its website. That was 44.1% of the equivalent day last year, the most since levels plunged in mid-March.

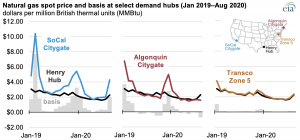

Natural gas price differentials to Henry Hub narrowed at most hubs in first half of 2020

AJOT | September 08, 2020 | Energy | Conventional | By The Numbers

The average spot price differentials between regional natural gas hubs and the Henry Hub, also typically known in the natural gas industry as the basis price, have narrowed at many trading hubs in the first half of 2020 compared with the first half of 2019.

Latin America’s renewable energy capacity set to skyrocket to 123 GW by 2025

AJOT | September 08, 2020 | Energy | Alternative | By The Numbers

Latin America is emerging as a green powerhouse, with some of the strongest renewable capacity growth expected globally in the coming years.

WRI: The Global Forest Industry This Quarter

AJOT | September 08, 2020 | International Trade | Commodity | By The Numbers

Sawlog prices fell in most of the major regions of the world in the 2Q/20. A strengthening US dollar, weaker log demand early in the quarter, and sufficient log supply in some markets contributed to the lower prices.

Europe could see $35 billion in CCS spending till 2035, with most capacity coming in the UK

AJOT | September 08, 2020 | Energy | Conventional | By The Numbers

It’s been a long and costly two decades of carbon capture and storage (CCS) studies and test centers. Now Europe has reached a stage where big-scale developments make financial sense and could trigger up to $35 billion in development spending until 2035 – by which time as much as 75 million tonnes of CO2 could be captured and stored per year on the continent, a Rystad Energy analysis shows.

Rystad Energy’s daily market comment from our Senior Oil Markets Analyst Paola Rodriguez-Masiu

AJOT | September 08, 2020 | Energy | Conventional | By The Numbers

Traders had been happy to support prices throughout the last months, ignoring worrying signals that the oil demand’s recovery would be slowed. Yet the slowdown is now starting to be more evident than ever and these two first weeks of September are weeks of sobering up to the reality.

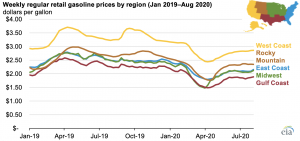

U.S. gasoline prices heading into Labor Day weekend are the lowest since 2004

AJOT | September 04, 2020 | Energy | Conventional | By The Numbers

The U.S. average regular gasoline retail price as of the Monday before Labor Day weekend is $2.22 per gallon (gal) this year, the lowest level for this time of year since 2004, according to the U.S. Energy Information Administration’s (EIA) weekly gasoline price series.

Rystad Energy’s daily market comment from our Senior Oil Markets Analyst Paola Rodriguez-Masiu

AJOT | September 04, 2020 | Energy | Conventional | By The Numbers

The oil market has enjoyed five months of solid gains, but oil prices kick off September on a weak note. During the first week of this month, the Brent benchmark is set to register the biggest weekly decline since early June on concerns about weaker demand and fears of supply increases.

Higher flows amid Mexican refinery woes

AJOT | August 31, 2020 | Energy | Conventional | By The Numbers

President Andres Manuel Lopez Obrador (AMLO) vowed to considerably increase refinery runs earlier this year, and despite a rebound in April, Mexican crude processing has tumbled to 534,000 bpd in July.

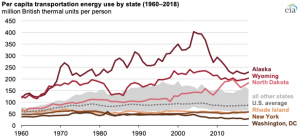

More energy is used per person for transportation in states with low population density

AJOT | August 31, 2020 | Energy | Conventional | By The Numbers

States with higher population density, such as Rhode Island and New York, used less transportation energy per capita in 2018.

Container rates slide but carrier performances continue to defy expectations

AJOT | August 31, 2020 | Maritime | Liner Shipping | By The Numbers

Despite the economic shockwaves engendered by the ongoing global pandemic, the world’s leading carriers continue to display signs of effective strategic management skills.

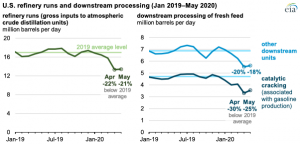

Changing demand for petroleum products has led to operational changes at U.S. refineries

AJOT | August 28, 2020 | Energy | Conventional | By The Numbers

Demand for transportation fuels in the United States has fallen since mid-March because of the spread of coronavirus and efforts to mitigate it.

Port of Baltimore’s July cargo numbers show signs of continued economic recovery

AJOT | August 24, 2020 | Ports & Terminals | Ports | By The Numbers

Increases in cargo volumes and new and returning business from national retailers helped the Helen Delich Bentley Port of Baltimore surge to significantly higher month-over-month numbers in July, signaling a continued rebound from the impact of the COVID-19 emergency.

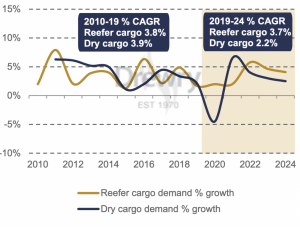

Reefer shipping to outpace dry cargo trade despite container shortages

AJOT | August 24, 2020 | Maritime | Liner Shipping | By The Numbers

Growth in seaborne perishable cargo slowed in 2019 but is forecast to better weather the COVID-19 induced economic storm than the dry cargo trade given the broader resilience of the food supply chain.

© Copyright 1999–2025 American Journal of Transportation. All Rights Reserved