By the Numbers

U.S. refinery capacity sets new record as of January 1, 2020

AJOT | June 26, 2020 | Energy | Conventional | By The Numbers

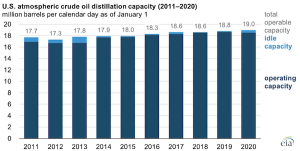

U.S. operable atmospheric crude oil distillation capacity increased 0.9% during 2019, reaching a record of 19.0 million barrels per calendar day (b/cd), up 0.2 million b/cd from the previous record of 18.8 million b/cd the year before.

International wood fiber prices decline

AJOT | June 26, 2020 | International Trade | Commodity | By The Numbers

Wood Fiber Costs Declined for both Softwood and Hardwood Pulp Producers in 2019 and early 2020

Rystad Energy’s daily market comment from our Head of Oil Markets Bjornar Tonhaugen

AJOT | June 26, 2020 | Energy | Conventional | By The Numbers

Traders show some reserved positivity in today’s session. Although oil prices saw some modest gains earlier in the day, the contracts retreated a bit, only to tick up again.

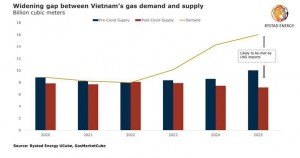

How Covid-19 benefits coal: The case study of Vietnam

AJOT | June 22, 2020 | Energy | Conventional | By The Numbers

The global energy industry downturn at the hands of Covid-19 has not only hurt immediate revenues, but is also affecting national infrastructure and energy policy planning.

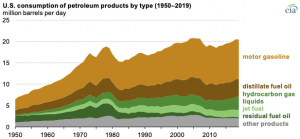

Motor gasoline accounted for almost half of U.S. petroleum consumption in 2019

AJOT | June 22, 2020 | Energy | Conventional | By The Numbers

Petroleum was the largest primary source of energy consumed in the United States in 2019, accounting for 37% of total energy consumed. In 2019, motor gasoline accounted for about 45% of petroleum products consumed in the United States.

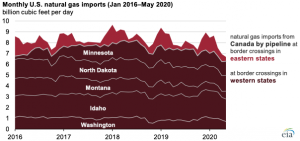

Higher Western Canada spot prices limit U.S. natural gas imports from Canada

AJOT | June 19, 2020 | Energy | Conventional | By The Numbers

U.S. imports of natural gas by pipeline at U.S.-Canada border crossings in the western United States fell to an estimated average of 6.2 billion cubic feet per day (Bcf/d) in April and 6.3 Bcf/d in May 2020, according to Genscape pipeline flow estimates.

FTR Reports May Final Trailer Orders at 4,300 Units

AJOT | June 19, 2020 | Intermodal | Trucking | By The Numbers

New orders are still tepid, and cancellations were elevated for the third consecutive month. Trailer orders for the past twelve months now total 155,000 units.

Weekly Rail Traffic for the Week Ending June 13, 2020

AJOT | June 17, 2020 | Intermodal | Rail | By The Numbers

For this week, total U.S. weekly rail traffic was 449,291 carloads and intermodal units, down 14.9 percent compared with the same week last year.

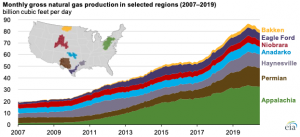

U.S. natural gas production efficiency continued to improve in 2019

AJOT | June 17, 2020 | Energy | Conventional | By The Numbers

The U.S. Energy Information Administration’s (EIA) latest Drilling Productivity Report (DPR) was updated on Monday, June 15.

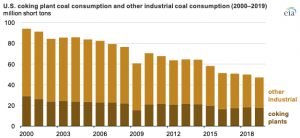

U.S. coal consumption continues to decline across all sectors

AJOT | June 16, 2020 | Energy | Conventional | By The Numbers

U.S. coal consumption has been declining since its peak in 2007 of 1.1 billion short tons. In 2019, U.S. coal consumption totaled 590 million short tons (MMst).

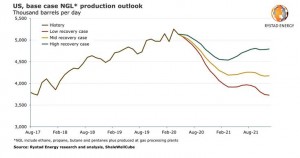

US NGL output set to fall by 20% by end-2021 from March’s all-time high, but Permian will hold up

AJOT | June 16, 2020 | Energy | Conventional | By The Numbers

The US output of natural gas liquids (NGL), which reached an all-time high of 5.3 million barrels per day (bpd) as recently as March 2020, is poised for a steep two-year decline, Rystad Energy’s base case view reveals

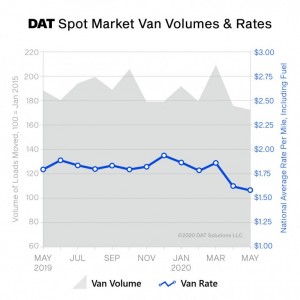

DAT Truckload Volume Index: Spot Market Stabilizes to Pre-COVID Levels, Largely Returning to Seasonal Patterns

AJOT | June 16, 2020 | By The Numbers

After bottoming out at the beginning of May, truckload freight volumes recovered to pre-COVID levels and largely returned to seasonal patterns in the second half of the month, according to DAT Freight & Analytics, which operates the industry’s largest online marketplace for spot truckload freight.

North American Freight Begins Long Road to Recovery

AJOT | June 16, 2020 | Intermodal | By The Numbers

The freight market seems to have bottomed out in April, but May didn't fare much better, showing only a 1.6% increase from April. Shipping volumes were down 23.6% compared to last year.

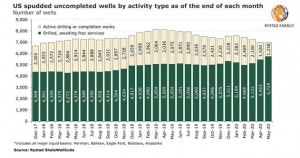

US fracking slowdown set to add at least two years of backlog work as DUC wells pile up

AJOT | June 15, 2020 | Energy | Conventional | By The Numbers

The backlog, which will likely increase in June, is equivalent to about two years of fracking at the current pace.

Cargo Volumes Continue Slide in May; Trend Could Last Through August

AJOT | June 15, 2020 | Ports & Terminals | Ports | By The Numbers

The Port of Virginia’s cargo volumes are continuing to reflect the impact of the COVID- 19 pandemic on commercial shipping as the port, in May, experienced its biggest one-month volume drop since the virus began slowing the global economy.

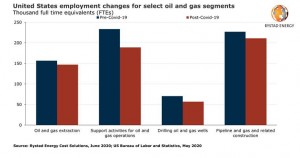

More than 100,000 oil and gas jobs already lost in the US, wages seen falling at least 8-10% in 2021

AJOT | June 12, 2020 | Energy | Conventional | By The Numbers

The US oil and gas labor market is amongst the world’s most severely hit by the downturn that the Covid-19 pandemic has brought, a Rystad Energy analysis of the latest data from the US Bureau of Labor Statistics (US BLS) reveals.

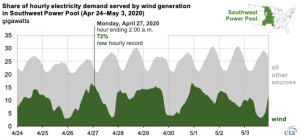

The central United States set several wind power records this spring

AJOT | June 12, 2020 | Energy | Alternative | By The Numbers

Earlier this year, the Southwest Power Pool (SPP), the regional transmission organization that manages the electric grid for much of the central United States, set records for the highest share of electricity demand supplied by wind power in both a single-hour period (72%) and a full day (62%).

U.S. fuel ethanol production and inventory changes have largely followed motor gasoline

AJOT | June 08, 2020 | Energy | Conventional | By The Numbers

U.S. fuel ethanol production fell dramatically during late March and in April 2020, driven by significant reductions in motor gasoline demand as a result of mitigation efforts for the 2019 novel coronavirus disease (COVID-19).

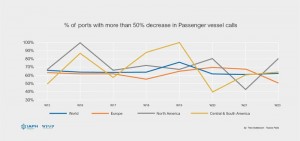

Ports report regional transshipments on the rise with cargo call volumes flat-lining or falling - WPSP

AJOT | June 08, 2020 | Ports & Terminals | Ports | By The Numbers

With a record response of 104 ports from around the world, the summary of the latest IAPH-WPSP Port Economic Impact Barometer for weeks 22 and 23 highlights the following trends

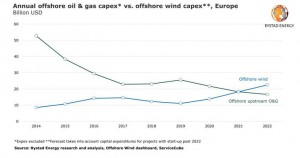

Offshore wind expenditure set to match upstream oil and gas in Europe in 2021, surpass it in 2022

AJOT | June 08, 2020 | Energy | Alternative | By The Numbers

The oil market collapse caused by the Covid-19 pandemic is set to delay several oil and gas developments in Western Europe, putting capital expenditure in the offshore sector on a continued downwards trajectory through 2022.

© Copyright 1999–2024 American Journal of Transportation. All Rights Reserved