By the Numbers

US DOT: February 2020 North American Transborder Freight Numbers

AJOT | April 22, 2020 | Intermodal | Trucking | By The Numbers

Transborder freight between the U.S. and other North American countries (Canada and Mexico) in February 2020

China’s Precious Metals Retail Trade Revenue Slump by 47%

AJOT | April 21, 2020 | International Trade | Commodity | By The Numbers

Data gathered by Learnbonds.com indicates that revenue from the Chinese retail trade of precious metals has dropped by 47%. The slump in revenue from the trade of gold, silver, and jewelry mainly occurred between January and March this year.

ReCAAP Reports 1 act of piracy and 3 acts of armed robbery against ships in Asia

AJOT | April 21, 2020 | Maritime | By The Numbers

During 14-20 April 2020, four incidents of piracy and armed robbery against ships in Asia were reported to the ReCAAP ISC.

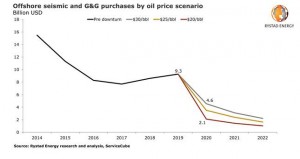

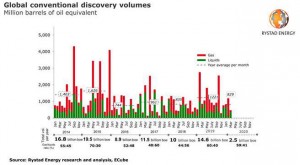

Seismic oil industry revenues to nearly evaporate in 2020

AJOT | April 21, 2020 | Energy | Conventional | By The Numbers

The Covid-19 pandemic and the current low-oil-price environment have pushed global exploration and production operators to cut costs, scrapping all but the most vital of their investment plans.

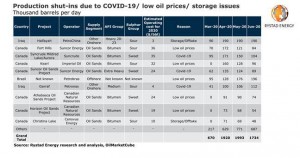

Canada, Iraq and Venezuela lead the 2 million BPD wave

AJOT | April 21, 2020 | Energy | Conventional | By The Numbers

After three consecutive months of Covid-19 demand destruction and gravity-defying oil prices, operators are finally being forced to shut-in considerable production volumes. Globally, at least 1.9 million barrels per day (bpd) of oil production have been booted offline in April according to Rystad Energy estimates. In May, this will likely grow to at least 2 million bpd.

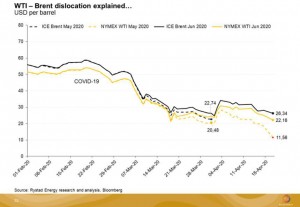

Two of Rystad Energy’s analysts adding comments on the WTI collapse:

AJOT | April 20, 2020 | Energy | Conventional | By The Numbers

The intraday WTI destruction today is certainly epic in scale, which is largely a case of jitters ahead of the WTI May 2020 futures contract expiring tomorrow and storage fears finally materializing. But if you have been watching the physical spot prices in the North Sea, currently trading in the $15-18 range, this drop in WTI May 2020 futures isn’t as shocking.

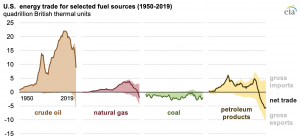

U.S. total energy exports exceed imports in 2019 for the first time in 67 years

AJOT | April 20, 2020 | Energy | Conventional | By The Numbers

Energy exports from the United States reached an all-time high of 23.6 quadrillion British thermal units (quads) in 2019, marking the first time in 67 years that annual U.S. gross energy exports exceeded U.S. gross energy imports, according to the U.S. Energy Information Administration’s (EIA) Monthly Energy Review.

February Likely The Last Positive Month For FTR’s Trucking Conditions Index Until 2021

AJOT | April 20, 2020 | Intermodal | Trucking | By The Numbers

Sharp declines in freight volumes, utilization, and rates due to the COVID-19 pandemic could lead to the worst overall trucking conditions on record during the second quarter of this year, according to FTR’s projections for the Trucking Conditions Index (TCI).

Millions of Orchids Are Being Thrown Out by Top World Exporter

Bloomberg | April 18, 2020 | International Trade | By The Numbers

As global tourism collapses, so does the orchid industry in top exporter Thailand, where the flowers are regarded as a symbol of hospitality.

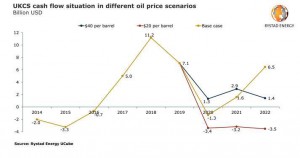

$20 oil will not devastate UK production, but its not a pretty picture

AJOT | April 17, 2020 | Energy | Conventional | By The Numbers

With the reality that Brent oil prices are scratching closer and closer to $20 per barrel, shut-ins are already happening around the world. Even if prices reach this threshold, the UK will avoid shut-ins and exploration is likely to continue in 2020, although cash flow and project sanctioning will suffer, a Rystad Energy impact analysis shows.

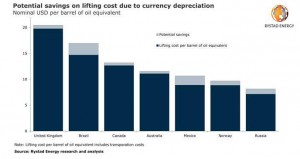

Brazil tops savers list as countries with currencies hit by COVID-19 see production costs shrinking

AJOT | April 17, 2020 | Energy | Conventional | By The Numbers

As most operating expenses in oil and gas production are realized in local currencies, a Rystad Energy analysis shows that lifting costs per barrel of oil equivalent (opex by produced boe), could drop significantly, with Brazil being the world’s top dollar saver per barrel.

Rystad Energy’s comment on Monday’s oil prices

AJOT | April 13, 2020 | Energy | Conventional | By The Numbers

Oil prices were already at higher levels than they should be before the OPEC+ and the G20 meetings due to market enthusiasm and hopes for a solution to the crisis.

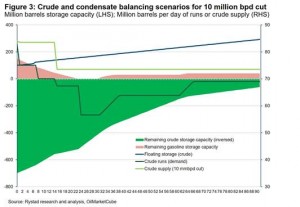

Rystad Energy’s final comment on Thursday’s OPEC deal

AJOT | April 10, 2020 | Energy | Conventional | By The Numbers

The proposed 10 million bpd cut by OPEC+ for May and June will keep the world from physically testing the limits of storage capacity and save prices from falling into a deep abyss, but it will still not restore the desired market balance. Just hours before delegates stepped into the (again virtual) closed meeting, Brent was fluttering in the mid-$30s, seemingly oblivious to the fact that even if a 10 million bpd cut is agreed upon, or even in the best-case scenario 15 million bpd if the US, Canada, Norway and Brazil join forces, an excess of supply of the magnitude of 5-10 million bpd will remain, and will need to be stored. image001.jpg Rystad Energy currently estimates that the demand-supply imbalance for April 2020 is 27.4 million bpd, an amount that is physically impossible for the oil market to absorb. So while the unprecedented gesture by OPEC+ is, without doubt, saving the market from the worst imaginable collapse by buying producers precious needed time to adjust and by removing strain from the storage infrastructure, one should not be overly optimistic. The proposed OPEC++ cuts alone cannot reverse the deep contango curve of Brent prices in a meaningful or lasting way as storage need to remain economical to handle the standing oversupply. We thus believe that the renewed market optimism will be short-lived. image002.jpg Although the proposal is nowhere close to restoring the 2Q20 balances, it does buy time. Rystad estimates that the difference between a “no deal” and 10-15 million bpd cut deal gives the oil market an additional 2-3 months before filling crude storage capacity “right to the top.” image003.jpg The supply cut will give demand time to improve as quarantines in parts of Europe are partially lifted, but more importantly, it gives E&P companies more time to prepare supply chains and activity plans, reduce costs and avoid an uncontrolled dismantling of parts of the industry. In this scenario, crude prices would still come under pressure, but we may bottom at $25 Brent for 2Q20 average, and see lower price spike risk down the road. Global storage is already close to being filled to the brim. The world has around 7.4 billion barrels crude and products in onshore storage, including 1.3 billion currently onboard tankers at sea. We estimate that on average 79% of the world’s oil storage capacity is already full. Therefore, we believe that the theoretical available storage capacity is limited to 1.5 billion barrels onshore for crude and products combined. The operational available capacity, unfortunately, is below the theoretical maximum as tanks cannot be filled 100% and not all market participants have equal access since most available capacity is concentrated in the US and China.. According to our bottom-up supply database, total liquids production in OPEC was 30.25 million bpd in March 2020, and without taking into account any future cuts, is on track to grow to 31.65 million bpd in April 2020, buoyed mostly by Saudi Arabia’s export spree. So on the conservative side if we estimate Russia takes on 2 million bpd of cuts, that means the share of cuts from OPEC members would translate into cutting 26% of total production. For comparison, at the last December 2019 meeting, a total 1.168 million bpd was pledged in cuts when OPEC crude production stood at 26.314 million bpd, so a less than 5% cut of total production. Ever since President Trump sent oil prices sky high with a single tweet about the potential OPEC+ production deal, the White House has been quite non-committal in joining along in these supply cuts, even though US shale is a clear target should oil market destruction escalate any further. Particular US companies, such as Pioneer Resources and Parsley have spoken up about 20-30% production cuts, but majors such as Chevron insist it should be left to market forces. Canada, which has already shuttered several oil sands projects as the oil price ticks lower, is now looking at nearly 1.1 million bpd of curtailments in 2Q20, and has expressed interest in joining a global oil market management program. A usual the devil is in the details and there are still many important questions that remain unanswered. Despite the many unknowns, one thing certain with this deal is that OPEC countries are once again coming to the rescue. We will know more once the “emergency” G-20 meeting takes place on 10 April 2020 and whether or not other non-OPEC producers are ready to take similar unprecedented action.

Virus-Driven Drop in Container Volumes Continues; Port Focuses on Readiness, Safety

AJOT | April 10, 2020 | Ports & Terminals | Ports | By The Numbers

Slight Growth in Exports; Barge Volume to Richmond up More than 28%

First quarter volumes drop 18.5% at Port of Los Angeles

AJOT | April 08, 2020 | Ports & Terminals | Ports | By The Numbers

COVID-19 Crisis Hits Supply Chain Hard as March Cargo Falls 30.9%

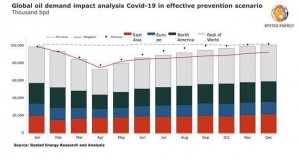

Oil seen down 9.4%, jet fuel down 31%, road fuel down 9.4% in 2020

AJOT | April 08, 2020 | Energy | Conventional | By The Numbers

Rystad Energy’s weekly comprehensive Covid-19 report calculates the effect of the novel coronavirus in our lives and offers updated estimates for global fuel markets.

EIA expects the United States will return to being a net importer of crude oil and petroleum products

AJOT | April 08, 2020 | Energy | Conventional | By The Numbers

In the April Short-Term Energy Outlook (STEO), EIA forecasts that the United States will again become a net importer of crude oil and petroleum products in the third quarter of 2020 and remain a net importer in most months through the end of 2021.

Targeted billion-barrel oil resources at risk as world’s top exploration wells may face delays - Rystad Energy

AJOT | April 08, 2020 | Energy | Conventional | By The Numbers

At least nine of the world’s top planned exploration wells for 2020 are at risk of being suspended as a result of the combined effect on oil and gas activities of the Covid-19 virus and the oil price war, a Rystad Energy impact analysis shows.

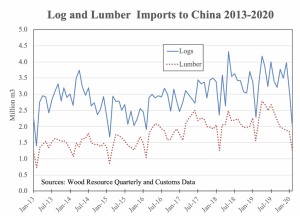

Forest Products Imports to China drop

AJOT | April 08, 2020 | International Trade | Commodity | By The Numbers

The value of imported forest products to China dropped by 750 million dollars y-o-y during January and February 2020, with the biggest falls on the values of wood pulp and softwood lumber, reports the Wood Resource Quarterly

Drewry Maritime Financial Insight - April 2020

AJOT | April 08, 2020 | Maritime | By The Numbers

Container shipping stock prices have been in full retreat with early March witnessing a market storm as stock markets around the world sold off and investors struggled to calculate the economic fallout from the coronavirus (COVID-19) outbreak.

© Copyright 1999–2024 American Journal of Transportation. All Rights Reserved