By the Numbers

Frankfurt Airport: Weekly Traffic Figures for March 30 – April 5

AJOT | April 07, 2020 | Air Cargo | Airports | By The Numbers

Cargo flights with a more than 20 percent increase in comparison with the previous year's period – This increase compensates only partially for the decline in belly freight (shipped on passenger aircraft) Week 14/2020 (March 30 - April 5) Week Δ %* Passengers 66,151 -95.2% Cargo (airfreight + airmail) in metric tons 32,904 -25.0% Aircraft movements 1,545 -85.1% *Change compared to Week 14 of 2019

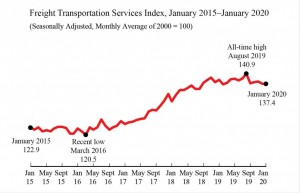

Freight Transportation Services Index (TSI), February 2020

AJOT | March 30, 2020 | International Trade | By The Numbers

. In the previous release for January, the Freight TSI was unchanged in January from December. From January 2019 to January 2020, the index fell 1.0% compared to a rise of 5.5% from January 2018 to January 2019 and a rise of 6.0% from January 2017 to January 2018.

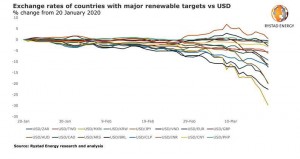

COVID-19 set to wipe out global solar and wind project growth for 2020

AJOT | March 27, 2020 | Energy | Alternative | By The Numbers

Renewable energy projects expecting to achieve financial close or break ground globally will not avoid taking a hit from Covid-19’s effect on the economy.

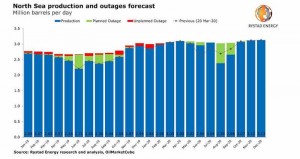

You thought global oil supply couldn’t get any larger? Ineos: ‘hold my maintenance’

AJOT | March 27, 2020 | Energy | Conventional | By The Numbers

With only a week to go before OPEC+ countries start flooding the world’s total oil production with an estimated extra 2.5 million barrels per day (bpd) amid the Covid-19 crisis, building one of the biggest oil supply gluts the world has ever seen, UK operator INEOS has decided to postpone its scheduled maintenance for the North Sea Forties pipeline system (FPS) in a move that Rystad Energy calculates will add several hundred thousands of extra barrels to the market every day.

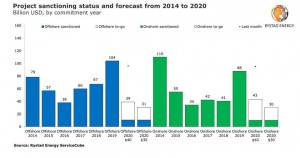

COVID-19 and oil price war could derail two-thirds of the world’s oil & gas project sanctioning in 2020

AJOT | March 23, 2020 | Energy | Conventional | By The Numbers

The effect of the COVID-19 virus on global demand for oil and gas, along with an ongoing price war that has sent oil prices tumbling at an unprecedented rate, are poised to wreak havoc on new project development plans for this year.

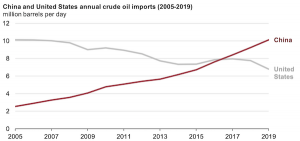

China’s crude oil imports surpassed 10 million barrels per day in 2019

AJOT | March 23, 2020 | Energy | Conventional | By The Numbers

China’s annual crude oil imports in 2019 increased to an average of 10.1 million barrels per day (b/d), an increase of 0.9 million b/d from the 2018 average.

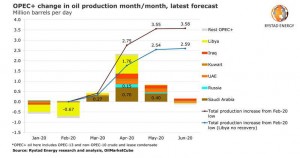

Up to 3 million bpd of extra oil can hit the market from April, more coming in May - Rystad Energy

AJOT | March 18, 2020 | Energy | Conventional | By The Numbers

The extra oil coming into the global market from April will be as much as 3 million barrels per day (bpd), Rystad Energy estimates.

Oil seen down 2.8%, jet fuel down 12%, road fuel down 2.2% in 2020

AJOT | March 18, 2020 | Energy | Conventional | By The Numbers

Rystad Energy is creating a weekly comprehensive report calculating the effect of the novel coronavirus in our lives and updating estimates for global fuel markets.

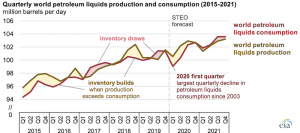

OPEC shift to maintain market share will cause global inventory increases and lower prices

AJOT | March 16, 2020 | Energy | Conventional | By The Numbers

Markets for oil, as well as other commodities and equities, have experienced significant volatility and price declines since the final week in February amid concerns over the economic effects of the 2019 novel coronavirus disease (COVID-19).

EIA projects air-conditioning energy use to grow faster than any other use in buildings

AJOT | March 13, 2020 | Energy | Conventional | By The Numbers

In the Annual Energy Outlook 2020 (AEO2020) Reference case, the U.S. Energy Information Administration (EIA) projects that delivered energy for air conditioning will increase more than any other end use in residential and commercial buildings (also known as the buildings sector) through 2050, while energy consumption for space heating will decline.

Overseas Shipholding Group reports 2019 financial results

AJOT | March 13, 2020 | Maritime | Bulk | By The Numbers

Overseas Shipholding Group, Inc. (the “Company” or “OSG”), a provider of energy transportation services for crude oil and petroleum products in the U.S. Flag markets, today reported results for the fourth quarter and full year 2019.

PAO Sovcomflot) 2019 financial results announced

AJOT | March 13, 2020 | Maritime | By The Numbers

2019 financial results see robust growth across key metrics and strategy on track

SC Ports reports strong cargo volumes in February

AJOT | March 09, 2020 | Ports & Terminals | Ports | By The Numbers

S.C. Ports Authority saw steady container volumes in early 2020 and recorded the highest February ever for both cargo volumes and rail moves at inland ports.

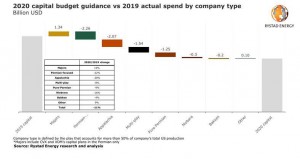

US light oil production guided to grow by 8.1% in 2020, despite lower capex

AJOT | March 09, 2020 | By The Numbers

Light oil production in the United States is guided to grow by 8.1% year-on-year, according to Rystad Energy’s analysis of the latest shale E&P guidance, despite an expected decrease in capital expenditure, which is estimated to drop by 11% compared to 2019.

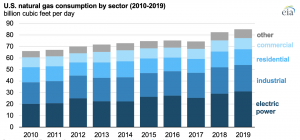

U.S. natural gas consumption sets new record in 2019

AJOT | March 03, 2020 | Energy | Conventional | By The Numbers

U.S. natural gas consumption increased by 3% in 2019, reaching a record of 85.0 billion cubic feet per day (Bcf/d), according to the U.S. Energy Information Administration’s (EIA) recently released Natural Gas Monthly. New natural gas-fired electric capacity and lower natural gas prices led the increase in domestic natural gas consumption.

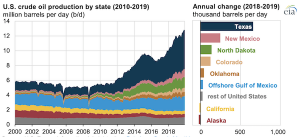

U.S. crude oil production grew 11% in 2019, surpassing 12 million barrels per day

AJOT | March 02, 2020 | Energy | Conventional | By The Numbers

Annual U.S. crude oil production reached another record level at 12.23 million barrels per day (b/d) in 2019, 1.24 million b/d, or 11%, more than 2018 levels.

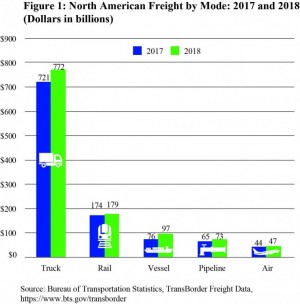

US BTA North American Freight Data, Annual 2019

AJOT | March 02, 2020 | International Trade | By The Numbers

This release provides an annual summary of North American Transborder freight by mode. In the previous release, BTS reported that trucks were the most heavily utilized mode in 2018 for moving goods to and from both Canada and Mexico, carrying 63% of the freight transported. Trucks accounted for $772 billion of the $1.2 trillion in freight flows with Canada and Mexico in 2018. Rail accounted for $179 billion, almost 15%. Previous release Database

WCD: only the prelude to an extraordinary Q1 2020

AJOT | March 02, 2020 | Air Cargo | General | By The Numbers

At the time of writing, it had become very clear that the first quarter of 2020 (and quite possibly the months beyond) will turn out to be an extraordinary period for the world and for world trade, and thus for air cargo.

Rystad Energy: Coronavirus to delay most of 2020’s FPSO deliveries and postpone $30 billion of E&P investments

AJOT | February 28, 2020 | Energy | By The Numbers

Out of a global total of 28 floating production, storage and offloading (FPSO) vessels that are under construction, 22 are being built at shipyards in China, South Korea and Singapore.

Descartes acquires Peoplevox

AJOT | February 24, 2020 | Logistics | By The Numbers

Descartes Systems Group announced that it has acquired Peoplevox, a leading provider of cloud-based ecommerce warehouse management solutions

© Copyright 1999–2024 American Journal of Transportation. All Rights Reserved