By the Numbers

Rystad Energy’s daily market comment from our Oil Markets Analyst Louise Dickson

AJOT | April 13, 2021 | Energy | Conventional | By The Numbers

The oil market is having a slow month after the latest OPEC+ meeting as the latest production policy leaves little room for big surprises in oil balances.

Saudi Aramco’s profit halved in two years, market cap $210b below Apple’s

AJOT | April 13, 2021 | Energy | Conventional | By The Numbers

Even before the pandemic, the oil and gas industry was faced with slumping prices. However, with a record collapse in oil demand amid the lockdowns, the COVID-19 crisis has further shaken the market, causing massive revenue and market cap drops for even the largest oil companies.

Port of Hueneme board demonstrates fiscal responsibility

AJOT | April 13, 2021 | Ports & Terminals | Ports | By The Numbers

Additional contribution to employee retirement trust brings total to $2.5M The Port of Hueneme continues to ensure financial stability and fiscal responsibility as the Board of Oxnard Harbor District Commissioners voted to fund another $500,000 to the District’s California Employers’ Retiree Benefit Trust (CERBT) account for their fiscal year ending June 30, 2021. Other Post-Employment Benefits (or OPEB) are benefits costs (other than pensions) that Federal, State, local governments and special districts provide to their retired employees. These costs include health care, dental, vision and life insurance. It has become evident, with rising costs of healthcare, that future expenses for the OPEB costs will increase significantly as the years go on. Prior to opening the CERBT account, the Port practiced a pay as you go system covering the OPEB retiree costs for the current fiscal year only. The future years unfunded liability continued to grow with the onset of more retiring employees. Then in fiscal year 2017, the Port took a step towards lowering their Unfunded Accrued Liability (UAL) with the creation of a CERBT with an opening deposit of $500k. Then in the following two fiscal years, increased the account balance by $500k each in fiscal years 2018 and 2019. With the current successes of the stock market, the $1.5M investment grew to nearly $2M. The effect on the unfunded liability was dramatic. The UAL was growing towards $9M but has been reduced to approximately $6M. After waiting to see the fiscal impacts of FY2020, on March 15, 2021 Oxnard Harbor District’s Board of Commissioners voted to reduce the Port’s unfunded OPEB liability further by authorizing another $500,000 deposit in the CERBT account which bring the Port’s prefunding to approximately $2.5M. This Pay & Save As You Go method has proven to be a significant and consistent way to reduce the Port’s unfunded OPEB liability over time. This trust, administered by CalPERS, will serve as the pre-funding element for Other Public Employee Benefits (OPEB,) supplementing the pay-as-you-go method currently in place. According to the American Legislative Exchange Council (ALEC,) California has one of the largest unfunded OPEB liabilities in the country, exceeding $166 billion, or $4,200 per resident1. By adding the OPEB pre-funding element, the Port is avoiding passing on debt to future generations and preventing potential budget shortfalls in future years. The Government Finance Officers Association of the United States and Canada (GFOA) identifies this type of pre-funding OPEB as a “best practice.” Further, it was noted as a positive comment on the Port’s last Bond rating review by Standard & Poors (S&P) that the pre-funding action was a positive reflection upon the fiscal responsibility of the Port. “With financial uncertainty heightened by the COVID-19 crisis, we are proud to make all efforts to prioritize the fiscal health of the Port,” says Oxnard Harbor District Board President Jason T. Hodge. “In doing so, we are investing in our Port’s future and taking very seriously our role of sustainable provider of jobs and security for our local communities.” “Our goals and efforts have been with meeting our financial responsibility to account for future costs.,” says Andrew Palomares, Port Deputy Executive Director, CFO/CAO. “By investing a little each fiscal year, it softens the blow of a larger demand on our future financial reserves. Instead of simply a pay as you go system, we’ve adopted a pay & save as you go.”

Rystad Energy’s daily market comment from our Oil Markets Analyst Louise Dickson:

AJOT | April 12, 2021 | Energy | Conventional | By The Numbers

Oil prices rose today as a result of progress in vaccination campaigns in the US, which are helping the country’s plan to spend and revive the economy stand on strong feet.

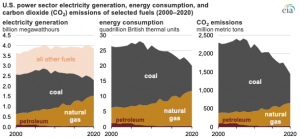

U.S. energy-related CO2 emissions declined by 11% in 2020

AJOT | April 12, 2021 | Energy | Conventional | By The Numbers

Based on data in EIA’s Monthly Energy Review, energy-related carbon dioxide (CO2) emissions decreased by 11% in the United States in 2020 primarily because of the effects of the COVID-19 pandemic and related restrictions. U.S. energy-related CO2 emissions fell in every end-use sector for the first time since 2012.

Rystad Energy’s daily market comment from our Oil Markets Analyst Louise Dickson

AJOT | April 09, 2021 | Energy | Conventional | By The Numbers

Oil prices are about to close the week with mild losses as demand concerns are spreading pessimism in the market.

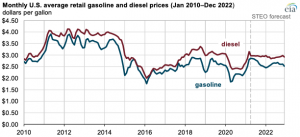

EIA: More gasoline expected to be consumed this summer than last, but not more than in 2019

AJOT | April 09, 2021 | Energy | Conventional | By The Numbers

As some of the economic and behavioral effects of COVID-19 subside over the next year, we forecast that U.S. demand for transportation fuels will increase.

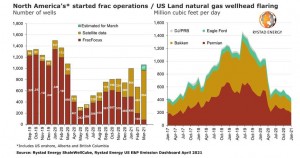

Permian oil output set to grow in Q2 as fracking reaches 12-month high; flaring lowest since 2017

AJOT | April 09, 2021 | Energy | Conventional | By The Numbers

Fracking in North America has almost recovered to pre-pandemic levels, with the count of started frac jobs reaching a 12-month high in March 2021, a Rystad Energy report shows.

Taiwan’s Exports Up for Ninth Straight Month on Chip Demand

Bloomberg | April 09, 2021 | International Trade | By The Numbers

Taiwan continued to benefit from global demand for its electronics goods, with exports rising for a ninth straight month in March.

Ocean-Shipping Demand Staying ‘Very Strong,’ Hapag CEO Says

Bloomberg | April 08, 2021 | Maritime | Liner Shipping | By The Numbers

Robust demand for shipping goods across the world’s oceans shows no signs of slowing down, the chief executive of Germany’s largest container carrier said, signaling that elevated rates in the tight market for seaborne cargo may extend into the second half of the year.

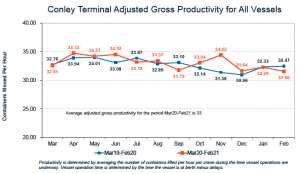

Port of Boston: 2020 – The best bad year ever

George Lauriat | April 05, 2021 | Ports & Terminals | Ports | By The Numbers

The Port of Boston TEU throughput dropped 9% to 283,061 TEUs in FY 2020 – so why was that a good year?

Rail Traffic for the Week Ending March 27, 2021

AJOT | March 31, 2021 | Intermodal | Rail | By The Numbers

For this week, total U.S. weekly rail traffic was 521,731 carloads and intermodal units, up 16.1 percent compared with the same week last year.

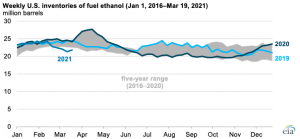

Extreme winter weather event in Texas reduced fuel ethanol production in February

AJOT | March 31, 2021 | Energy | Alternative | By The Numbers

The colder-than-normal weather that affected much of the United States in mid-February and disrupted Midcontinent and Gulf Coast petroleum markets also affected fuel ethanol producers.

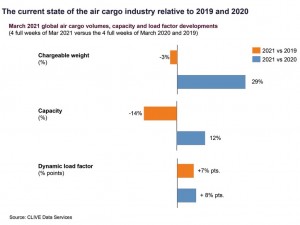

Is Covid fatigue dampening air cargo’s recovery?

AJOT | March 31, 2021 | Air Cargo | Freighters | By The Numbers

The New Year recovery in global air cargo volumes stalled in March as volumes fell -3% versus comparative data for March 2019, but reduced airline capacity levels saw the ‘dynamic loadfactor’ and prices remain ‘relentlessly high,’ according to the latest market data from industry analysts CLIVE Data Services and TAC Index.

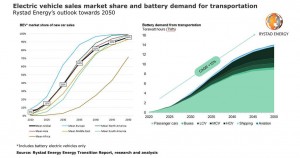

Electric vehicle market share set to exceed 50% from 2033, battery demand to plateau at 20 TWh in mid-2040s

AJOT | March 31, 2021 | Energy | Alternative | By The Numbers

The market penetration of electric vehicles is increasing rapidly as a result of the accelerating energy transition, and demand for batteries is expected to skyrocket going forward for both transportation and grid storage.

Rystad Energy’s daily market comment from our Oil Markets Analyst Louise Dickson

AJOT | March 31, 2021 | Energy | Conventional | By The Numbers

The oil market is still playing a guessing game today as to what supply policy OPEC+ will set out at tomorrow’s meeting, but the $64 per barrel Brent price signals that traders expect a cautious approach from the alliance.

Rystad Energy’s daily market comment from our Oil Markets Analyst Louise Dickson

AJOT | March 30, 2021 | Energy | Conventional | By The Numbers

Oil prices declined on Tuesday as the reopening of the Suez Canal route relieved the vessel congestion and ensured that oil supply will flow again to Europe without extreme delays for deliveries.

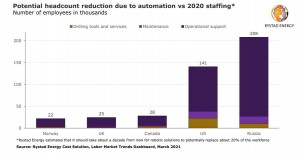

Robots could replace hundreds of thousands of oil and gas jobs, save billions in drilling costs by 2030

AJOT | March 29, 2021 | Energy | Conventional | By The Numbers

Even when the Covid-19 downturn is finally past us, operators will have to continue exploring new avenues for cost reductions to be better equipped to withstand future market declines.

Rystad Energy’s daily market comment from our Oil Markets Analyst Louise Dickson

AJOT | March 29, 2021 | Energy | Conventional | By The Numbers

The blockade at the Suez Canal caused oil prices to build up at the end of last week, as many tankers were stuck and prevented from resuming course.

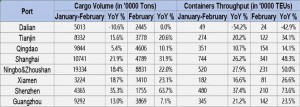

China ports container volume rises 35.5% in February of 2021

AJOT | March 29, 2021 | Maritime | Liner Shipping | By The Numbers

Ningbo Containerized Freight Index decrease in March

© Copyright 1999–2024 American Journal of Transportation. All Rights Reserved