By the Numbers

Oil falls as Suez ship partially refloated, market weighs demand

Bloomberg | March 29, 2021 | Energy | Conventional | By The Numbers

Oil retreated as salvage teams partially refloated the giant vessel that has been blocking the Suez Canal, and traders weighed the impact of renewed lockdowns on global demand before an OPEC+ policy meeting.

Utilities continue to increase spending on the electric transmission system

AJOT | March 26, 2021 | Energy | By The Numbers

Annual spending by major U.S. electric utilities on the U.S. electric transmission system has increased from $9.1 billion (2019 dollars) in 2000 to $40.0 billion in 2019

Rystad Energy’s daily market comment from our Vice President Oil Markets Paola Rodriguez Masiu

AJOT | March 26, 2021 | Energy | Conventional | By The Numbers

The oil market is swinging wildly from gains to losses and gains again this week, a clear sign of the uncertainty that the Suez Canal blockade and European lockdowns are creating.

AJOT’s Top Fifty North American 3PLs 2021

George Lauriat | March 22, 2021 | Logistics | By The Numbers

3PLs – Adapting to the times

Rystad Energy’s daily market comment from our Oil Markets Analyst Louise Dickson

AJOT | March 18, 2021 | Energy | Conventional | By The Numbers

The oil price ‘super’ cycle rhetoric is finally getting a bit of a reality check. The negative sentiment was kicked off by doubts in Europe over the AstraZeneca vaccine, and was ossified by the nearly 2.4 million-barrel crude build in US crude inventories.

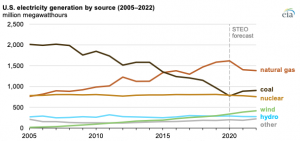

Less electricity was generated by coal than nuclear in the United States in 2020

AJOT | March 18, 2021 | Energy | Conventional | By The Numbers

U.S. coal-fired electricity generated totaled 774 million megawatthours (MWh) in 2020, which is less than both natural gas-fired (1.6 billion MWh) and nuclear-powered generation (790 million MWh), according to the U.S. Energy Information Administration’s (EIA) Electric Power Monthly.

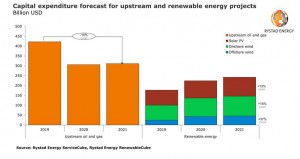

Renewables spending set for new record in 2021, luring service suppliers as oil and gas gap narrows

AJOT | March 18, 2021 | By The Numbers

Capital expenditure for renewable energy projects is set for a new record in 2021, a Rystad Energy analysis shows, forecast to reach $243 billion, and narrowing the gap with oil and gas spending, which is projected to be relatively flat this year at $311 billion.

China’s gasoline and diesel exports surged on weak local demand

Bloomberg | March 18, 2021 | Energy | Conventional | By The Numbers

China’s gasoline and diesel exports surged in the first two months of the year as domestic fuel demand weakened during the Lunar New Year holidays.

Dreary: Shipowner opex remains hostage to rising marine insurance costs

AJOT | March 16, 2021 | Maritime | By The Numbers

Vessel operating costs are expected to continue rising on a hardening marine insurance market, as conclusion of the P&I renewal season exposes the fallout from rising claims and the impact of Covid-19 on global merchant shipping.

U.S. drivers are burning more gas, a trend likely to continue

Bloomberg | March 15, 2021 | Energy | Conventional | By The Numbers

After a year of setbacks for the oil market, American drivers are underpinning the first rebound in gasoline demand since the pandemic began that is likely to stay.

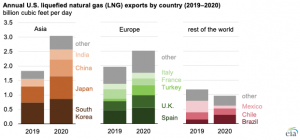

Asia became the main export destination for growing U.S. LNG exports in 2020

AJOT | March 15, 2021 | Energy | Conventional | By The Numbers

U.S. exports of liquefied natural gas (LNG) continued to grow in 2020, averaging 6.6 billion cubic feet per day (Bcf/d) on an annual basis, according to the U.S. Energy Information Administration’s Natural Gas Monthly.

Rystad Energy’s daily market comment from our Oil Markets Analyst Louise Dickson

AJOT | March 15, 2021 | Energy | Conventional | By The Numbers

The oil price optimism continues to be alive and well this week as demand growth prospects and rapid vaccine rollouts continue their steady ascent in tandem.

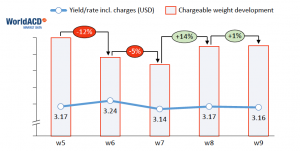

Air Cargo Market Trends for the past 5 weeks March 12, 2021

AJOT | March 12, 2021 | Air Cargo | Airlines | By The Numbers

Trends based on appr 250 000 transactions per week WorldACD publishes weekly data for hundreds of markets the largest market based on data for 170 forwarders, the smallest on data for 20 forwarders

Rystad Energy’s daily market comment from our Head of Oil Markets Bjornar Tonhaugen

AJOT | March 12, 2021 | Energy | Conventional | By The Numbers

Oil prices are largely keeping their ground today but, looking at the bigger picture, Brent recovered much of this week’s losses and climbed back to just below $70, a level that is beyond healthy in the current market.

Global air cargo volumes recover to pre-Covid level inside 10 months

AJOT | March 03, 2021 | Air Cargo | Freighters | By The Numbers

A robust global air cargo market has virtually completed its recovery to post-Covid volume levels inside 10 months, according to airline performance data for February 2021 from industry analysts CLIVE Data Services and TAC Index.

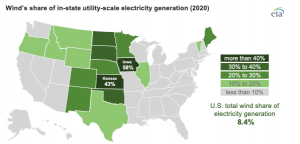

The United States installed more wind turbine capacity in 2020 than in any other year

AJOT | March 03, 2021 | Energy | Alternative | By The Numbers

In both 2019 and 2020, project developers in the United States installed more wind power capacity than any other generating technology.

Freight rates to US West Coast dip, finally, post-CNY

AJOT | March 03, 2021 | Air Cargo | Freighters | By The Numbers

Ocean rates from China to the US West Coast fell 14% this week, the largest single-week drop since before the pandemic, likely due to some easing of seasonal demand surrounding Chinese New Year. But rates are still expected to stay elevated on strong demand as well as on congestion and delays into H2.

FTR Reports Preliminary North American Class 8 Net Orders Stay Strong for February at 44,000 Units

AJOT | March 03, 2021 | Intermodal | Trucking | By The Numbers

FTR reports preliminary North American Class 8 net orders remained impressive in February for the fifth consecutive month coming in at 44,000 units, +3% m/m, and +209% y/y. Emphasizing the strength of the orders, February 2021 was the second-highest total ever for the month of February. Orders for the previous twelve months now total 338,000 units.

Rystad Energy’s daily market comment from our Head of Oil Markets Bjornar Tonhaugen

AJOT | March 03, 2021 | Energy | Conventional | By The Numbers

This week’s OPEC+ meeting will chart out exactly how wide the 23-nation group will open the supply spigot from April onwards, and whether OPEC+ stays ahead, behind or precisely on the rebalancing curve in the months to come.

Old Dominion Freight Line provides update for Q1 2021

AJOT | March 02, 2021 | Intermodal | Trucking | By The Numbers

Old Dominion Freight Line, Inc. reported certain less-than-truckload (“LTL”) operating metrics for February 2021. Revenue per day increased 9.2% as compared to February 2020 due to a 5.9% increase in LTL tons per day and an increase in LTL revenue per hundredweight.

© Copyright 1999–2024 American Journal of Transportation. All Rights Reserved