By the Numbers

Tighter US corn and soybean carry-out intensifies Spring acreage battle

AJOT | January 20, 2021 | International Trade | Commodity | By The Numbers

Tighter US Corn and Soybean Carry-out Intensifies Spring Acreage Battle; Wheat Rallies with Export Constraints and New Crop Supply Concerns

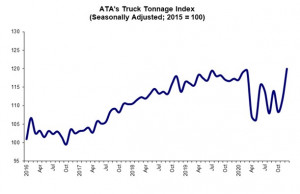

ATA Truck Tonnage Index Jumped 7.4% in December

AJOT | January 20, 2021 | Intermodal | Trucking | By The Numbers

American Trucking Associations’ advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index increased 7.4% in December after rising 3.2% in November. In December, the index equaled 120 (2015=100) compared with 111.7 in November.

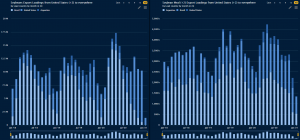

Great Lakes-St. Lawrence Seaway System reports strong 2020 navigation season

AJOT | January 19, 2021 | Ports & Terminals | Canal and Waterway | By The Numbers

American and Canadian ports in the Great Lakes-St. Lawrence Seaway system reported that overall tonnage during the 2020 navigation season was down just 1.7 percent compared to the 2019 navigation season, despite facing a challenging year.

Rystad Energy’s daily market comment from our Head of Oil Markets Bjornar Tonhaugen

AJOT | January 19, 2021 | Energy | Conventional | By The Numbers

The market is looking forward to a new round of positive signals and today’s oil price uptick has a lot to do with US developments.

The bull run is wreaking havoc with cargo delays in major ports

AJOT | January 18, 2021 | Maritime | Liner Shipping | By The Numbers

Ocean Insights’ cargo delay statistics show how the bull run is wreaking havoc on the market, with surging rollover rates across major ports during December and most major carriers seeing increases in delays.

The UK offers operators best profit conditions to develop big offshore fields; Kuwait, Canada follow

AJOT | January 18, 2021 | Energy | Conventional | By The Numbers

This year marks the beginning of a recovery after a disappointing 2020, when the Covid-19 pandemic caused sanctioning of offshore projects to dip to $44 billion from $99 billion the year before. Rystad Energy projects offshore sanctioning to rebound to at least $56 billion in 2021 and keep rising to as high as $131 billion in 2023.

Rystad Energy’s daily market comment from our Head of Oil Markets Bjornar Tonhaugen:

AJOT | January 18, 2021 | Energy | Conventional | By The Numbers

As the beginning of 2021 coincided with a crucial OPEC+ meeting, the beginning of the year kickstarted an oil price rally that is now running out of steam.

FTR’s Trucking Conditions Index for November Eases from October High

AJOT | January 18, 2021 | Intermodal | Trucking | By The Numbers

FTR’s Trucking Conditions Index (TCI) fell in November from the previous month’s record high. The November reading of 10.26 is still strong as rising freight rates continue to power robust trucking conditions FTR expects the index to settle into single-digit positive readings through 2021, reflecting a healthy but more stable truck freight market.

Air Travel Consumer Report: November 2020 Numbers

AJOT | January 15, 2021 | Air Cargo | Airlines | By The Numbers

The U.S. Department of Transportation today released its January 2020 Air Travel Consumer Report (ATCR) on reporting marketing and operating air carrier data compiled for the month of November 2020.

The dynamism of the Asian market and the rise in fuel prices increase freight rates in Valenciaport

AJOT | January 15, 2021 | Energy | Conventional | By The Numbers

The Valencia Containerised Freight Index (VCFI) of December experienced a growth of 4.19% with respect to the previous month, confirming the trend of the last five months of the year of increased freight rates.

Rystad Energy’s daily market comment from our Head of Oil Markets Bjornar Tonhaugen

AJOT | January 15, 2021 | Energy | Conventional | By The Numbers

The price rally that Saudi Arabia kickstarted after the OPEC+ meeting seems to be over, as oil prices already made the most out of the supply news and are now being trimmed of the excess gains.

AJOT’s Top 100 North American Trucking Companies 2020

AJOT | January 04, 2021 | Intermodal | Trucking | By The Numbers

North America's top 100 trucking companies using data collected by AJOT resources.

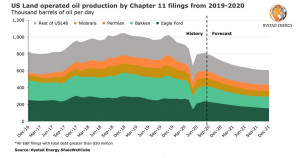

Bankruptcy-hit US operators set to lose a quarter of oil production in 2021, offsetting nationwide growth

AJOT | December 16, 2020 | Energy | Conventional | By The Numbers

As Chapter 11 filings by US E&Ps continue to pile up, onshore oil production from companies that filed for bankruptcy in the last two years is set to decrease by about 25% by the end of 2021, or by about 200,000 barrels per day (bpd) compared to current output levels, a Rystad Energy analysis shows.

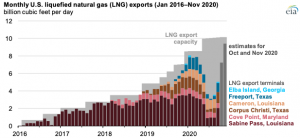

U.S. liquefied natural gas exports set a record in November

AJOT | December 16, 2020 | Energy | Conventional | By The Numbers

During the summer of 2020, monthly exports of liquefied natural gas (LNG) from the United States were the lowest in 26 months but have since increased, and in November, estimated LNG exports surpassed the previous record set in January 2020.

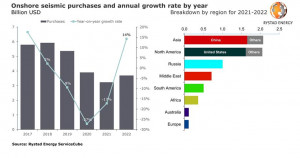

China to be top market for onshore seismic in the next two years; global recovery to wait until 2022

AJOT | December 16, 2020 | Energy | Conventional | By The Numbers

The global onshore seismic market has had a devastating 2020 with a 27% slump in purchase value. Next year is set to be even more painful year as operators’ budget cuts will continue to strain the services sector, before a projected recovery in 2022, a Rystad Energy report shows.

Rystad Energy’s daily market comment from our Head of Oil Markets Bjornar Tonhaugen

AJOT | December 16, 2020 | Energy | Conventional | By The Numbers

Oil prices this week seem to get the blues in the mornings, as the market firstly digests bearish indicators, but then as positive news emerge from the vaccination front prices tick up again.

Rystad Energy’s daily market comment from our Head of Oil Markets Bjornar Tonhaugen

AJOT | December 15, 2020 | Energy | Conventional | By The Numbers

Today oil prices experienced a characteristic swing, caused by how sometimes trading focuses on different news when it moves from East to West.

Rystad Energy’s daily market comment from our Head of Oil Markets Bjornar Tonhaugen

AJOT | December 14, 2020 | By The Numbers

Christmas came early for oil prices as a combo of global medical, fiscal and geopolitical developments this week is helping Brent recover the 50+ dollar level it achieved last week.

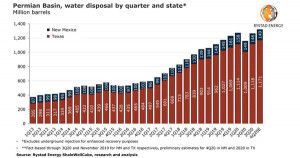

Rystad: The last growing market of US land services, water disposal, is set for an all-time high in the Permian

AJOT | December 11, 2020 | Energy | Conventional | By The Numbers

Water disposal* in the Permian Basin is likely to hit a new all-time high in the fourth quarter of 2020, exceeding 1.3 billion barrels for the period for the first time in history, potentially further expanding Texas’ total water market which had already recovered close to its pre-Covid record in October, a Rystad Energy analysis projects.

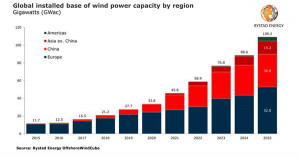

Rystad: China’s growth set to help Asia’s installed offshore wind capacity catch up with Europe in 2025

AJOT | December 11, 2020 | Energy | Alternative | By The Numbers

From almost no offshore wind farms in 2015, Asia’s operational capacity has grown to more than 6 gigawatts (GW) today. Fueled by China’s growth, the continent’s installed base is expected to rise sixfold by 2025, when it will reach 52 GW and be almost on par with Europe, the global offshore wind leader, a Rystad Energy analysis shows.

© Copyright 1999–2024 American Journal of Transportation. All Rights Reserved