By the Numbers

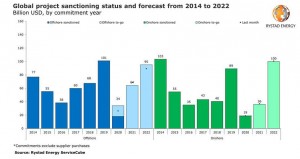

Global oil & gas project sanctioning is set to recover and exceed pre-Covid-19 levels from 2022

AJOT | September 21, 2020 | Energy | Conventional | By The Numbers

The Covid-19 pandemic has devastated global oil and gas project sanctioning this year and will cause total committed spending to drop to around $53 billion from 2019’s $190 billion, Rystad Energy projects. Postponed plans will, however, cause the total worth of final investment decisions (FIDs) to double next year and exceed pre-pandemic levels already from 2022.

Rystad Energy’s daily market comment from our Head of Oil Markets Bjornar Tonhaugen

AJOT | September 21, 2020 | Energy | Conventional | By The Numbers

Oil prices are starting the week on the back foot as traders digest news about downside risks to oil demand and upside risks to supply this morning.

Indonesia’s palm oil exports rise on higher shipments to China

Bloomberg | September 20, 2020 | International Trade | By The Numbers

Indonesia’s palm oil exports increased in July on higher shipments to China and the Middle East, according to the Indonesian Palm Oil Association.

Rystad Energy’s daily market comment from our Head of Oil Markets Bjornar Tonhaugen

AJOT | September 18, 2020 | Energy | Conventional | By The Numbers

It was a strong OPEC meeting yesterday, not necessarily in actions, but in words. The alliance showed strength and reassured the market that if further action will be needed to discipline sub-compliers and balance the market, it would be taken.

U.S. Airlines report second quarter 2020 losses

AJOT | September 14, 2020 | Air Cargo | Airlines | By The Numbers

U.S. scheduled passenger airlines reported a second-quarter 2020 after-tax net loss of $11.0 billion and a pre-tax operating loss of $16.2 billion.

Port of Virginia loaded imports mark third consecutive month of growth as trade rebuilds

AJOT | September 14, 2020 | Ports & Terminals | Ports | By The Numbers

The Port of Virginia’s cargo volumes are continuing their rebound and in August grew by more than 26,000 units when compared with July.

Virus and trade woes set to cut Australian farm exports by 10%

Bloomberg | September 14, 2020 | International Trade | Commodity | By The Numbers

The value of Australian agricultural commodity exports is expected to slump by 10% in 2020-21, as the Covid-19 pandemic and trade tensions with China hit demand and prices, according to a report from government forecaster Abares.

Rystad Energy’s daily market comment from our Head of Oil Markets Bjornar Tonhaugen

AJOT | September 14, 2020 | Energy | Conventional | By The Numbers

After two weeks of back to back losses, oil prices are continuing their decline, a sign that the bearish trend is not going to be so easily reversed.

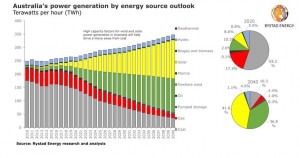

Australia’s gas and coal demand for power has peaked – to be overtaken by solar and wind from 2026

AJOT | September 11, 2020 | Energy | Alternative | By The Numbers

Australia’s top two electricity generation sources, coal and natural gas, have both seen demand in the country peak, a Rystad Energy analysis shows. The combined power production from coal and gas will be overtaken by electricity generated by solar photovoltaic (PV) and onshore wind farms from 2026.

Rystad Energy’s daily market comment from our Senior Oil Markets Analyst Paola Rodriguez-Masiu

AJOT | September 11, 2020 | Energy | Conventional | By The Numbers

ou have to look at the trend. Oil prices are keeping their low levels, heading for a second consecutive week of losses for the first time since April, the height of Covid-19’s first wave.

U.S. Imports spike as economy continues recovery and retailers stock up for holidays

AJOT | September 09, 2020 | International Trade | By The Numbers

Imports surged to unexpected high levels this summer and may have hit a new record as the U.S. economy continues to reopen and retailers stock up for the holiday season, according to the monthly Global Port Tracker report released today by the National Retail Federation and Hackett Associates.

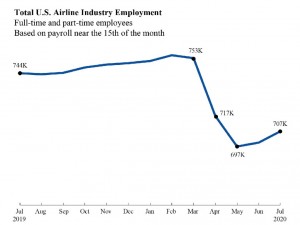

Mid-July airline employment up 7,000 from mid-June

AJOT | September 09, 2020 | Air Cargo | Airlines | By The Numbers

U.S. airlines employed 706,824 workers in the middle of July 2020, 7,101 more than in mid-June 2020 and 46,461 fewer than in March 2020. The July 2020 numbers consist of 597,982 full-time and 108,842 part-time workers.

Oil bounces back with boost from rising equities and technicals

Bloomberg | September 09, 2020 | Energy | Conventional | By The Numbers

Oil rebounded as broader markets clawed back some losses from Tuesday’s swift selloff.

DAT: Spot rates hit new highs heading into holiday

AJOT | September 09, 2020 | Intermodal | Trucking | By The Numbers

Aug 31 - Sept 6 - The average linehaul rate for dry van freight set an all-time record high in August (all-in spot rates were higher in June 2018 due to higher fuel surcharges).

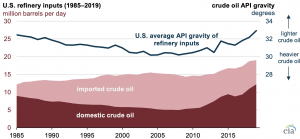

The U.S. continued to produce more light crude oil in 2019 and import less heavy crude oil

AJOT | September 09, 2020 | Energy | Conventional | By The Numbers

This increase in production was led by relatively light, less dense crude oil and was largely the result of the growth in crude oil production from shale and tight rock formations.

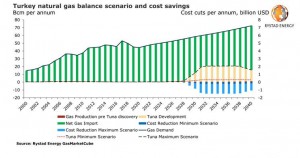

Turkey’s hooked Tuna gas discovery could save it up to $21 billion in import costs

AJOT | September 09, 2020 | Energy | Conventional | By The Numbers

The future development of Turkey’s giant Tuna-1 gas discovery could save the country up to $21 billion in import costs, Rystad Energy estimates, depending on the field’s peak output, which remains to be determined pending appraisal drilling and further testing. Actual savings could be even higher as global gas prices and import costs are expected to rise in coming years.

Rystad Energy’s daily market comment from our Senior Oil Markets Analyst Paola Rodriguez-Masiu

AJOT | September 09, 2020 | Energy | Conventional | By The Numbers

After registering on Tuesday the worst one-day drop since late-June, oil prices finally ticked up a bit this morning with Brent breaking back to 40+ dollar territory. The gains today, so far below a dollar in both grades, are indeed a rectification of the massive blow the market took yesterday. But the real overall correction is the price decline itself which started last week and continued until this morning. The balances outlook has been tight and we have been expecting a bearish correction for a while, but in the last days it came like a blow to shock the market. The persistence of Covid-19 infections globally and in key oil-consuming markets in particular has been asking for a price squeeze since some time. The market really worries and has been worrying about stalling demand, and bearish news keep emerging. One of the latest bearish signals came yesterday from Abu Dhabi after the country announced cuts to its official selling price. Abu Dhabi followed Saudi Arabia's price cuts from Saturday and is the first trimming done to prices in about four months. When strong Middle Eastern producers are willing to sell-off in lower prices it is normal that the global market panics and follows suit. The panic is what registered the massive losses yesterday and that is why we see the minor uptick this morning. But make no mistake, it may take a while to see the return of 45-dollar levels that oil prices have been enjoying recently. The real correction happened and it was a bearish one. The market is fragile and if traders have been enjoying a summer utopia, they finally woke up to the reality of the oil demand recovery’s prospects. Our liquids balances now point to a just-balanced market that could very quickly tip over if OPEC+ members start to reduce compliance, or if fears of a worsening demand outlook become a reality. In addition, our current balances outlook shows that the market will fall short of the titanic task of eliminating the surplus that was accumulated during the first half of the year. As a result, inventories are expected to remain at high levels for longer, pressuring prices well into 2021. Looking at the bigger picture, the current bearish price correction was inevitable. It is not only the demand-side of the equation that is looking increasingly worrying. There is also the threat of supply coming back quicker than anticipated due to mounting economic pressure in OPEC+ economies, which are currently suffering from a double whammy: lower volumes and lower prices.

Oil extends losses after first sub-$40 close since mid-June

Bloomberg | September 09, 2020 | Energy | Conventional | By The Numbers

Oil extended losses after its biggest one-day drop in more than two months as growing doubts over the strength of the global demand recovery along with continued weakness in stocks soured market sentiment.

Airline travel over Labor Day surges to most since March

Bloomberg | September 08, 2020 | Air Cargo | Airlines | By The Numbers

On Friday, 968,673 people passed through security screening portals at U.S. airports, the Transportation Security Administration said on its website. That was 44.1% of the equivalent day last year, the most since levels plunged in mid-March.

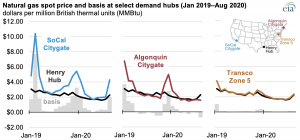

Natural gas price differentials to Henry Hub narrowed at most hubs in first half of 2020

AJOT | September 08, 2020 | Energy | Conventional | By The Numbers

The average spot price differentials between regional natural gas hubs and the Henry Hub, also typically known in the natural gas industry as the basis price, have narrowed at many trading hubs in the first half of 2020 compared with the first half of 2019.

© Copyright 1999–2024 American Journal of Transportation. All Rights Reserved