PMA report warns U.S. West Coast Ports could lose up to 45% of intermodal imports to B.C. ports by 2030

A Mercator study commissioned by the Pacific Maritime Association (PMA) warns that high U.S. rail costs and other factors could cause U.S. West Coast (USWC) ports to lose between 15% to 45% of intermodal import business to British Columbia (BC) ports by 2030.

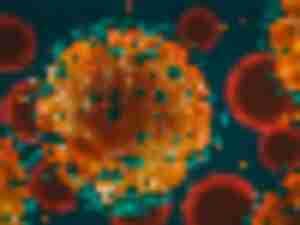

What COVID-19 has taught us about supply chain risks and how companies need to rethink their approach

The pandemic has not only taken a personal toll on nearly everyone in the world, it has also rocked global economies to its core causing financial strain across industries, including healthcare, retail and automotive, among other sectors.

AI optimization software helping ports improve intermodal rail operations

American seaports are vital to the U.S. economy, providing a gateway to the global marketplace. Today, however, they are in need of critical infrastructure and technology improvements.

Seroka reports Port of LA August imports are up as holiday season kicks in

At a September 15th virtual press conference, Port of Los Angeles Executive Director Gene Seroka announced that imports rose in August and the Port sees trends indicating volumes will continue to improve in September and October.

Consultant says shippers using U.S. West Coast ports can’t book rail on BNSF and UP

A Northern California logistics consultant was unable to book containers on the Burlington Northern Santa Fe (BNSF) or Union Pacific (UP) railroads for the first week of September going to and from U.S. West Coast ports and Midwest destinations.

UK study says sea level rise will force ports to spend as much as $18 billion by 2050

By 2050, the effects of sea level rise will require ports around the world to allocate an additional $8 billion to $18 billion to protect their facilities, according to a new study.

STB and FRA echo rail worker concerns about U.S. rail service

On August 24th, the heads of the Surface Transportation Board (STB) and the Federal Railway Administration (FRA) sent identical letters to the heads of the leading U.S. railroads, including the Union Pacific (UP) and the Burlington Northern Santa Fe (BNSF) expressing concerns about the quality of the U.S. railroad infrastructure and disruptions in rail service.

Stanford says Northern California highways face sea level threat rise

A Stanford University study warns that coastal highways face a growing risk of flooding from sea level rise and storm surges that cascade into delays for commuters with limited road alternatives that may be miles away from flooding.

Does Amazon Dominate the U.S. Supply Chain?

Book Review: “The Cost of Free Shipping: Amazon in the Global Economy” Pluto Press 2020 Hardcover $99

Seroka reports LA container volumes decline by 6% in July

Port of Los Angeles Executive Director Gene Seroka told a press conference via Zoom that the Port’s July container volumes were down by 6.11% in July 2020 at 856,389 TEUs (twenty-foot container units) compared to 912,154 TEUs in 2019.

© Copyright 1999–2024 American Journal of Transportation. All Rights Reserved