By Ed Bastian, Special to the AJOT

You could call this the perfect storm but I’m sure major retailers and importers from Asia would have other choice words to describe the current situation in the container sector. The supply chain is currently experiencing severe disruptions. Tight capacity on the vessel side, terminal congestion at major hub ports like Los Angeles/Long Beach and equipment shortages both on the water and on land has caused freight rates to soar. In some trade lanes container rates have more than doubled and, in some cases, tripled in the last 12 months.

Alexander Graham Bell coined the phrase “when one door closes, another opens;” This quote rings true today. You could also call it the “COVID” effect. We tend to focus on the severe impact COVID has wreaked on the airlines, hospitality, dining establishments and many other businesses. At the same time, we have seen new industries pop up, such as, PPE supplies, these are the latest additions to your fashion ensemble. And the demand for plexiglass and other building materials in order to make businesses adapt to the new COVID conditions. The door that did open was on a global scale!

Multipurpose Sector

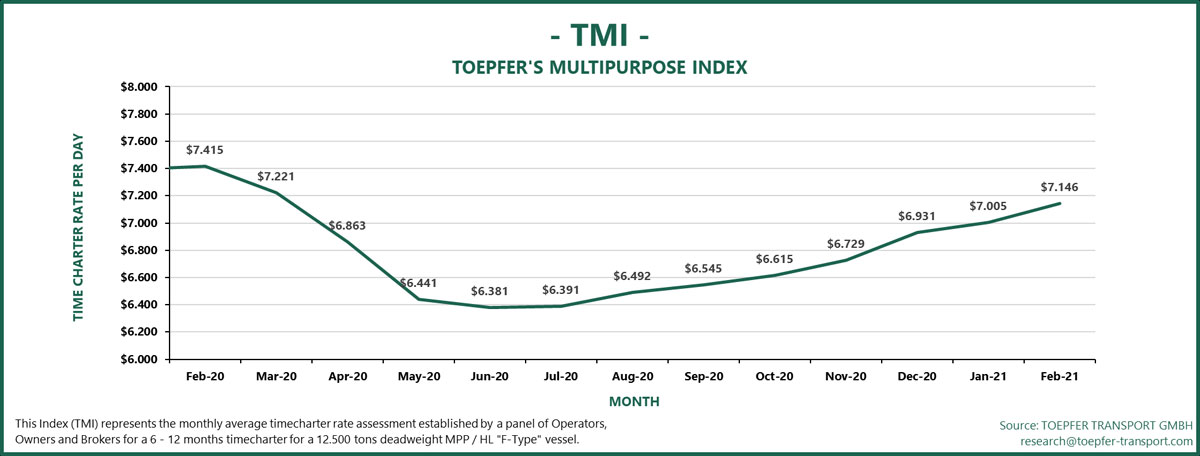

For years now, the Multipurpose Sector has been under pressure from container; RO/RO and bulk carriers who have been poaching away cargoes to support their own breakbulk and out of gauge cargo ambitions. While this has certainly had an impact on available cargo volumes for the MPP segment, it has been relatively confined to major port pairs when it comes to container carriers. However, recently we have seen the shoe move to the other foot as MPP carriers are being approached by major forwarders and shippers offering containers for on-carriage that cannot find their way on to traditional container ships. We have also seen major container operators going into the charter market and taking on multipurpose tonnage to relieve the current shortage of container space. This demand for tonnage has also resulted in the rise of average daily charter rates.

In addition to this recent windfall of containers coming over to MPP vessels the outlook for the sector was also beginning to look up again. Over the past few year MPP owners have been much more tempered in their newbuild ordering which has now created a much closer balance between capacity and cargo demand. The wind and renewable energy sector are forecast to remain strong, and one must think that oil prices will rise if the new US administration is able to curb U.S. production.

It should make for a very interesting year!

Editor’s Note: Ed Bastian is Global Director of Sales for BBC Chartering. BBC Chartering is the largest MPP operator in the world.