The air freight equivalent of the ocean container, unit load devices (ULDs) are the backbone of the air cargo supply chain. Whether goods are shipped inside closed containers or loaded onto pallets, ULDs are critical for the efficient and secure transit of freight around the globe. Unfortunately, global inventories of ULDs are under enormous strain, and airlines are finding it’s taking much longer for these assets to be delivered back to warehouses after collection by the consignee.

While ULD shortages grow more acute, the demand for air cargo is soaring. In 2021, the global air freight market posted its biggest improvement in year-on-year demand since 2010, according to IATA’s annual market analysis. With leasing companies charging record rates for ULDs—both pallets and containers—and manufacturers’ lead times for new assets of at least four to six months, technology can provide a path to help air cargo stakeholders simplify the returns process and enhance asset management for the long-term.

A number of major factors have contributed to the strain on global inventories of ULDs for the air cargo industry, particularly in the transpacific trade. The dramatic increase in ecommerce and the scale of supply chain disruption created by the pandemic have slowed ULD turnaround to a crawl. Transportation issues like driver shortages and capacity constraints have compounded the problem, as have significant backlogs in warehouse operations for airlines, cargo terminal operators/ground handing agents (CTO/GHA) and freight forwarders. Some freight forwarders are even running out of warehouse space and keeping ULDs as supplementary storage.

The current level of disruption and delays are creating intense demand for these assets. Airlines are trying to overcome the challenge by leasing more units, offering incentives for faster turnarounds, and expediting repairs. Leasing companies are charging record-high rates but are themselves running out of inventory. Similarly, container and pallet manufacturers are running at maximum capacity, but they still cannot fulfill the current demand in short order. As factors such as the strong consumer demand for goods, the appeal of air cargo as an alternative to ocean container shipping, new large scale Shanghai lockdowns and geopolitical uncertainty exert unprecedented pressure on global supply chains, the need for ULDs shows little sign of diminishing and it remains extremely difficult to predict how long shortages will persist.

The complexities of demurrage penalties

In the maritime industry, demurrage has been charged for many years to help ocean carriers recover their container assets, but air carriers have not often taken this step. As ULD owners struggle, however, with the widespread habit of third parties picking up, retaining, moving, and sharing assets without returning them, demurrage is emerging as an option.

From the forwarder’s point of view, it’s all about convenience—it’s more efficient to hold onto assets than to spend time and effort to return them. In some cases, it may require a few hours lining up at the airport for a return. It’s also handy to have assets on hand for the next shipment, instead of needing to travel to the airport to pick up equipment. What’s also in the mix is that there’s currently no “real” pressure to return them. While some airlines have demurrage policies in place whereby third parties may incur penalties of US$30.00 – $50.00 per day (depending on the type of ULD) when assets are not returned on time, penalties are seldom levied. In one respect, airlines would be, in effect, penalizing their customers—a potentially detrimental move to the business relationship. Additionally, many airlines don’t have the systems in place to monitor, manage, calculate, and collect demurrage fees—or the human resources required to administer demurrage workflows (e.g., issuing invoices).

IoT technologies optimize asset use and return

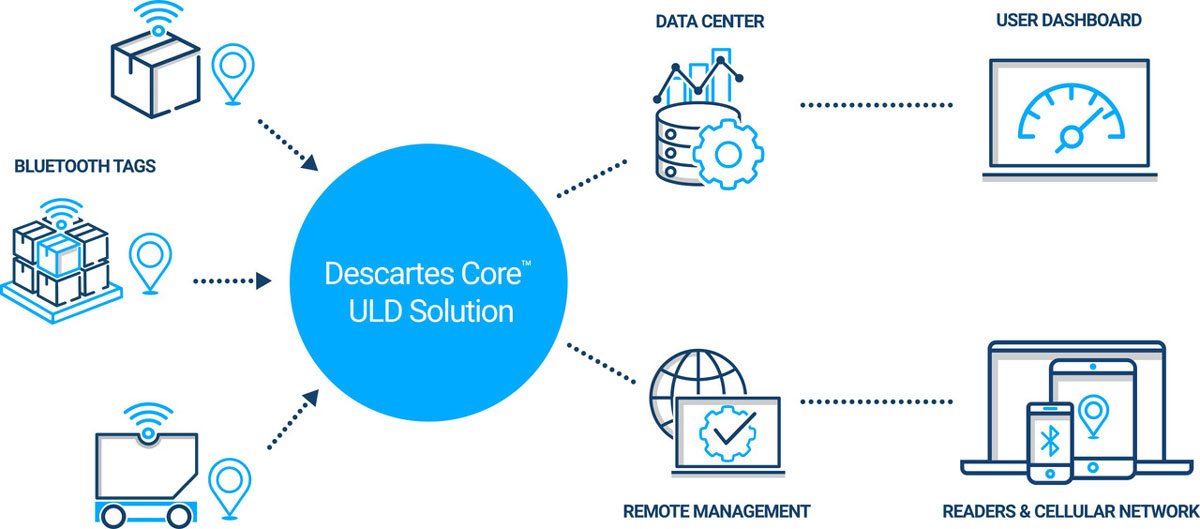

Two technologies can help airlines maximize the use of the ULDs they do have and simplify return practices by changing the behavior of agents, so they return assets on time: (1) Bluetooth® Low Energy (BLE)-enabled ULD tracking and (2) demurrage automation. BLE tracking uses Bluetooth tags affixed to containers or pallets to automate end-to-end tracking of assets. BLE readers capture the movement of ULDs that have BLE tags attached. Assets, and the shipments bundled inside them, can be tracked whether in the air or on the ground. In addition to location, other sensor-based, condition-related information can be monitored for shipments, such as precise temperature, movement, and humidity. Tags can also be added to any ground service equipment, like dollies, for full control over a carrier’s equipment.

BLE tracking provides real-time visibility into the exact location of ULDs, whose custody they are in at a given time, and traces asset movements easily to clarify any discrepancies between stakeholders. While this technology tells you where your assets are, it doesn’t know when demurrage is going to start and stop, or when assets are to be returned. By integrating demurrage capabilities with BLE tracking, however, companies have a single platform to automate the release and return of ULDs, capture the image of assets to record any damage, calculate demurrage fees, generate invoices, and reconcile billing, as well as send return and overdue alerts to forwarders or ground handlers. Technology also drives better forecasting and planning so airlines can identify asset shortages before they occur and take proactive action as necessary, such as leasing or purchasing new assets.

Capitalizing on Air Cargo Growth

Understanding exactly where ULDs are in real-time is instrumental in getting them back from third parties. Automating demurrage processes will help enforce asset turnaround and better asset utilization for all stakeholders. Combining demurrage automation and BLE tracking technologies will provide the maximum commercial benefit associated with fulfilling air cargo shipments (i.e., protecting and earning revenue), as there will be no business loss due to the shortage of shipping assets. By helping air carriers reduce asset losses, better match capacity with asset inventory, and reduce the costs associated with misplaced equipment or the requirement to lease additional assets, these technologies will help air cargo industry stakeholders capitalize on today’s opportunities for growth.