In the past two years, a lot of attention has been paid to global supply chains. According to Google Trends, searches for “supply chain” have increased more than 64% since the beginning of 2019 – with interest more than doubling at the height of the West Coast port crisis last fall.

With empty grocery shelves, stuck cargo ships and port shutdowns, it’s no surprise that the world took notice of global logistics infrastructure that was previously invisible to most people. Unfortunately, with ongoing surges of COVID-19 now shutting down cities like Shanghai and Shenzhen, war and other unpredictable events, supply chains will remain under the microscope.

There is a strong correlation between COVID-19 cases per capita and changes in average port dwell times during COVID-19 outbreaks. For example, during the Omicron outbreak in the U.S., the states with the highest COVID-19 incidence rates could expect a ~45% higher average dwell time increase vs. states with the lowest incidence rates.

When combined with other major events — Brexit, Lunar New Year and war in Ukraine — delays can snowball or create a bullwhip effect, with downstream impacts to other modes and regions.

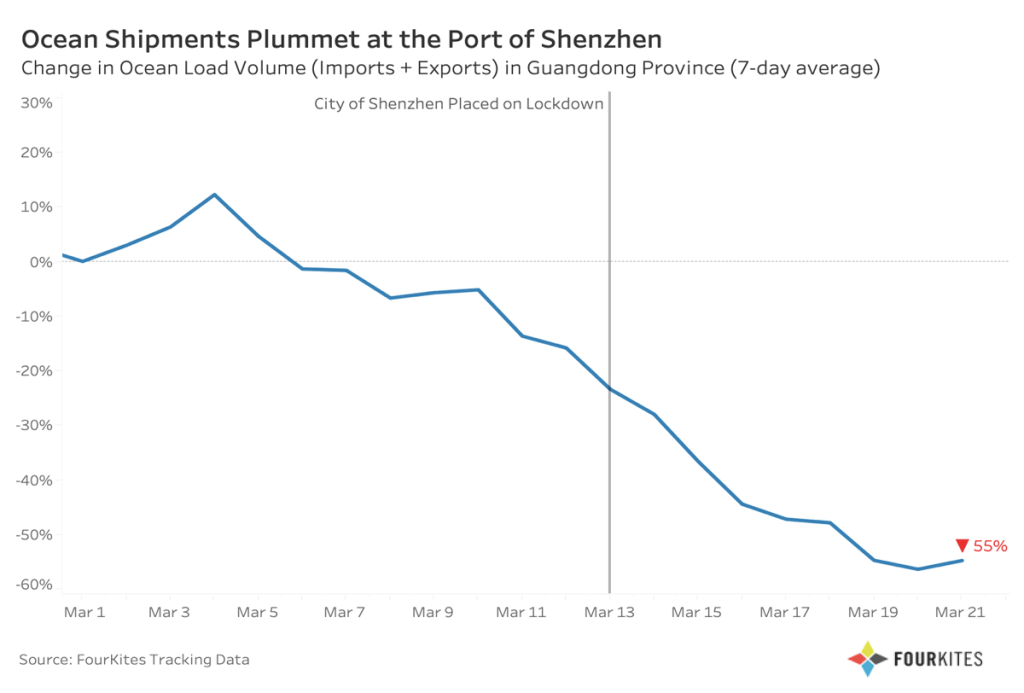

Most recently, following COVID-19-related lockdowns in the Guangdong Province, where the City of Shenzhen is located, the 7-day average ocean load volume for imports and exports is down 55% since March 1.

Meanwhile, FourKites data show that the 7-day average ocean dwell time for imports is now 8 days, a 63% increase from the beginning of March. For exports, the 7-day average ocean dwell time is now close to 10 days, an 11% increase over the same period.

Shenzhen is the second busiest port next to Shanghai, so we will expect to see significant

volume shift to the other ports within China. This will increase potential dwell, suboptimal routing, as well as increased inland costs to move freight to a port further away from the manufacturing point.

It’s a familiar trend — in December 2021, the Omicron outbreak in Tianjin, China, caused average ocean dwell times at the port to grow over 52% higher while weekly Chinese imports tracked by FourKites decreased by 57%. Similarly, New York, one of the states hit hardest by the Omicron variant, saw average ocean dwell times increase by 54% from before the spike in cases during the week of January 10.

And now cases are rising elsewhere around the world. While we cannot predict when the next wave will happen, we know that it will cause delays that are 45%+ higher than our current “normal.”

More Port Problems

But wait, there’s more. War in Ukraine, Brexit and inevitable weather events have and will exacerbate supply chain disruption caused by the relentless SARS-CoV-2 virus. Not to mention that as carriers and terminal operators work through these issues, we can expect to see temporary constraints on assets, such as containers and chassis, that will contribute to further delays.

Brexit, for instance, led to ports in other European countries to see their share of transshipments increase. Specifically, during the period of February 2021-January 2022, Germany has grown from 8% to 20%, the Netherlands from 11% to 23%, and Spain from 5% to 15%. Dwell times at UK ports of discharge, meanwhile, increased from a low of 3.6 days in April 2021 to 7.7 days as of February 2022.

With COVID-19 and Brexit already mucking up the flow of goods from Asia to Europe and from the UK elsewhere, the war in Ukraine has only complicated supply chains and restricted capacity further.

As of March 28, ocean dwell times European ports remain high – particularly in Eastern and Southern Europe, where dwell times are 28% and 29% above mid-February levels, respectively. Notably, deliveries to countries bordering Russia and/or Ukraine have increased, signaling that shippers may still be diverting goods to nearby countries to avoid the conflict. Seven-day average delivery volume to these countries (including Finland, Latvia, Estonia, Poland, and others) was up 42% compared to February 21.

Predictable Outcomes of Unpredictable Events

As we’ve said before, bottlenecks, delays and disruptions are commonplace in logistics management, and balancing supply with anticipated demand is a delicate art even in the best of times. When dealing with the unforeseeable, organizations need better data to track their products as they travel to their final destinations.

Companies must be agile and have the right insights to react to supply chain disruptions quickly. Reliance on siloed teams, antiquated processes and manual track-and-trace efforts is no longer enough.