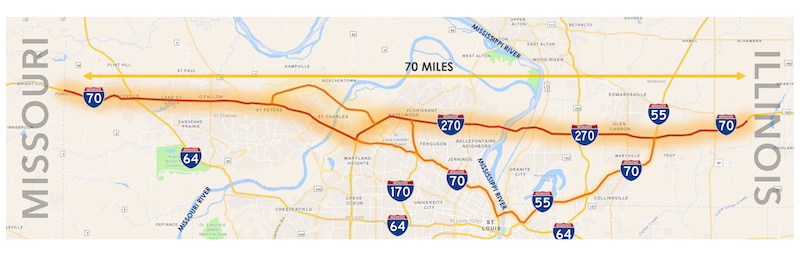

A 70-mile transportation corridor is the epicenter of the historic surge in new construction in the St. Louis regional industrial market. More than 24 million square feet of new industrial space hit the market over the last five years, and nowhere is this construction boom more evident than along the Interstate 70 corridor running from Foristell, Missouri to Marine, Illinois. The major logistics corridor is home to a wealth of national manufacturers, suppliers, and distributors, with room to develop even more. The activity in the corridor and anticipated direction of future growth was the focus of the final session of FreightWeekSTL 2023 on May 26, which was moderated by Doug Rasmussen, CEO and Managing Principal of Steadfast City Economic & Community Partners, and featured panelists Ed Lampitt, Vice Chair of Cushman & Wakefield, and Matt Hrubes, Senior Vice President of CBRE.

Steadfast City recently completed in-depth research on the 70s corridor, which includes Interstate 70 and portions of Interstates 170, 270 and 370. Regarding this corridor, Rasmussen noted that in 2022, eight million square feet of new space was delivered and about six and a half million square feet was absorbed. The top six leases in the market in 2022, which represented about 2.4 million square feet, were all signed with companies in this 70-mile corridor. He noted that Procter & Gamble was at two million square feet, Unilever at 1.7 million square feet, and Walgreens with a half million square feet, and the corridor also recently attracted other companies that are new to the market, including Tesla. Overall, the corridor is home to about 30 companies that each occupy more than a half million square feet, and there are approximately one billion dollars of infrastructure improvements underway or planned along the corridor.

Lampitt said it is noteworthy that 85% of all institutional product in the St. Louis area is along the 70s corridor and agreed that it is where they are seeing the bulk of regional industrial activity. In discussing recent trends in the corridor, he said one of the biggest, especially in 2022, was the shift from e-commerce and 3PL tenants to manufacturing tenants. He clarified it was still a lot of distribution space being leased, but it was being leased by manufacturing companies.

“Also, we continue to see service deliveries continue to go up, meaning they have to be closer to their customers. We've seen a significant increase of new tenants, new users to St. Louis,” said Lampitt. “We used to quote that 17% of all deals were new to St. Louis, meaning they didn't have a presence here. That's doubled. It's in the 30, 30-plus percent range.”

Those trends are reflected in the diversity of the deals being done in the 70s corridor, from spaces of 200,000 sq. ft. or less being snapped up by companies that want to be closer to rooftops for their distribution, to the new 800,000 square foot manufacturing facility being built by American Foods Group in Warren County, Missouri.

Hrubes talked about the changes he has seen related to tax abatements and the impact that has had on the market and along the 70s corridor, as the types of tax abatements that originated on the Illinois side of the Mississippi River many years ago and drove industrial development there, have made their way into Missouri.

“That's what really spearheaded a lot of that development along Highway 70, especially in the Hazelwood market,” Hrubes said, pointing to developments such as Hazelwood Logistics Park and Hazelwood TradePort, both developed by NorthPoint, the old Ford plant that Panattoni redeveloped and the former Mills Outlet Mall that is now being converted into industrial space after receiving an almost 20-year tax abatement. “Without those kinds of economic incentives, who knows where we'd be. That was really a driving force, I think, that added to the success of those developments.”

Hrubes said, “in the Southwestern Illinois market, it used to be a 10-year sliding scale tax abatement, and now on the Missouri side of the Mississippi River, the industry is seeing 18 or even 20 years of tax abatement being offered and the same thing occurring in St. Charles County, where other types of incentives, such as Chapter 100s, are adding to the success of developments such as the Premier 370 Business Park.”

“Finally we're able to compete and challenge other states. If it's a multi-city search, St. Louis now looks a lot better compared to where it used to be just five to 10 years ago,” Hrubes said

The labor pool was discussed, with Lampitt highlighting that retaining workers is as important as finding them, while Hrubes said the areas attracting industrial investment along the 70s corridor are the ripe areas for the types of workers needed. He said one of the first things a lot of companies do when exploring different site locations is to check the box on the labor study.

“If they can see that there's a readily available workforce, whether it's a skilled workforce or a warehouse workforce, they need to have those things in place before they decide to either lease space or build property in those locations,” Hrubes said.

The demand for labor is what Hrubes said will continue to drive development further west along the 70s corridor, where there’s not only a good existing labor pool in St. Charles County, but also the potential to draw from nearby Lincoln, Franklin and Warren counties. Rasmussen said he also expects further growth on the eastern edge of the 70s corridor as companies have the ability to draw workers from nearby Bond and Clinton Counties in Illinois.

Lampitt highlighted that some of the significant growth in recent years has been internal growth, with existing companies expanding their presence in the bi-state region, underscoring the need to make sure developers are taking care of the companies already invested here. He cited as examples, Procter& Gamble, which started with 800,000 square feet and now has three million, and Worldwide Technology, which started with 200,000 square feet in 2005 and now is at 3.6 million.

Looking forward, Rasmussen called attention to the fact that industry experts are estimating there may be about three million square feet of space coming back on the market as second generation space, and speculated if that might be a cause for concern. Both panelists said they saw that as a plus for the region at this time, given the historically low vacancy rates and the need to have flexible product offerings to meet market demands. Hrubes said that just three of four deals would be all it would take to absorb the entire amount of second generation space by the end of the year.

“I actually think that there needs to be more spec built right now; there's not enough product out there,” said Hrubes. “To Ed's point about the vacancy rate, it's probably too low. And I think that we need more space because you get below 6% to 8% vacancy rate, it's time to build. If you don't have it, then you're not going to see the activity.

The need to have available product was further highlighted by Rasmussen, Hrubes, and Lampit, who talked about Tesla’s decision to locate its newest Midwest facility in the St. Louis region. The company was initially targeting the Kansas City market, but couldn’t find the 700,000 square feet of space it needed there. Tesla found exactly what they needed at Gateway TradePort, a planned industrial park in Pontoon Beach, Illinois, which is one of the newest industrial parks in the 70s corridor. Hrubes said that infrastructure investment has been key to spurring development all along the 70s corridor.

“Before Highway 370 was developed, that land was worthless, you know, it was just farm ground and floodplain, and then, all of a sudden, 370 comes along. Now look at all the industrial development that's been spurred along there,” said Hrubes. “Then comes the Page Extension Bridge. Now look at all the development that's going on along 141 and the improvements that were done there, to actually have a connector that goes all the way from South County to North County through ground zero for our industrial real estate sector, which is Earth City. And you follow 141, there's probably a lot of decision makers that live in that zip code. It just makes sense. When you add that infrastructure and you invest dollars in it, it opens up other opportunities for development that makes a lot of sense to a lot of people.”

Rasmussen asked the panelists if they were seeing any reshoring activity along the 70s corridor. Hrubes pointed to the General Motors (GM) plant in Wentzville, which is likely the largest manufacturer in the bi-state St. Louis region, noting that GM master leased a supplier warehouse. “I think when you have large scale manufacturing like that, then it does increase the demand for suppliers to that company or that facility,” said Hrubes. “They all need to locate close to there, obviously, because the transportation cost to get those items, on demand, on time is significant. So yes, you can call it onshoring. I think it's been happening here for years, and I think that it will just continue to ramp up.

Panel session host Mary Lamie said, “We appreciate you providing some great insight that will be helpful as the Freightway continues to promote the 70s corridor and its incredible concentration of industrial warehousing and distribution operations that make it a prime location for existing businesses and future industrial site selection and economic growth.” Lamie is the Executive Vice President of Multi Modal Enterprises for Bi-State Development, which operates the St. Louis Regional Freightway as one of its enterprises.