The Mineta Transportation Institute has released the topline results from its 13th annual survey exploring public priorities for the federal transportation program and support for transportation taxes and fees.

“Virtually all Americans see the need for better maintained local roads, highways, and public transit,” says study co-author Asha Weinstein Agrawal, PhD. “More than 85% of survey respondents rated maintaining each of these modes as a high or medium priority for spending federal transportation dollars.”

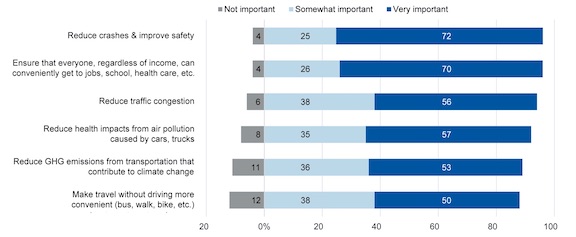

Other priorities that emerged are equity and climate-friendly policies. For example, 96% of respondents said it was somewhat or very important to ensure that people of any income can conveniently get to jobs, health care, and other essentials. Almost as many (89%) saw it as somewhat or very important to reduce greenhouse gas emissions from the transportation system.

The survey also assessed public support for raising the federal gas tax rate or adopting a new federal mileage fee. Key findings from these questions reflect the priority respondents placed on the maintenance, equity, and environment. For example:

The survey data for this study was collected from a nationally-representative sample of 2,620 adults living in the United States. Respondents completed the online survey between January 31 and March 10, 2022.

- 70% of respondents would support raising the federal gas tax rate by 10 cents per gallon if the money were dedicated to projects for maintaining streets, roads, and highways.

- If the federal government were to charge vehicles a fee for every mile driven as a replacement for the gas tax, 53% think that electric vehicles should pay a lower rate than gas and diesel vehicles. Also, 59% of respondents think that low-income drivers should pay a lower mileage fee rate than higher-income drivers.

In June, the Mineta Transportation Institute will release a full report on the survey findings that assesses how transportation system priorities and support for transportation tax options differs among population subgroups (e.g., people who drive vs. those who do not). This report will also discuss how public opinion on federal transportation taxes has evolved since 2010.