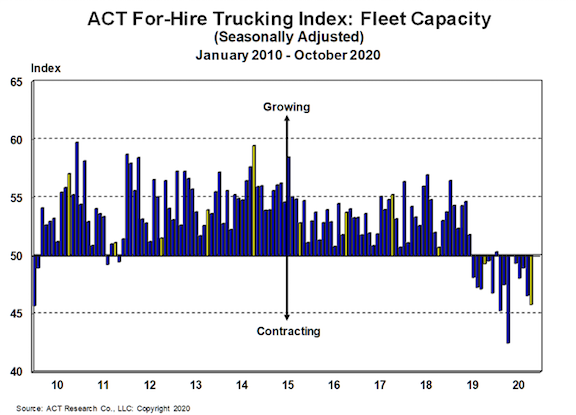

The latest release of ACT’s For-Hire Trucking Index, with October data, showed a second consecutive month of record tightness. October’s Volume Index was flat at 70.7 (SA), while Pricing dropped two points to 69.2, but still a top-decile result. With capacity and driver availability in contraction territory, at 45.8 and 28.6, respectively, the combination of strong demand and tight supply pushed the Supply-Demand Balance to its tightest level in survey history, now at 74.9.

The ACT For-Hire Trucking Index is a monthly survey of for-hire trucking service providers. ACT Research converts responses into diffusion indexes, where the neutral or flat activity level is 50. Please contact us at [email protected] if you are a for-hire executive interested in participating. In return, participants receive a detailed monthly analysis of the survey data, including Volumes, Freight Rates, Capacity, Productivity and Purchasing Intentions, plus a complimentary copy of ACT’s Transportation Digest report.

He added, “Class 8 retail sales have improved recently, suggesting equipment capacity will start to grow over the next few quarters, but as a steel shortage could constrain production and with ongoing driver market constraints, tightness is likely to continue in the near-term. We would still expect some loosening after the holiday season, as parked trucks are redeployed when extended unemployment benefits expire, but strong demand from restocking should keep the market fairly tight in the near-term.”

The ACT Freight Forecast provides forecasts for the direction of truck volumes and contract rates quarterly through 2020 with three years of annual forecasts for the truckload, less-than-truckload and intermodal segments of the transportation industry. For the truckload spot market, the report provides forecasts for the next twelve months. In 2019, the average accuracy of the report’s truckload spot rate forecasts was 98%. The ACT Research Freight Forecast uses equipment capacity modeling and the firm’s economics expertise to provide unprecedented visibility for the future of freight rates, helping businesses in transportation and logistics management plan for the future with confidence.

ACT Research is recognized as the leading publisher of commercial vehicle truck, trailer, and bus industry data, market analysis and forecasts for the North America and China markets. ACT’s analytical services are used by all major North American truck and trailer manufacturers and their suppliers, as well as banking and investment companies. ACT Research is a contributor to the Blue Chip Economic Indicators and a member of the Wall Street Journal Economic Forecast Panel. ACT Research executives have received peer recognition, including election to the Board of Directors of the National Association for Business Economics, appointment as Consulting Economist to the National Private Truck Council, and the Lawrence R. Klein Award for Blue Chip Economic Indicators’ Most Accurate Economic Forecast over a four-year period. ACT Research senior staff members have earned accolades including Chicago Federal Reserve Automotive Outlook Symposium Best Overall Forecast, Wall Street Journal Top Economic Outlook, and USA Today Top 10 Economic Forecasters. More information can be found at www.actresearch.net.

_-_127500_-_fd58817006781b0655e77d342459c13ff31c7a97_yes.png)