In the release of its Commercial Vehicle Dealer Digest, ACT Research reported that the strength in new commercial vehicle demand can be summed with strength in freight rates.

The report, which combines ACT’s proprietary data analysis from a wide variety of industry sources, paints a comprehensive picture of trends impacting transportation and commercial vehicle markets. This monthly report includes a relevant but high-level forecast summary, complete with transportation insights for use by commercial vehicle dealer executives, reviewing top-level considerations such as for-hire indices, freight, heavy and medium duty segments, the total US trailer market, used truck sales information, and a review of the US macro economy.

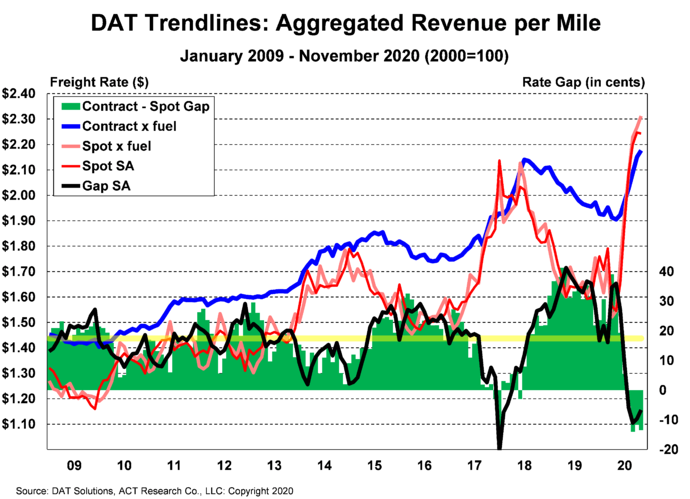

Vieth elaborated, “Since August and through November, spot freight rates have been at record levels and continued to rise in early December. For only the second time in history, spot and contract rates are inverted, with contract rates following spot rates by around five months, this suggests accelerating fleet profitability into 2021.”

He concluded, “A strong freight pipeline and structural and regulatory challenges surrounding driver recruiting suggest an unprecedented level of intractability in the supply-demand balance. Barring an exogenous event, the data suggest strong carrier profits are likely to extend through 2021 and well into 2022. The situation bodes well for new commercial vehicle demand.”