Air cargo load factors and airfreight rates continued their expected peak season climb in September, according to the latest global market data from industry analysts, CLIVE Data Services.

CLIVE’s ‘dynamic loadfactor’ – which measures both the volume and weight perspectives of cargo flown and capacity available to produce a true indicator of airline performance – rose to 68% in the last week of the month, higher than any pre-covid peak season level since CLIVE began sharing data in May 2018.

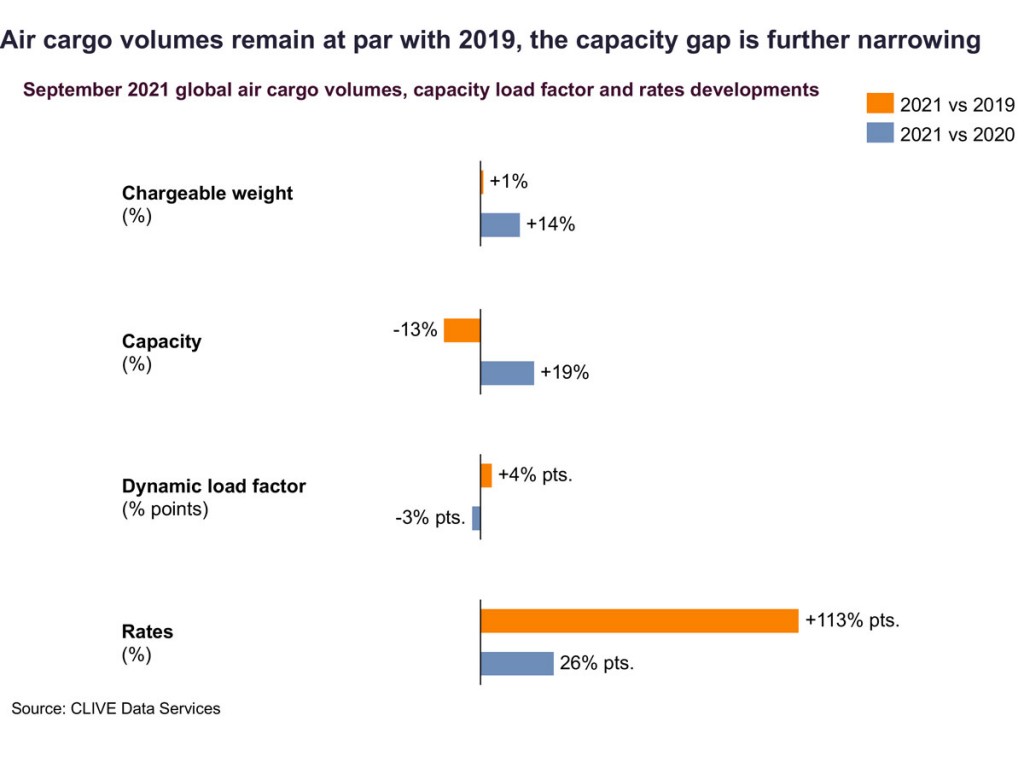

Capacity remained constrained at -13% versus the pre-covid level seen in September 2019, while in August it was still -16% versus 2019, although this more reflects the reduction in capacity in 2019 because of the ending of the summer season than an increase in capacity in 2021. Compared to August 2021, global air cargo capacity was more-or-less flat on a like-for-like basis month-over-month.

The dynamic loadfactor for September overall remained at 66% - but saw a strong upward trend towards the end of the month. This growing demand was reflected in continued higher pricing levels, with the average rate in September 2021 following a similar trend to the previous month at more than double the average rates (+113% pts) in 2019. Versus 2020, following the + 15% pts rise in rates in August, September saw a +26% pts increase as demand vs. supply further improved the ‘sellers’ market’, highlighting the strain on the air cargo supply chain.

“This September data shows just the early stages of the typical Q4 surge, but many signals and commentaries seem to suggest that this will not be a ‘typical’ peak season. The recent week-over-week increase in load factor is a significant jump by any standards and shows the pressure on the air cargo supply chain is clearly further heating up. If airlines are micromanaging their capacity right now, they can benefit from it quite substantially,” said Niall van de Wouw, CLIVE’s Managing Director.

He added: “Currently, air cargo capacity is still largely controlled by cargo departments of airlines, and I see no reason why this will change in the immediate term. We might, however, not be too far away from this starting to change as certain lanes traditionally dominated by passenger flights begin to open up again for passenger travel, like the transatlantic. This is obviously extremely important to the long-term health and survival of passenger airlines, but it will also be a bittersweet moment after the heroics of the cargo industry. The role of air cargo within the airline boardroom will likely start to recede and impact the demand vs. supply ratio once again.”