- Led the industry in completion rate in the third quarter

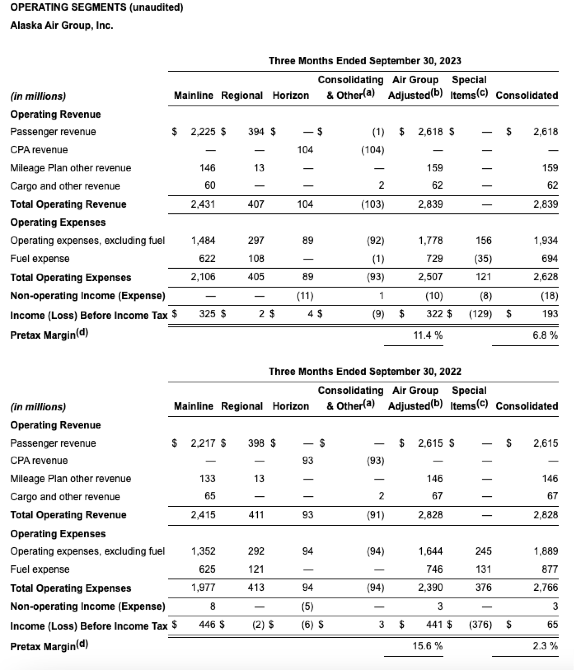

- Delivered adjusted pretax margin of 11.4%, among the best in the industry despite West Coast fuel price headwinds

- Flew the final Airbus operating flight, completing Alaska's transition to an all-Boeing fleet

Alaska Air Group (NYSE: ALK) today reported financial results for the third quarter ending September 30, 2023, and provided outlook for the fourth quarter ending December 31, 2023.

"I am grateful to our people for delivering industry-leading operational performance and strong cost discipline this quarter," said CEO Ben Minicucci. "Our 11.4% adjusted pretax margin is among the best in the industry despite external headwinds. Our investments in our all-Boeing fleet, premium seating on 100% of our aircraft and access for our loyalty members to a global alliance provide our guests with a premium domestic product that rivals any in the industry."

Financial Highlights:

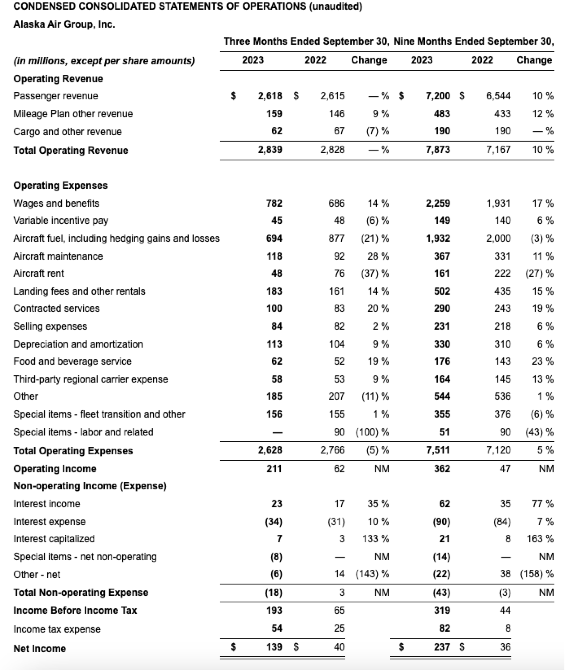

Reported net income for the third quarter of 2023 under Generally Accepted Accounting Principles (GAAP) of $139 million, or $1.08 per share, compared to a net income of $40 million, or $0.31 per share, for the third quarter of 2022.

Reported net income for the third quarter of 2023, excluding special items and mark-to-market fuel hedge accounting adjustments, of $237 million, or $1.83 per share, compared to $325 million, or $2.53 per share, for the third quarter of 2022.

Recorded $2.8 billion in operating revenue.

Reduced CASM excluding fuel and special items by 5% compared to the third quarter of 2022.

Repurchased 248,988 shares of common stock for approximately $13 million, bringing total repurchases to $70 million for the nine months ended September 30, 2023.

Generated $271 million in operating cash flow for the third quarter of 2023.

Held $2.5 billion in unrestricted cash and marketable securities as of September 30, 2023.

Ended the quarter with a debt-to-capitalization ratio of 48%, within the target range of 40% to 50%.

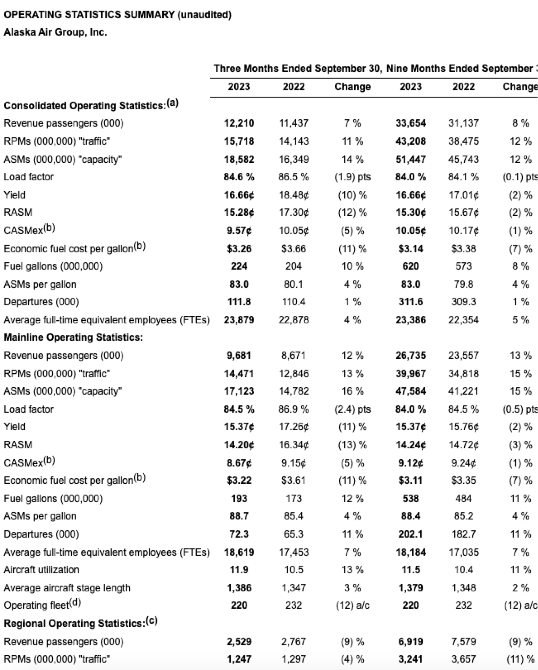

Finished the third quarter with an industry-leading completion rate of 99.7%.

Completed Alaska's transition to an all-Boeing fleet with the retirement of its A321neo aircraft in September, and reached an agreement to sell the ten A321neos to American Airlines, with aircraft sales beginning in the fourth quarter of 2023.

Received five 737-9 aircraft and two E175 aircraft during the quarter, bringing the totals in the Alaska and Horizon fleets to 56 and 41.

Provided support and relief to the Maui community following the devastating August wildfires, bringing aid to the island and donating nearly 30 million miles to assist with ongoing efforts.

Announced new nonstop daily service between San Diego and Atlanta, which will be the 37th nonstop destination from San Diego and the most of any airline serving the airport.

Launched the Mobile Verify program, providing guests with the ability to securely verify their passports before arriving to the airport for international travel.

Announced establishment of the Airline Venture Lab with UP.Labs, a partnership designed to build startups aimed at solving strategic challenges facing the airline industry.

Through Alaska Star Ventures, invested in Assaia, whose aim is to utilize artificial intelligence to optimize aircraft turn times and improve on-time performance.

Launched a new partnership with Portland-based Stumptown Coffee Roasters to create a custom coffee blend which will be introduced on all flights by the end of 2023.

Awards and Recognition:

Named for the third year in a row to Newsweek's list of America's Best Customer Service.

Recognized by Forbes as one of America's Best Employers for Women.

The following table reconciles the company's reported GAAP net income per share (EPS) for the three and nine months ended September 30, 2023 and 2022 to adjusted amounts.

Statistical data, as well as a reconciliation of the reported non-GAAP financial measures, can be found in the accompanying tables. A glossary of financial terms can be found on the last page of this release.

Alaska will hold its quarterly conference call to discuss third quarter results at 8:30 a.m. PDT on October 19, 2023. A webcast of the call is available to the public at www.alaskaair.com/investors. For those unable to listen to the live broadcast, a replay will be available after the call.

References in this update to "Air Group," "Company," "we," "us," and "our" refer to Alaska Air Group, Inc. and its subsidiaries, unless otherwise specified.

This news release may contain forward-looking statements subject to the safe harbor protection provided by Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the Private Securities Litigation Reform Act of 1995. These statements relate to future events and involve known and unknown risks and uncertainties that may cause actual outcomes to be materially different from those indicated by our forward-looking statements, assumptions or beliefs. For a comprehensive discussion of potential risk factors, see Item 1A of the Company's Annual Report on Form 10-K for the year ended December 31, 2022. Some of these risks include competition, labor costs, relations and availability, general economic conditions including those associated with pandemic recovery, increases in operating costs including fuel, inability to meet cost reduction, ESG and other strategic goals, seasonal fluctuations in demand and financial results, supply chain risks, events that negatively impact aviation safety and security, and changes in laws and regulations that impact our business. All of the forward-looking statements are qualified in their entirety by reference to the risk factors discussed in our most recent Form 10-K and in our subsequent SEC filings. We operate in a continually changing business environment, and new risk factors emerge from time to time. Management cannot predict such new risk factors, nor can it assess the impact, if any, of such new risk factors on our business or events described in any forward-looking statements. We expressly disclaim any obligation to publicly update or revise any forward-looking statements made today to conform them to actual results. Over time, our actual results, performance or achievements may differ from the anticipated results, performance or achievements that are expressed or implied by our forward-looking statements, assumptions or beliefs and such differences might be significant and materially adverse.

Alaska Airlines and our regional partners serve more than 120 destinations across the United States, Belize, Canada, Costa Rica and Mexico. We strive to be the most caring airline with award-winning customer service and an industry-leading loyalty program. As a member of the oneworld alliance, and with our additional global partners, our guests can travel to more than 1,000 destinations on more than 25 airlines while earning and redeeming miles on flights to locations around the world. Learn more about Alaska at news.alaskaair.com and follow @alaskaairnews for news and stories. Alaska Airlines and Horizon Air are subsidiaries of Alaska Air Group.

Note A: Pursuant to Regulation G, we are providing reconciliations of reported non-GAAP financial measures to their most directly comparable financial measures reported on a GAAP basis. We believe that consideration of these non-GAAP financial measures may be important to investors for the following reasons:

By excluding fuel expense and special items from our unit metrics, we believe that we have better visibility into the results of operations. Our industry is highly competitive and is characterized by high fixed costs, so even a small reduction in non-fuel operating costs can result in a significant improvement in operating results. In addition, we believe that all domestic carriers are similarly impacted by changes in jet fuel costs over the long run, so it is important for management (and thus investors) to understand the impact of (and trends in) company-specific cost drivers such as labor rates and productivity, airport costs, maintenance costs, etc., which are more controllable by management.

Cost per ASM (CASM) excluding fuel and special items, is one of the most important measures used by management and by the Air Group Board of Directors in assessing quarterly and annual cost performance.

CASM excluding fuel and special items is a measure commonly used by industry analysts, and we believe it is the basis by which they have historically compared our airline to others in the industry. The measure is also the subject of frequent questions from investors.

Adjusted income before income tax (and other items as specified in our plan documents) is an important metric for the employee incentive plan, which covers the majority of Air Group employees.

Disclosure of the individual impact of certain noted items provides investors the ability to measure and monitor performance both with and without these special items. We believe that disclosing the impact of these items as noted above is important because it provides information on significant items that are not necessarily indicative of future performance. Industry analysts and investors consistently measure our performance without these items for better comparability between periods and among other airlines.

Although we disclose our unit revenue, we do not, nor are we able to, evaluate unit revenue excluding the impact that changes in fuel costs have had on ticket prices. Fuel expense represents a large percentage of our total operating expenses. Fluctuations in fuel prices often drive changes in unit revenue in the mid-to-long term. Although we believe it is useful to evaluate non-fuel unit costs for the reasons noted above, we would caution readers of these financial statements not to place undue reliance on unit costs excluding fuel as a measure or predictor of future profitability because of the significant impact of fuel costs on our business.

GLOSSARY OF TERMS

Adjusted net debt - long-term debt, including current portion, plus capitalized operating and finance leases, less cash and marketable securities

Adjusted net debt to EBITDAR - represents net adjusted debt divided by EBITDAR (trailing twelve months earnings before interest, taxes, depreciation, amortization, special items and rent)

Aircraft Utilization - block hours per day; this represents the average number of hours per day our aircraft are in transit

Aircraft Stage Length - represents the average miles flown per aircraft departure

ASMs - available seat miles, or "capacity"; represents total seats available across the fleet multiplied by the number of miles flown

CASM - operating costs per ASM; represents all operating expenses including fuel and special items

CASMex - operating costs excluding fuel and special items per ASM, or "unit cost"; this metric is used to help track progress toward reduction of non-fuel operating costs since fuel is largely out of our control

Debt-to-capitalization ratio - represents adjusted debt (long-term debt plus capitalized operating and finance lease liabilities) divided by total equity plus adjusted debt

Diluted Earnings per Share - represents earnings per share (EPS) using fully diluted shares outstanding

Diluted Shares - represents the total number of shares that would be outstanding if all possible sources of conversion, such as stock options, were exercised

Economic Fuel - best estimate of the cash cost of fuel, net of the impact of our fuel-hedging program

Load Factor - RPMs as a percentage of ASMs; represents the number of available seats that were filled with paying passengers

Mainline - represents flying Boeing 737, Airbus A320, and Airbus A321neo jets and all associated revenue and costs

Productivity - number of revenue passengers per full-time equivalent employee

RASM - operating revenue per ASMs, or "unit revenue"; operating revenue includes all passenger revenue, freight & mail, Mileage Plan and other ancillary revenue; represents the average total revenue for flying one seat one mile

Regional - represents capacity purchased by Alaska from Horizon and SkyWest. In this segment, Regional records actual on-board passenger revenue, less costs such as fuel, distribution costs, and payments made to Horizon and SkyWest under the respective capacity purchased arrangement (CPAs). Additionally, Regional includes an allocation of corporate overhead such as IT, finance, other administrative costs incurred by Alaska and on behalf of Horizon.

RPMs - revenue passenger miles, or "traffic"; represents the number of seats that were filled with paying passengers; one passenger traveling one mile is one RPM

Yield - passenger revenue per RPM; represents the average revenue for flying one passenger one mile