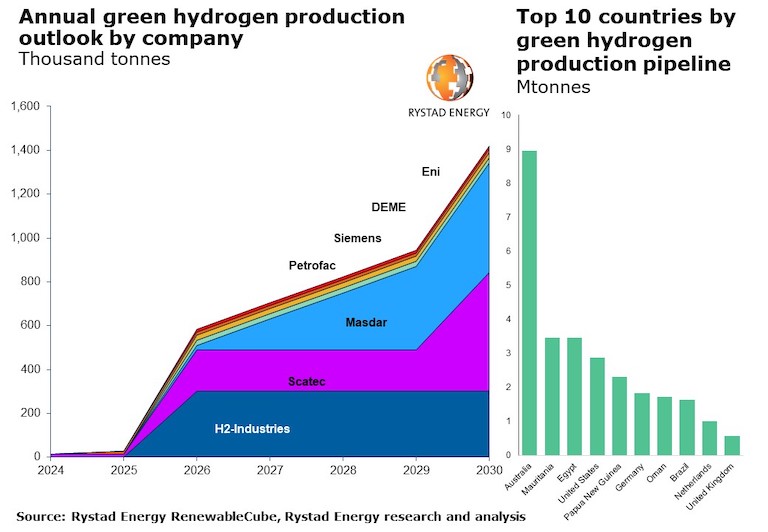

Egypt’s pipeline for green hydrogen projects stands at 11.62 gigawatts (GW), equivalent to over 1.57 million tonnes of green hydrogen, ranking the country in the top three green hydrogen pipelines globally, after Australia and on par with Mauritania. The estimated cost for these hydrogen projects alone, without additional infrastructures, will be around $20 billion. The projects are expected to come online before 2035, according to Rystad Energy research.

The series of projects announced in Egypt over the past three months has captivated foreign developers, highlighted the country’s potential, and came as the country gears up to host COP27 in 2023. The interest shown by international developers in Egypt is due to some favorable factors including the country’s location, natural gas infrastructure, liquefaction facilities, bunkering market, and marine ports, as well as its high solar and wind potential. Egypt is also close to markets like the European Union and the Middle East – regions set to see a huge demand for hydrogen in the coming years.

The government of Egypt plans to release a $40-billion national hydrogen plan in the coming months, recognizing the importance of production, storage and export/import of green hydrogen and ammonia under its economic development strategy and allowing for state support and tax incentives. The process of establishing, operating, and managing hydrogen projects has been simplified, requiring a single permit, which means less red tape. Additional incentives could include special custom points for export/import, utilities connection costs being passed on to the state, the reimbursement of 50% of land allocation costs (under the condition that the project commences production within two years) and other non-fiscal incentives.

“Egypt has all the prerequisites to become a green hydrogen giant – fantastic renewable potential, space for mega projects and construction expertise. The 40 billion in planned investments by the Egyptian government demonstrates commitment and will bring further foreign investment. Sitting between three continents and with the Suez Canal carrying approximately 12% of all the seaborne freight in the world, Egypt can supply renewable energy near and far. The domestic market will benefit too as the Egyptian agriculture sector can look forward to being one of the greenest when it comes to fertilizer use,” says Dr Minh Khoi Le, Head of Hydrogen at Rystad Energy

This plan would be a huge development for Egypt’s green hydrogen economy. The upcoming legislation will enable green hydrogen and ammonia plans, and with the over 11-GW of projects already announced, Rystad Energy expects a huge inflow of foreign investment into the country. Several feasibility studies and MoUs between Egyptian state entities and leading international ammonia and hydrogen market players for the development of green ammonia and green hydrogen have been reported in 2021. These studies and preliminary agreements are expected to proceed to projects due to the commitment from the Egyptian government that should encourage additional international investors to enter the Egyptian hydrogen and ammonia market.

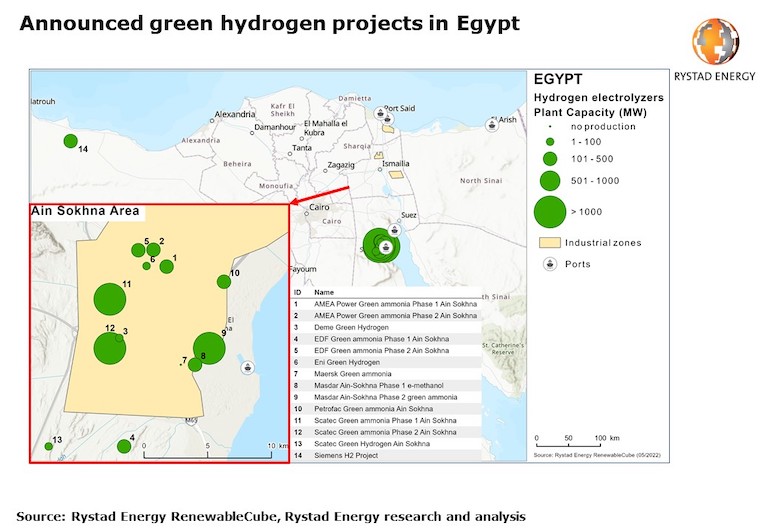

Major announcements made this year include French utility EDF and ZeroWaste, a UAE-based project developer, which signed an MoU with Egypt's Suez Canal Economic Zone (SCZONE) to produce 350,000 tonnes of green fuel annually in the Ain Sokhna region for ships, vessels, and tankers crossing the Suez Canal. The project’s first phase will produce 140,000 tonnes of green ammonia using close to 25,000 tonnes of green hydrogen from desalinated seawater and renewable energy as feedstock. Commissioning is scheduled for 1Q 2026. Capacity will then gradually increase to 350,000 tonnes of green ammonia production per year. The project will involve a total investment of $3 billion. AMEA Power, a subsidiary of Al Nowais Group, also inked an MoU with SCZONE to produce 390,000 tonnes of green ammonia per year in Ain Sokhna for export purposes. In addition, Norway’s Scatec announced plans to develop a $5 billion green hydrogen and ammonia facility, that will also be located in the SCZONE. Scatec inked an MoU with the General Authority for SCZONE for the project, which will be capable of producing 1 million tonne of green ammonia annually, and could potential expand to 3 million tonnes green ammonia. The green ammonia will mainly be exported to European and Asian markets, where demand for clean ammonia is increasing rapidly.

Other projects in the country come from Danish shipping company Maersk. British oilfield services provider Petrofac and New-York based hydrogen production and energy storage company H2-Industries aim to produce green fuels, green ammonia as well as liquid organic hydrogen carriers (LOHC).

Almost 80% of the announced green hydrogen projects in Egypt are planned for SCZONE, a global logistics hub that aims to connect Europe, Africa and Asia through the Arabian Gulf and is responsible for 20% of the international container trade and 10% of the seaborne trade. The hub’s Air Sokhna region enjoys proximity to a seawater desalination plant (150,000 m3/day), sewage treatment plant (35,000 m3/day), and bunkering facilities like ammonia (80,000 tonnes), which make it very suitable for the trade of hydrogen and its derivatives. The seven projects announced for the region in the last three months have a combined capacity of 10.76 GW, meaning an output of over 1.5 million tonnes of green hydrogen.