Key insights:

1 More indications from inbound volumes, Asian manufacturing orders, and growing US inventories for certain goods, add to signs that US demand for imports is slowing.

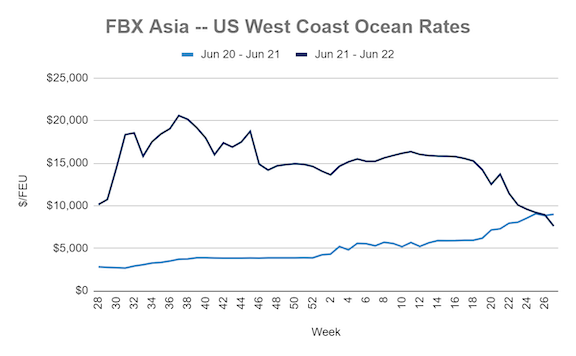

2 Falling transpacific ocean rates add to this hypothesis, as Asia - US prices to both coasts dropped by more than 13% since last week, and are at least 13% lower than this time last year – the first annual decrease since H1 2020. West Coast rates have now fallen more than 50% in Q2.

3 Of the major tradelanes, only transatlantic ocean prices are higher than at the start of the year. Europe – US East Coast rates are 42% higher than a year ago, and about 4X pre-pandemic norms as strong demand and port congestion have combined to keep rates elevated.

Asia-US rates:

• Asia-US West Coast prices (FBX01 Daily) fell 15% to $7,599/FEU. This rate is 14% lower than the same time last year.

• Asia-US East Coast prices (FBX03 Daily) dropped 13% to $10,113/FEU, and are 13% lower than rates for this week last year.

Analysis

More indications of falling demand for imports to the US and elsewhere were reported this week, including a drop in inbound ocean volumes at some US ports in June, dips in orders for certain goods from Chinese manufacturers, and more signs of excess inventory for certain goods in the US as well.

And of course, falling transpacific ocean rates also show that demand is decreasing: Asia - US prices to both coasts dropped by more than 13% since last week, are at least 13% lower than this time last year marking the first annual decrease since H1 2020. And – though still well above pre-pandemic norms – prices are trending down at a time they were already climbing on peak season demand a year ago.

Asia - US West Coast rates have now fallen more than 50% in Q2. Asia – N. Europe prices have been stable since early May – possibly due to worsening congestion at European hubs – but are nearly 30% lower than at the start of the year.

Of the major tradelanes, only transatlantic prices are higher than at the start of the year. Europe – US East Coast rates are 42% higher than a year ago, and about 4X pre-pandemic norms. Demand has remained strong, and – even with capacity diverted from Russian ports to the lane – congestion in European and East Coast ports continue to slow operations and put pressure on rates.

Questions remain for what the rest of the year will look like.

A recent Sea-Intelligence analysis indicates that the drop in exports from Shanghai during the lockdown was mostly compensated by shifts to other ports. Together with signs that demand is slow, this insight makes a possible surge in volumes out of Shanghai as it reopens even less likely.

If underlying transpacific demand has eroded significantly enough, then we could expect rates to continue to fall even as we move deeper into the traditional peak season. At the same time, if carriers find themselves with excess capacity, we could also expect them to start canceling sailings which would slow the price decline.

And finally, though labor negotiations on the US West Coast are reportedly making progress, new labor issues that could affect logistics are developing in Europe and among Canadian and US rail workers.