Giant solar producers in China are ruling out any recovery in panel exports to the US as a recently enacted law targeting forced labor has stalled negotiations between US project developers and some foreign manufacturers.

China-based module producers, the world’s largest, expect no significant lift in shipments to the US in the third quarter and a high risk to fourth quarter shipments, according to Daiwa Capital Markets analyst Dennis Ip, who cited conversations with company officials.

The key concern is the US Uyghur Forced Labor Prevention Act, which went into effect in June and targets goods produced in China’s Xinjiang region, a hub of the solar supply chain.

Resolving issues over equipment supply could be a “dark cloud” over the solar industry for six months, according to analysts at Roth Capital Partners. That could dampen the outlook for US clean energy even as optimism grows that Washington could pass a sweeping climate and tax legislation package.

The forced labor law “continues to be a challenging situation,” Roth analysts including Philip Shen said in the July 30 note. “Specifically, neither side wants the risk, and the parties are having a difficult time figuring out how to share the risk.”

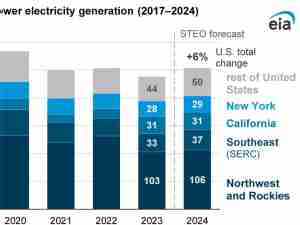

US imports of solar power equipment tumbled 16% over the first five months of the year, according to BloombergNEF. Daiwa forecasts full-year installations at about 23 gigawatts, down 14% from 2021.

The US is the second-largest solar market, but it relies on imports for most of its panels. China, by far the largest market, dominates the global supply chain.

Troubles for US developers stem from a series of political and trade skirmishes with China dating back more than a decade.

The most recent issue is the forced labor act, which bars imports of any product with components made in the Xinjiang region in western China unless it can be proved that forced labor wasn’t used in their manufacturing. Xinjiang is home to several large producers of silicon and polysilicon, the key material used to make solar panels. Some products have already been detained under the new law.

At issue is who should bear the risk of increased costs or delays should panels be detained under the new law. China’s Trina Solar Co. said last week that it faces a legal claim in California after US measures to crack down on Chinese imports scuttled a $300 million deal.