Clothing companies and gadget makers are among manufacturers across Asia seeing early signs of cooling demand from their global customers as soaring inflation takes hold.

Bumper exports from Asia, especially China, were a major dynamo in the global economy’s recovery from the pandemic. Recent data suggest that’s fading due to supply blockages linked to China’s aggressive Covid lockdowns and Russia’s invasion of Ukraine. Well-stocked inventories have been another headwind.

One of those producers seeing signs of an early shift is Lever Style, a Hong Kong-listed maker of apparel for leading global brands. While overall demand remains robust, orders for delivery in the final quarter look weaker, according to Executive Chairman Stanley Szeto.

“I am seeing that growth tapering off big time in another few months,” he said. “We get orders months and quarters before they are actually shipped and we are seeing people becoming very tentative in buying inventory and ordering.”

While some of the spending shift reflects a normalization of habits, some of it also reflects softening underlying demand as inflation and interest rates rise—conditions that are bound to impact spending decisions, Szeto said. Fading government stimulus and volatile financial markets are also having an impact, he added.

“There is a perfect storm coming,” he said. “I can see all the macroeconomic conditions working against the consumer.”

The slowdown isn’t yet at the point of a trade recession. Both analysts and manufacturers say underlying demand remains solid and consumers have money to spend. Household expenditures in the US, for example, continued to power ahead at least through April. Shanghai is easing its lockdown, which is expected to lift pressure off the nation’s exporters.

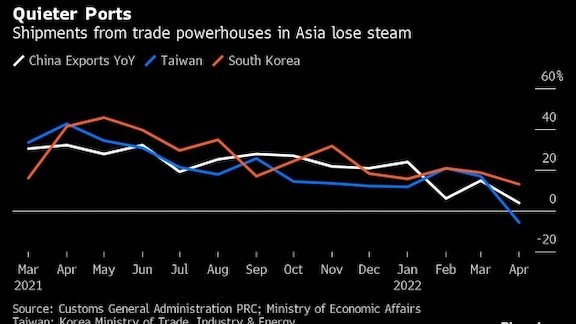

Still, the overall downshift is notable. The World Trade Organization in April lowered its projection for growth in merchandise trade this year to 3%, down from its previous projection of 4.7%. Asia’s manufacturing sector contracted in April for the first time since June 2020, according to closely watched PMI data.

The Bloomberg Trade Tracker shows the latest evidence of a softening in shipments: Throughput at some of the world’s busiest ports took another hit in April. Nine of the Tracker’s 10 indicators across shipping, sentiment, and exports are below long-run averages. The tenth—tallying Korean exports—looks better only on paper given that there were two extra working days in the period compared with last year.

“The outlook has turned quite challenging for this year and the next at least,” said Priyanka Kishore of Oxford Economics. “Even before the start of the war, we were talking about a rotation from goods to services trade,” she said.

Steve Chuang, whose Hong Kong-based company makes products such as power systems for camper vans and other recreational vehicles, saw his order book hit records in 2020 and 2021 as people were forced to vacation closer to home.

That’s now changing, said Chuang, founder and chief executive officer of ProVista Group. The firm’s broad offerings include automobile electronics and energy storage power products, and its biggest markets are the US and Europe.

“You can feel the inflation. The spending power in our major markets is becoming very soft,” Chuang said. “Trade will still grow, but it won’t be like the last two years.”

Even the usually reliable American spenders are showing signs of holding back. Retail giants Walmart Inc. and Target Corp. this month suffered big stock losses as their earnings reports showed general merchandise sales weakening.

The picture could get bleaker: Goldman Sachs models show Asia trade slowing further in the months ahead. HSBC economists say the region’s trade boom is showing its first cracks, while Nomura’s leading index of Asia exports plunged in May by the most since the first half of 2020.

What Bloomberg Economics Says

“Asia’s supply chains will continue to be buffeted by two shocks from China—reduced costs of production and logistics (due to the demand shock) and constraints on supply and increased delivery times (due to the supply shock).”

—Chang Shu, chief Asia economist

It’s clear that consumers have become more careful with their spending, said Christopher Tse, chief executive officer of Musical Electronics Ltd., a Hong Kong-based company that makes consumer electronics like Bluetooth speakers and high-power home stereo systems for the US market, among other products.

“We have seen a cooling of orders beginning in March,” Tse said. While his sales of healthcare-related products are holding up, there’s less demand for items such as high-power speaker systems.

“Inflation is impacting, interest rates are going up,” Tse said. “Buyers are very cautious these days.”