ASML Holding NV Chief Executive Officer Peter Wennink warned excessive control measures could lead to higher costs for chipmakers, as the US asks allies from Japan to the Netherlands to help limit China’s access to critical semiconductor technologies.

The Netherlands and Japan, home to key suppliers of semiconductor manufacturing equipment, are close to joining a Biden administration-led effort to curb exports of the technology to China, Bloomberg News has reported. ASML potentially faces more limitations on its sales to Chinese customers as the US seeks to undermine Beijing’s ambition to build a self-sufficient supply chain.

ASML shares fell 1.8% to €604.9 ($657.16) at 1:10 p.m. in Amsterdam on Wednesday, trimming a recent rally.

The decline came after ASML forecast better-than-expected first-quarter sales due to strong demand for its advanced chip-making machines, even as export controls threaten growth.

Wennink said that the borderless chip ecosystem will face hurdles and “it will not be as seamless going forward as it is today.” He added that while China will try to develop chip equipment domestically, the complex supply chain and know-how required to recreate advanced lithography machines that ASML builds will be a “massive challenge.”

Europe’s largest semiconductor equipment producer on Wednesday projected sales of €6.1 billion to €6.5 billion this quarter, beating the average analyst estimate of €6.07 billion in a Bloomberg survey.

The chip sector has been roiled by Washington’s bid to curb exports of leading-edge technology to China, threatening overall demand. ASML has said that demand elsewhere in the world for its most advanced products can make up for any revenue shortfall from China.

“We’re businesspeople. We’re not politicians,” Wennink said in a transcript with the earnings release. “We just have to wait for the governments and the politicians to keep talking and come to a reasonable solution.”

He added the company expects its sales to grow more than 25% in 2023 and gross margin to improve from the year before.

“Our customers indicate that they expect the market to rebound in the second half,” Wennink said. “Considering our order lead times and the strategic nature of lithography investments, demand for our systems therefore remains strong.”

In terms of possible new government restrictions on the sales of its chip-making machines, Wennink has said his company has “given up enough” with the pre-existing restrictions on the sales of its extreme ultraviolet lithography machines to China.

The Dutch chip-gear maker’s sales were €6.4 billion, in line with analyst estimates, in the three months ended December. Net income was €1.8 billion, edging out analysts’ forecast of €1.68 billion. The company continued to delay recognition for some deals in order to speed up delivery.

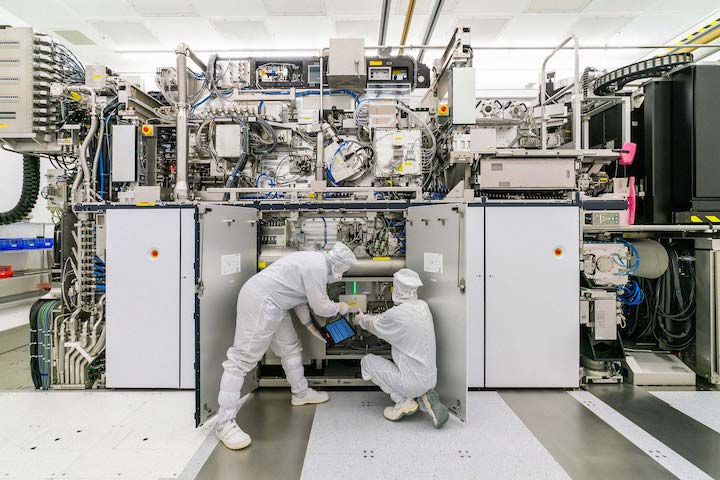

ASML said in November that it targets sales of as much as €40 billion by 2025 and as much as €60 billion by 2030. The company is one of the very few producers of the sophisticated lithography machines needed to make mid-grade semiconductors, and the manufacturer of an one-of-a-kind piece of equipment needed to make the most cutting-edge chips.

“There could be some concerns on gross margins but we expect the revenue beat to outweigh,” Barclays analyst Simon Coles said in a note to clients.

Jefferies analyst Janardan Menon said in a separate note that “we expect ASML’s strong growth rates and margin improvement to continue into 2024 and beyond.”