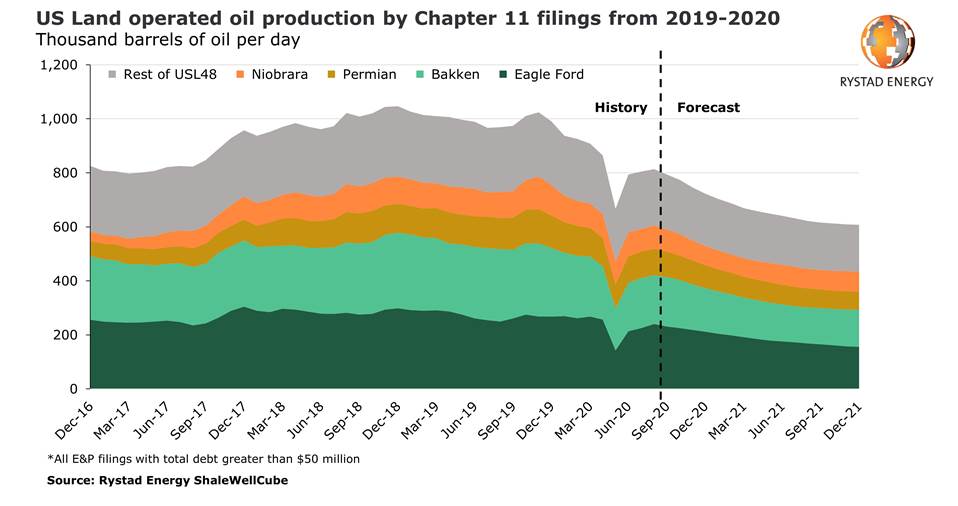

As Chapter 11 filings by US E&Ps continue to pile up, onshore oil production from companies that filed for bankruptcy in the last two years is set to decrease by about 25% by the end of 2021, or by about 200,000 barrels per day (bpd) compared to current output levels, a Rystad Energy analysis shows. The loss puts the projected nationwide production growth for 2021 at risk of being offset.

Operated oil production from the recent Chapter 11 filings is heavily weighted in the Eagle Ford and Bakken regions, at almost 400,000 bpd. Permian-focused operators that are currently going through restructuring only produce 80,000 bpd in the basin.

The same peer group lifted around 8.5 billion cubic feet per day (Bcfd) of gross US Land gas production. While some of this is associated gas, which will track oil output from the different oil basins, we do not expect any significant production declines in the Appalachia and Haynesville regions as operators who have filed for Chapter 11 are maintaining adequate activity levels there.

Our preliminary 2021 guidance summary, based on US companies' third-quarter earnings reports, shows that public tight-oil focused producers that are still active are targeting to just maintain activity levels next year. We may see sequential production growth somewhere in the 80,000-120,000-bpd range between the last three months of this year and the fourth quarter of next year. In addition, the supermajors and private companies will also post marginal production increases.

“Chapter 11 filings affect the whole industry. Most of the growth in US tight oil which was expected towards the end of 2021 is at risk to be offset by the decline in output from companies that have filed for restructuring in the last two years, as most of them are currently in their base decline phase with limited new well activity,“ says Artem Abramov, Head of Shale Research at Rystad Energy.

The group of operators that filed for bankruptcy in 2019 (many have already completed restructuring) have only spudded seven US onshore wells since the second quarter of 2020. The slow post-restructuring recovery is largely related to the market downturn, but regardless of the price environment, we argue that the ‘Chapter 11 group’ of operators are unlikely to come back with significant capex increases before the second half of 2021.

While E&Ps that filed for bankruptcy this year have drilled 15-30 wells per month since August, just two operators were responsible for nearly all of those wells: Chesapeake and Extraction. If we exclude Chesapeake and Extraction and focus on the remaining cases, then the current spud rate is negligible compared to the 100-140 wells per month that the peer group was delivering in 2017-2018.