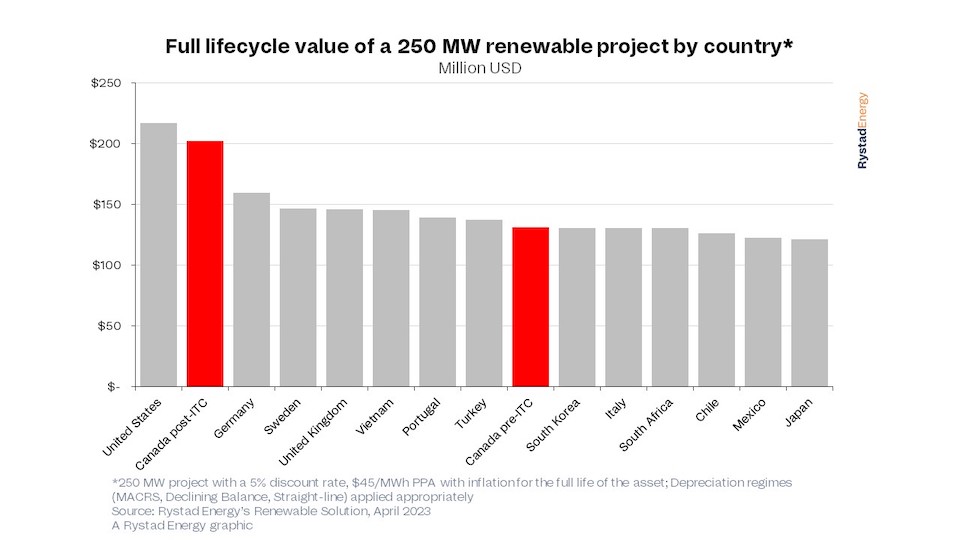

Canada’s new renewable energy investment tax credit (ITC), unveiled in the 2023 federal budget, will make the country a global leader in favorable financial conditions for green energy projects. Rystad Energy’s renewable economic modeling shows that these new tax breaks will raise the value of some projects by more than 50% over their lifetime, positioning Canada as the second most attractive place for renewable developers, behind only the US.

The ‘made in Canada’ strategy is part of a growing global trend of policies prioritizing domestic production and labor, similar to the US Inflation Reduction Act. The ITC – a refundable incentive that offers up a percentage of the cost of capital investment – will provide a 30% tax write-off for renewable technologies deployed through 2034.

“Canada looked at its southern neighbor’s renewable tax breaks and the influx of investment it’s set to trigger and thought: “I want some of that.” And its answer to the Inflation Reduction Act could have wide-ranging implications. In the short term, it will shake loose projects that hit snags due to recent economic conditions. However, in the long term, it could unleash a wave of new investments,” says Geoff Hebertson, senior renewables and power analyst at Rystad Energy.