Tight market conditions in Northern New Jersey and New York are making it challenging to find transportation advantaged industrial properties. Despite the hurdles, CenterPoint real estate development and investment teams are successfully locating prime properties, sifting through available inventory to find Class A assets and development sites that suit the most sophisticated industrial tenants: global retailers, logistics providers and product distributors.

“We continue to aggressively seek investment properties and development opportunities in the Northern New Jersey market that align with our strategic goals, including last mile facilities along major highways and warehouses that are in close proximity to the NY/NJ Ports,” says Ronel Borner, CenterPoint Senior Vice President of Development.

CenterPoint has enjoyed an active fourth quarter of 2019 in the nation’s largest population center, including:

• 49 Rutherford in Newark, New Jersey: This prime development site has a stellar, high-visibility location. Special thanks to Brian Colson of Avison Young for helping to facilitate this deal.

• 1049 Secaucus in Jersey City, New Jersey: This superb property features excellent parking and functionality. Brian Fiumara of CBRE National Partners was instrumental in bringing this deal to fruition.

• 101 Linden in Jersey City, New Jersey: This excellent last-mile facility is ready for lease and is represented by Stan Danzig, Steve Elman, Jules Nissim and Michael Terranova of Cushman & Wakefield.

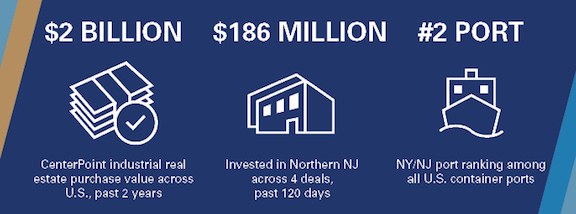

Nationally, CenterPoint has invested nearly $2 billion into the industrial real estate market over the past 24 months. In the year ahead, the Company plans to continue its strong push into port-centric and intermodal markets near high population centers, specifically in Los Angeles, Chicago, Seattle, Oakland, Northern New Jersey, South Florida, Houston and Savannah.