Today’s announcement that US supermajor Chevron will acquire Anadarko Petroleum in a deal valued at $50 billion is reflective of multiple trends that are becoming increasingly evident in the global energy market, according to industry expert Rystad Energy.

Commenting on the deal, Jarand Rystad, Rystad Energy founder and chief executive, says:

He adds: "This acquisition represents a golden opportunity for Chevron to achieve a more leveraged capital structure that is better suited for the lower risk energy projects of the future."

Looking at the respective asset portfolios of Chevron and Anadarko, Rystad Energy founding partner and Head of Research Per Magnus Nysveen remarks:

"We have always considered Anadarko as having the best positioned acreage in the sweetest spot of the Permian Delaware basin. Combining these shale assets with Chevron’s strong legacy position in the same area, we will now see Chevron emerging as the clear leader among all Permian players, both in terms of production growth and as a cost leader."

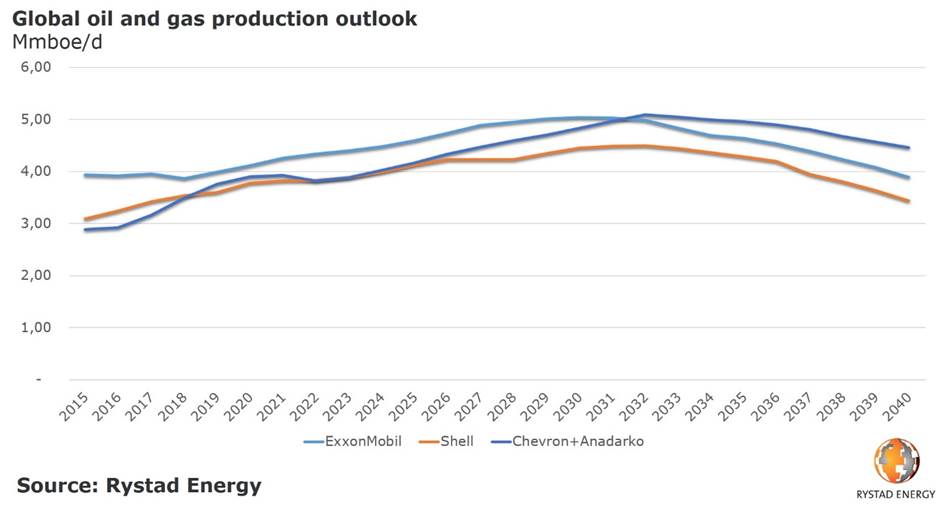

Nysveen continues: "The combined entity will be by far the largest producer in the Permian, which is the fastest growing basin in the world, well ahead of ExxonMobil. By 2025 the merged entity will be able to produce as much 1.6 million barrels of oil per day from the Permian basin alone."

Chevron and Anadarko, which currently rank as the world’s 10th and 41st largest producers of oil and gas, respectively, will climb to seventh place after the merger. The new entity will jump ahead of Shell and BP in the rankings, and will trail only ExxonMobil and the five biggest national oil companies.

Rystad Energy also sees strong synergies between the two companies in the US Gulf of Mexico, where the merged entity will become the largest producer, surpassing current leaders BP and Shell. Synergies are also apparent in East Africa, which is emerging as a vital region in the buoyant global market for liquefied natural gas (LNG). Chevron and Anadarko also have overlapping portfolios in Latin America.

Nysveen concludes: "Despite a 37% premium, we think the deal value price of $50 billion is surprisingly good for Chevron. The implicit oil price in the deal is 60 USD/barrel, while oil price today is 71 USD/barrel. Adding synergies, we see a strong potential for value capture here.”