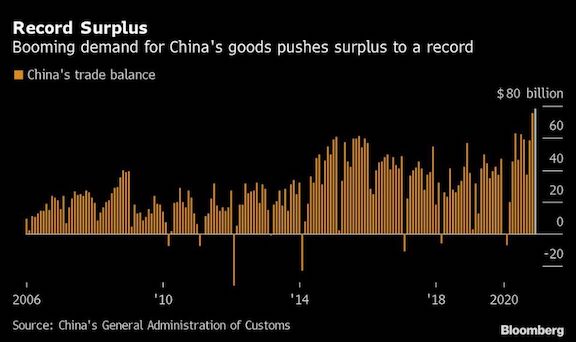

China’s export boom continued into December, pushing the trade surplus to a record high in the month and bolstering what is already the world’s best-performing major economy.

Fueling the shipments surge is insatiable global appetite for work-from-home technology and health care equipment as Covid-19 continues to surge in many places around the world. Demand is so strong that’s it’s contributing to a bottleneck at ports as manufacturers complain of a shortage of shipping containers and surging costs.

The bumper year also underscores China’s role as the fulcrum of global supply chains even as political tensions with the U.S. and other trading rivals simmered.

“The biggest takeaway is that China’s exports have remained surprisingly resilient despite the return of the second wave in major economies,” said Michelle Lam, Greater China economist at Societe Generale SA in Hong Kong.

The trade data showed surging demand across the board:

- Exports grew 18.1% in dollar terms in December from a year earlier—softer than November’s bumper 21.1% expansion—while imports rose 6.5%, both beating economists’ expectations

- The trade surplus of $78.2 billion for the month was higher than the $72 billion median estimate in a Bloomberg survey of economists. For the full year, the trade surplus reached $535 billion, a 27% increase from 2019 and the highest since 2015

- Exports to the U.S. surged 34.5% in December from a year earlier, while imports of American goods rose 47.7%, the most since January 2013. Click here for breakdown of China’s exports by country, and here for imports

- For the full year, the trade surplus with the U.S. was $317 billion, 7% higher than in 2019

- On face masks alone, factories exported the equivalent of almost 40 masks for every person in the world outside of China, according to the customs agency

“Demand for China’s goods may remain strong in the next few months with the recent surge of Covid infections in the U.S. and Europe,” said Ding Shuang, chief economist for Greater China and North Asia at Standard Chartered Plc in Hong Kong.

That outperformance will inevitably wane as the virus is controlled in big markets including the U.S. and Europe and industrial production recovers, he added.

What Bloomberg’s Economics Says…

The data showed external demand is driving China’s economic recovery, and this will likely continue in the coming months. Exports should jump in the first quarter, partly due to stronger U.S. demand from the expected economic relief package.

—David Qu, China economist

Li Kuiwen, an official at China’s General Administration of Customs, said the trade surplus may keep growing this year, supported by an expected recovery in the global economy and stable domestic growth.

Jian Chang, chief China economist at Barclays Plc in Hong Kong, said the data supports regional evidence from South Korea and Vietnam of booming demand.

“The external recovery has continued,” said Chang. “Chinese manufacturers have flexibly adjusted their production lines to produce goods to meet the demand through the new Covid era.” Both pandemic and non-pandemic related goods are growing strongly, she said.

The data probably won’t shift the central bank from its stance of gradually withdrawing monetary stimulus but without any sharp turn in policy, Chang said, adding there’s unlikely to be an interest-rate cut or hike this year.

The figures also showed shifts in China’s trading partners last year, with the 10-member bloc of Southeast Asian nations rising to the No. 1 spot, followed by the European Union and the U.S.