China halted some trade with Taiwan in retaliation to the high-profile visit of US House Speaker Nancy Pelosi to the island, with more disruptions likely as political tensions intensify.

China suspended some fish and fruit imports from Taiwan, citing excessive pesticide residue detected on products since last year and some frozen fish packages that tested positive for coronavirus in June. Exports of natural sand, used in construction, were also banned.

“What needs to be watched is whether Beijing will broaden the trade bans into the manufacturing sector, particularly semiconductors/electronics going forward,” said Ma Tieying, senior economist at DBS.

Chinese customs data show Beijing has also blocked the imports of over 2,000 food items from Taiwan out of about 3,200, spanning products from tea to biscuits to fish. It’s unclear when the imports were suspended though. On Monday, Taiwan media reported that China banned food imports from more than 100 of the island’s suppliers.

Beijing has often targeted Taiwan’s agricultural industry for punishment over political issues. Many of southern Taiwan’s fruit-producing regions are typically bastions of political support for President Tsai Ing-wen’s Democratic Progressive Party, which advocates for Taiwan’s formal independence.

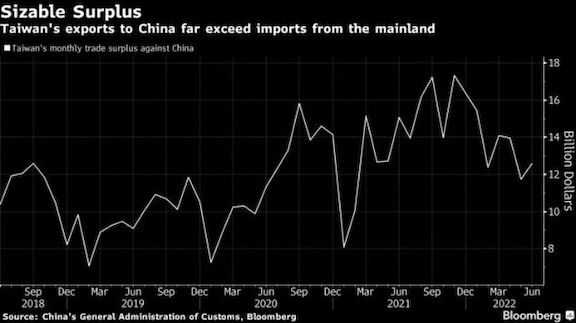

China is Taiwan’s largest trading partner, with bilateral trade rising 26% on year to $328.3 billion last year. Taiwan held a sizable surplus against China, with exports from the island exceeding imports by $172 billion, according to Chinese customs data. While Beijing could leverage that advantage by sanctioning exporters, China also relies on Taiwan for semiconductor supplies.

About a fifth of Taiwan’s total agricultural exports, or $1.12 billion, was shipped to China last year.

Shipping Disruptions

Even Pay, an analyst at consultancy Trivium China in Beijing, said more trade disruptions can be expected between China and Taiwan while tensions remain high. She said it was “common practice” for Beijing to identify minor compliance issues and enforce rules very strictly with trade partners, citing the example of Canadian canola after Meng Wanzhou, chief financial officer of Huawei Technologies Co., was detained.

“It looks like stepped up military exercises announced Tuesday night may disrupt shipping in the region through Sunday at least, particularly into ports in Taiwan and Fujian, but also for any cargoes that might typically pass through the area around Taiwan,” said Pay.

The disruptions, especially on the western coast of Taiwan facing the straits, however, may deal a heavy blow to the island’s commodity imports. Taiwan accounts for 5% of global coal imports, 5% of global LNG imports, 2% of global crude oil imports, 2% of global clean oil products, and 1% of global LPG imports, according to Banchero Costa & Co.

“For energy, Taiwan is almost entirely reliant on imports, hence a potential blockade on imports would be a disaster for the Taiwanese economy,” said Ralph Leszczynski, head of research at the shipbroker.

China caught Taiwan off guard last year when it suddenly blocked pineapple imports from there. Beijing later halted imports of wax and sugar apples last September. While most fruit produced in Taiwan is consumed domestically, the vast majority of exports go to China.

Taiwan downplayed the sand export ban on Wednesday, with the Ministry of Economic Affairs saying in a statement that the impact will be “limited.”

With grains about 5 millimeters wide or less, natural sand is typically used to produce things like concrete and asphalt. Sands used in Taiwan’s construction industry, though, are mostly from the island, its Finance Minister Su Jain-rong said. Taiwan imported about 20,000 metric tons of natural sand from China in the first half of this year, according to the economic affairs ministry.

China previously halted natural sand exports to Taiwan in March 2007, citing environmental concerns, and lifted the ban about one year later. Taiwan activated a contingency plan at the time, including importing materials from the Philippines and using local river sand to close the gap.

Taiwan imported 5.67 million metric tons of sand and gravel in 2020, with natural sand constituting about 8% of total, according to a report from Taiwan’s Ministry of Economic Affairs. More than 90% of Taiwan’s imported sand and gravel is from China, due to much higher transportation costs from other countries like Vietnam, the report said.