Key insights:

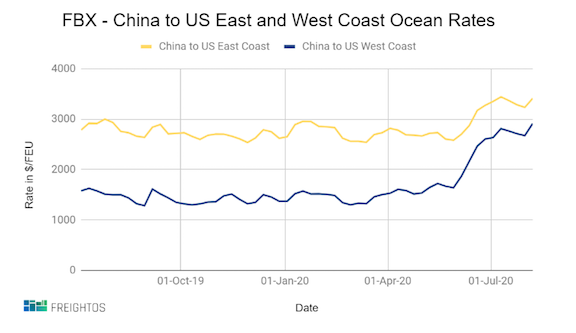

- Peak season volumes out of China kept ocean rates to the US climbing, sending China-US West Coast prices (FBX01 Daily) to a new all-time FBX high of $3058/FEU.

- The $1200 or 42% average premium to ship from China to East Coast ports compared to the West Coast has fallen by half since June. This week East and West Coast rates were separated by only $408 or 12% - an all-time FBX low. One driver may be lacking confidence in how long consumer demand will stay shored up.

Analysis

Even with capacity at its highest level since January (though the percentage of cancelled sailings is still high for peak season), this year’s early peak season volumes are keeping US bound ships from China full and rates up.

And though rates have increased to both coasts, the current conditions have impacted rates from China to the US West Coast much more than prices to the East Coast.

Rates to the West Coast have climbed 15% since the end of July – twice as much as for the East Coast.

It is usually about $1200 or 42% more expensive to ship on the longer voyage to eastern ports. But since the rebound in volumes in June, that gap has closed by half.

This week East and West Coast rates were separated by only $408 or 12% - an all-time FBX low.

In these uncertain times, US importers seem to prefer the speed and added flexibility of shipping to the West Coast while consumer confidence lasts. Struggles in the US automotive market have also caused transatlantic volumes to the East Coast to lag. So while volumes on Asia-Europe lanes are surging and US West Coast warehouses hustle to handle the influx of shipments, East Coast ports are dealing with significant losses. High ocean rates and delays are driving some shippers to opt for air cargo, contributing to the continued increase in air rates this week. Freightos.com marketplace data show transpacific air cargo rates increased for the fourth consecutive week, after consistently declining since early May. |