The Arctic blast that has wreaked havoc on U.S. energy markets is now poised to reverberate internationally as it slows shipments of liquefied natural gas from the Gulf Coast.

Power disruptions at export facilities, closed ship channels and a reduction in the flow of natural gas have held back LNG tankers off the coasts of Texas and Louisiana.

That’s just the latest setback for LNG facilities that have endured pandemic-driven demand destruction, canceled cargoes, a hyperactive hurricane season, Panama Canal delays, record shipping costs and dense fog that halted tanker traffic.

Located southwest of Houston, Freeport LNG cut back production after Texas Governor Greg Abbott asked the three-train plant to dial back operations in keeping with the state’s disaster declaration. Crews are working to restore power to the Sempra Energy-owned Cameron LNG export terminal in Louisiana. Houston-based Cheniere Energy, the largest U.S. LNG exporter, also scaled back production at Sabine Pass LNG in Louisiana and Corpus Christi LNG in Texas in response to the weather.

“By telling Freeport to dial back exports, it’s playing into an existing perception by Asian, especially Japanese, customers that the U.S. is not a reliable source of supply,” said Katie Bays, managing director at FiscalNote Markets. “In LNG markets, reliability is everything. So, that is a potentially negative long-term implication.”

Natural gas prices on regional spot markets soared into triple digits. Gas for next-day delivery was sold Tuesday at $999 per million British thermal units for two contracts on the Oneok Gas Transportation hub in Oklahoma.

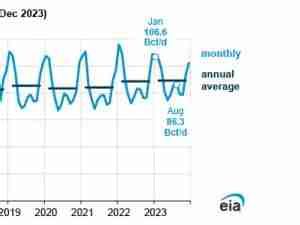

At the height of the freeze on Monday, U.S. LNG export terminals cut back production, only drawing 4.7 billion cubic feet of natural gas, the lowest level since Sept. 22, during hurricane season, figures from Bloomberg NEF show.

At full capacity, Freeport LNG was designed to use 690 megawatts of electricity from the grid and more than 2 billion cubic feet of natural gas, figures from the Electric Reliability Council of Texas and Bloomberg NEF show.

Sabine Pass LNG makes its own electricity using on-site natural gas generators while Corpus Chirsti draws power from the grid.

Although spot prices for natural gas were still trading Tuesday at triple digits on regional hubs, gas sold on the Henry Hub, the U.S. benchmark used for most LNG exports, settled at $3.129 per million British thermal units.

“The Henry Hub price has remained relatively calm, relative to Texas prices,” said Michael Stoppard, chief strategist of global gas at IHS Markit. “Nevertheless, aspiring international LNG buyers will be reminded that managing price volatility is part and parcel of buying gas from the United States.”

Looking ahead, U.S. natural gas prices are expected to remain below those in Europe and other overseas destinations, said David Seduski, an LNG industry analyst with Energy Aspects.

“There will always be demand for U.S. LNG in Europe where the arbitration is high,” Seduski said.