The container spot freight market rebounds amid a growing number of idle ships and new bunker surcharges.

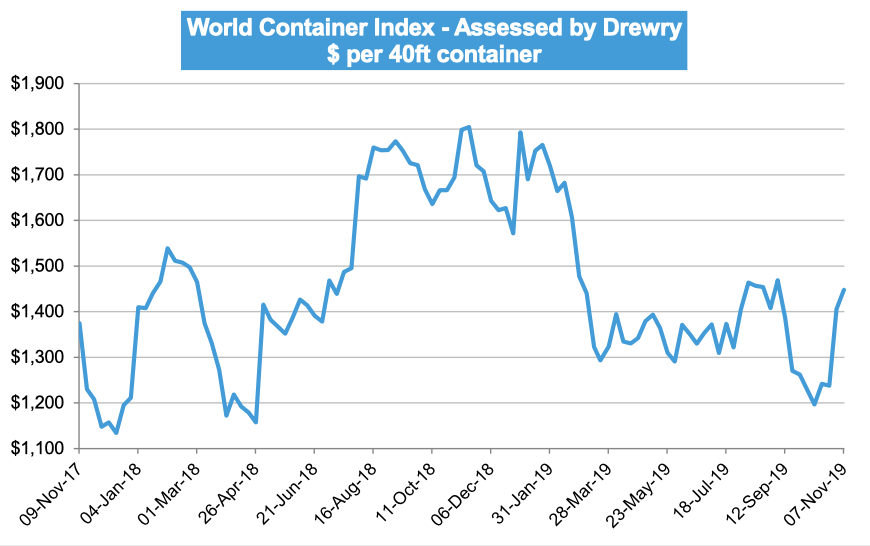

In what has been a mostly disappointing year for ocean carriers, spot market freight rates are currently enjoying resurgence. Drewry’s World Container Index – a composite of eight major East-West trades – in the past two weeks has swelled by $210 to return losses accumulated over the prior two months.

Before we answer that question, it is important to give some context to understand the true state of the market. Since the mid-point of this year spot rates have been significantly down on the corresponding period in 2018. This is less a reflection on the current market and more to do with what happened last year, when the US-China trade war super-charged freight rates. Therefore, spot rates in 2H19 were virtually destined to look very weak in comparison to an artificially inflated market.