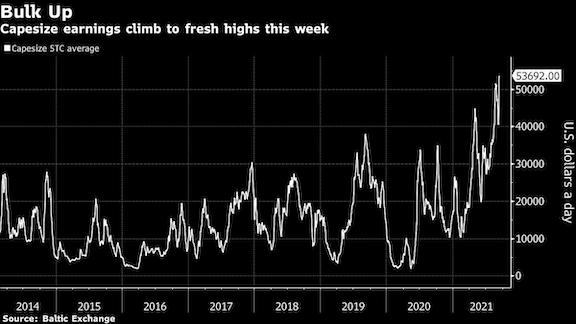

In an already banner year for shipping, commodity carriers just saw their biggest daily gain in a decade.

Average rates for giant Capesize bulk carriers—which can carry products like coal, iron ore and grains—jumped by $6,700 a day on Monday, the most since 2010, as owners continue to benefit from strong demand for raw materials. The rally extended Tuesday, pushing the daily rate to almost $53,700, the highest level in 11 years, Baltic Exchange data show.

Commodity shipping companies have benefited from global economic stimulus measures boosting industrial activity as economies reopen after the pandemic. In addition, a slowdown at ports—due to recent stormy weather in Asia and China’s restrictions to limit the spread of Covid-19—has crimped the supply of vessels.

“Economic stimulus and infrastructure spending have boosted the demand for dry bulk commodities,” said Randy Giveans, a shipping equity research analyst at Jefferies LLC. “We expect rates to remain robust during the fourth quarter,” as iron ore production ramps up, coal shipments increase in preparation for winter, and fleet growth slows, he added.