Indicators reported by the U.S. Department of Agriculture (USDA), the National Oceanic and Atmospheric Administration (NOAA), and other agencies suggest demand for heating fuels during the 2019 grain drying season may rise higher than the five-year average for the first time since 2013. Although crops are still about two months away from harvest, the combination of expected wet, late corn crops; relatively high grain prices; and relatively low propane prices suggest strong propane demand during this year’s grain drying season.

Demand for heating fuel for drying corn grain in commercial dryers―instead of in the field―is affected by several factors:

- Moisture content of harvested grain—corn kernels sold into the wholesale market must have a moisture content within allowable limits.

- Harvest time—the later the harvest, the less likely producers are to leave the corn to dry in the field, and the possibility of frost and precipitation increases.

- Producer economics—wholesale corn grain prices may or may not be high enough to allow producers to spend additional funds on commercial grain drying.

- Cost of fuel—producers use either natural gas or propane in commercial dryers.

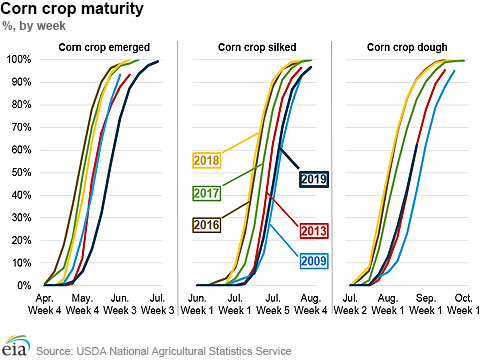

- Silking—about 9 to 10 weeks after emergence

- Dough—about 3 weeks after the silking stage

- Dent—about 1 week after the dough stage

- Mature—about 3 to 5 weeks after the dent stage

The USDA reported that corn crops are reaching the dough stage one to two weeks later than the 5-year average in the seven Midwest (PADD 2) states with the highest grain drying fuel demand (Illinois, Indiana, Iowa, Minnesota, North Dakota, South Dakota, and Wisconsin). However, this year’s crops appear to be catching up. Emergence occurred about five weeks behind the five-year average, and silking was only about three weeks behind the five-year average.

NOAA’s National Weather Service 30-day forecast suggests that in September―when corn crops should be reaching maturity―corn-growing states will experience weather that is both cooler and wetter than normal. This weather could slow the crop’s maturing process and increase the moisture that must be removed during the drying process.

The USDA projects 13.9 billion bushels of corn will be harvested in 2019—less than in the previous three years but slightly higher than the 13.8 billion bushels harvested in 2013. The relatively small corn crop, combined with lower corn inventories, has resulted in higher average futures prices for December corn delivery than at any time since 2013. Midwest propane prices, on the other hand, as reported at Conway, Kansas, are at multi-year lows, averaging less than 35 cents per gallon so far this August, less than one-half the price in August 2018 and less than one-third the price in August 2013.