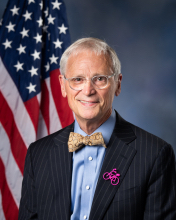

The Coalition for a Prosperous America (CPA) applauded new legislation introduced by U.S. Representative Earl Blumenauer (D-OR), Chairman of the House Ways and Means Trade Subcommittee. The bill will narrow an import loophole, known as de minimis, that is used by non-market economies and counterfeiters to ship hundreds of millions of packages valued under $800 into the United States without inspection, information disclosure, or duty payment.

“It’s long overdue that Congress address the rampant abuse of the de minimis loophole by China and companies like Amazon,” said Michael Stumo, CEO of CPA.“Originally meant for low-value goods, multinational corporations addicted to profiting off of cheap Chinese imports successfully lobbied to increase the de minimis limit to $800 in 2016. As a result, multinational importers of subquality—and often dangerous—Chinese goods have exploited de minimis to create a direct from Chinese manufacturer to U.S. consumer business model that has seen an explosion of more than 2 million packages per day. By prohibiting goods from countries that are recognized as high risk counterfeiters as well as non-market economies from using de minimis, Congressman Blumenauer’s legislation is exactly the kind of solution needed to reverse decades of harm to American innovators, workers and businesses from rampant trade lawlessness.”

- Prohibit Merchandise from Countries that are both Non-Market Economies and on the U.S. Trade Representative’s (USTR) Priority Watch List from Receiving De Minimis Treatment: To defend the rule of law and protect the integrity of our markets, the legislation denies eligibility for de minimis treatment if USTR has determined that the supplying nation denies effective protection of intellectual property and is non-market economy. This is entirely warranted; shipments from countries on both of these lists will consist of a disproportionate share of counterfeits and other dangerous goods. Furthermore, the country’s non-market economy status means that we cannot count on accurate valuations for our already too high $800 threshold.

- Prohibit Goods Subject to Enforcement Actions from Using De Minimis: U.S. enforcement statutes, such as Section 301 and 232, provide the United States with leverage to address unfair trade practices that harm U.S. workers and firms. Exempting de minimis shipments from paying enforcement-related duties has significantly undercut this leverage, even though de minimis shipments subject to other enforcement actions, like antidumping and countervailing duty orders, are still required to pay the duties.

- Close De Minimis Loophole for Offshore Distribution or Processing Facilities.

- Require Customs and Border Protection (CBP) to Collect More Information on All De Minimis Shipments and Prohibits Use by Bad Actors: To address concerns regarding compliance with U.S. laws, this provision makes common-sense changes that will require CBP to collect more information on de minimis shipments and prohibit importers that have been suspended or debarred from being able to use de minimis. This provision provides statutory support for the ongoing work that multiple administrations at CBP have already started.