Descartes Systems Group (Nasdaq:DSGX) (TSX:DSG), the global leader in uniting logistics-intensive businesses in commerce, released the results of its 8th Annual Global Transportation Management Benchmark Survey of over 630 companies. The study shows that 40% of the shippers and logistics services providers (LSP) surveyed are planning to invest in transportation technology to prepare for industry and regulatory changes. For top financially performing companies where senior leadership view transportation as a competitive weapon, this number rose to 44% compared to 32% for poorer financial performers.

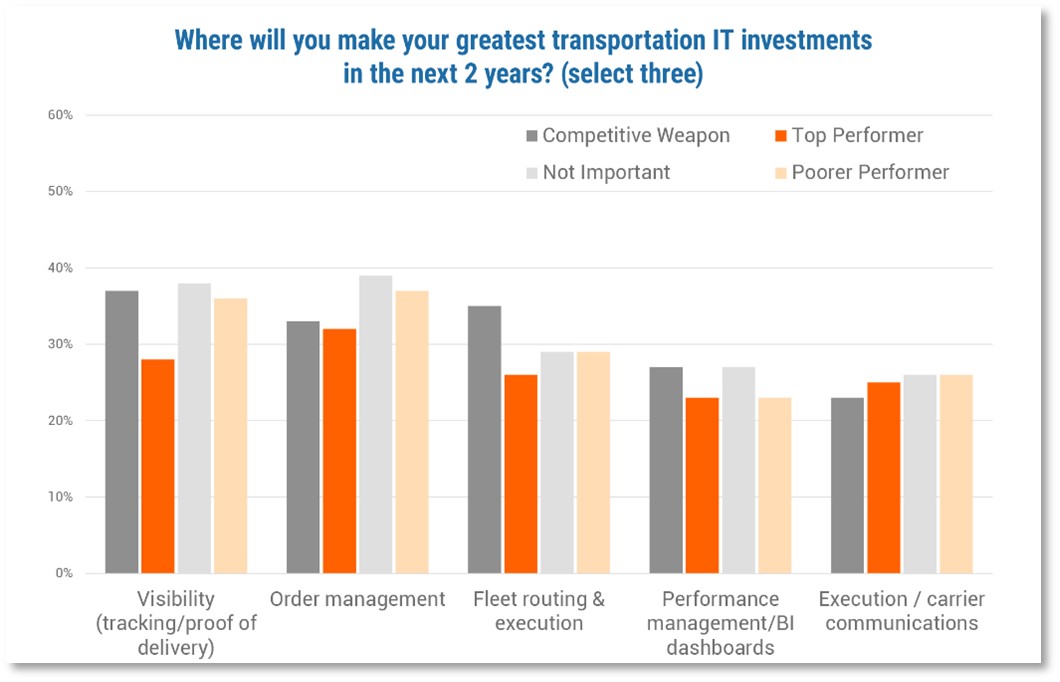

In terms of areas of focus, for the 7th consecutive year, real-time transportation visibility held the top spot for greatest transportation IT investment. Visibility was cited as the priority technology investment by 36% of respondents and was closely followed by order management at 35% in the 2nd spot. Jumping into the 3rd spot, fleet routing was noted by 29% of respondents as an important technology investment, compared to being 8th in 2023. Carrier sourcing continued to decline as an IT investment area for the 3rd year in a row, cited by only 20% of respondents and landing in the 10th spot in the capabilities rankings.

Source: Descartes

“This year’s study once again shows a correlation between business performance and management’s perception of the importance of transportation, as companies that place a higher strategic value on transportation realize stronger financial performance and growth,” said Mike Hane, Director, Product Marketing, Transportation Management at Descartes. “Top performers continue to take more aggressive actions to grow and expand delivery options for customers, which requires increasing technology investments such as visibility and order management. By contrast, poorer performers are more focused on cost cutting and are 10X less likely to expect growth greater than 15% annually than top performers, according to study findings.”

Descartes and SAPIO Research surveyed 630 participants representing the logistics community (i.e., brokers, forwarders and third-party logistics providers) and shippers (i.e., manufacturers, distributors and retailers) from a wide variety of industries. The goal was to understand how companies view the role of transportation management; uncover which capabilities, technologies and competitive strategies/tactics are having the greatest impact on transportation operations; and provide an outlook on future transportation IT investment.

Respondents were based in the United States, Canada and in Western Europe.