Global diesel and gasoline markets are witnessing blowout crack spreads in the US$50-60 per barrel (bbl) range, reflecting a clear lag in the refining system to respond effectively and decide between supplying diesel or gasoline. The precarious situation is driven by inventory stocks across the globe being at their lowest levels historically and, therefore, unable to provide the necessary shock absorbers. The loss of Russian refining owing to operational outages and product containment challenges has caused a diesel/gasoline hole greater than 1 million barrels per day (bpd) in Europe that is not easy to plug, Rystad Energy research shows.

“Diesel is the lifeblood of the global economy, essential to vital sectors such as agriculture, construction, and transportation – its price impacts almost all supply chains and goods. Governments face tough decisions. They can assist consumers by dropping taxes on diesel, but this will likely only increase demand, which may support the overall economy but will worsen the existing tight supply situation. If supply does not improve, governments will be forced to enact emergency plans to limit sales to consumers in order to ensure essential sectors are kept going,” says Per Magnus Nysveen, Head of Analysis at Rystad Energy

On the demand side, the recovery is resilient as residual Covid-related restrictions are being removed. Latest guidelines from the US Centers for Disease Control and Prevention (CDC) to remove all Covid testing requirements for incoming flights is one such clear indicator. On the supply side, Russia’s invasion of Ukraine has disrupted product flows and crude flows to the European market at a time when the rest of the world has limited ways in which to respond.

Refineries by Region

The loss of crude supply has hindered the shrinking European refining sector’s ability to run at high utilization rates and has accelerated a downward trend in Europe which has lost 2 million bpd of crude refining since peak capacity of 17.5 million bpd in 2005. The US has been following a similar trend, losing between 1 million and 1.5 million bpd of refining capacity in the last 3-4 years. The move to phase out Hydrofluoric Acid (HF) Alkylation technology and lower availability of imported vacuum gas oil (VGO)/residues has dented the US refining sector’s ability to increase gasoline production.

Outside the European Union and the US, refinery capacity has been growing primarily to meet rising domestic demand. However, the pandemic has severely impacted the pace of additions with many Middle Eastern, African and Asian refinery projects reporting delays owing to supply chain and resource issues. Recent news that Nigeria Dangote Refinery is unable to secure commissioning team is a case in point. Latin American refining was already in decline prior to the pandemic and does not have much to offer, let alone meet domestic product supply.

Overall, the cost of refining has gone up alongside inflated gas, hydrogen and utility costs. Thus, a constrained refining system as demand has recovered has resulted in precariously lower days of supply cover in most countries. Many have mandated higher days of stock cover making it hard to solve regional product imbalances with trade flows.

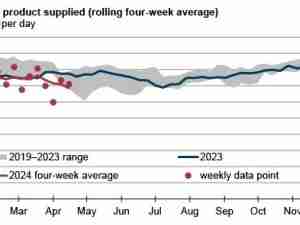

To meet rising demand, refining runs will need to increase by 4.6 million bpd from June to August 2022, compared to current projections of 3.3 million bpd. With a limited increase in overall runs, the second order lever of diesel versus gasoline optimization does not have much to offer. Diesel/jet fuel maximization is being pursued and indirectly fueling gasoline crack spreads.

Asia’s petchem-aromatic system is not operating at its highest level either as pandemic-related demand has waned. This is reflected in a continued weakening of naphtha cracks in Asia. Therefore, additional gasoline blending aromatic components are unlikely to be available to bump up gasoline supply. Strong very low sulfur fuel oil (VLSFO) cracks is also possibly making it harder for more VGO/residue to be diverted for fluidized catalytic cracking (FCC).