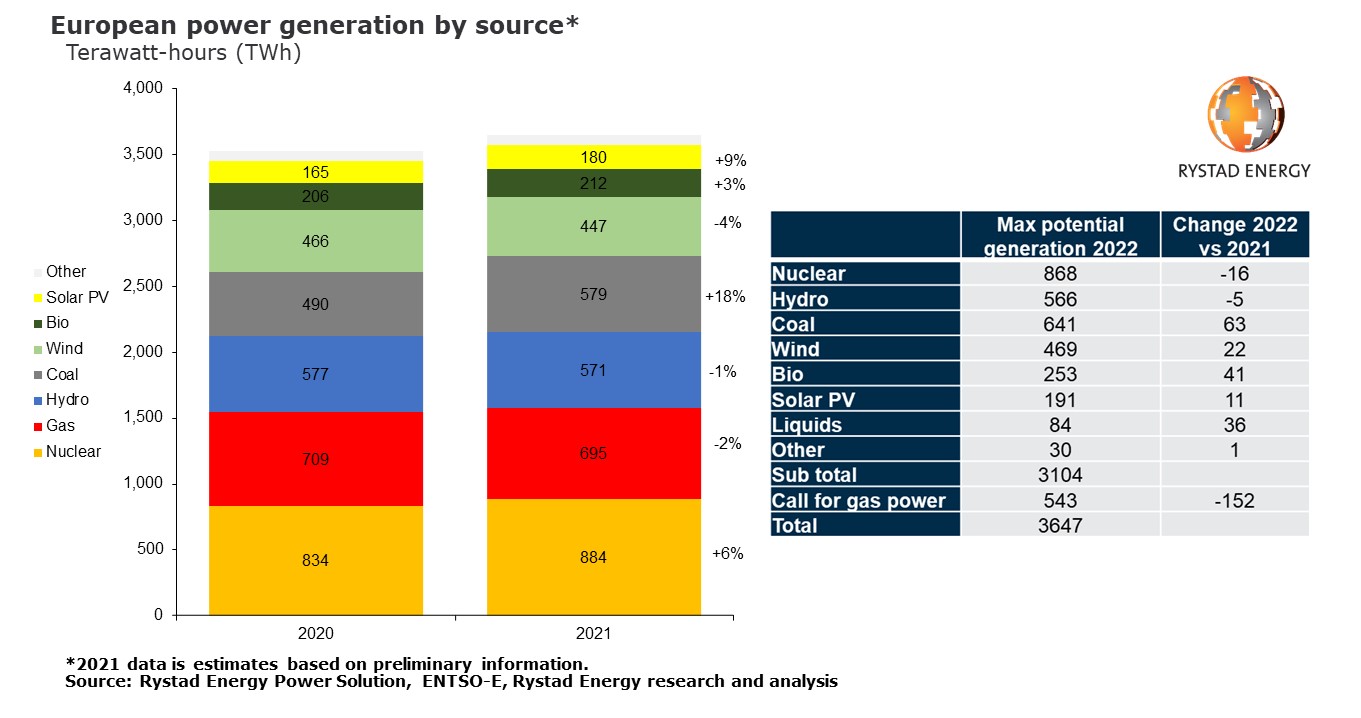

Following several years of strategic de-carbonization of the European power market, preliminary numbers suggest coal-generated electricity increased in the region last year for the first time in almost a decade, rising 18% from 470 terawatt-hours (TWh) in 2020 to 579 TWh, Rystad Energy research shows. Gas, hydro and wind power generation dropped last year, increasing the pressure on other energy sources, including coal, to bridge the gap.

Coal-fired electricity generation has been steadily declining in Europe since 2012, but affordability concerns surrounding gas, and availability concerns impacting nuclear, wind and hydro generation, could maintain coal’s momentum in 2022 and beyond. If, for instance, high gas prices persist or military conflict between Russia and Ukraine materializes, coal generation could jump by an additional 11% this year to 641 TWh – a return to 2018 levels – to ensure the lights stay on across the continent.

“European countries have been gradually decommissioning coal infrastructure over recent years, as the power market moves towards a greener, less carbon-heavy future. However, as the regional energy crisis shows, coal remains a critical component of the power mix, especially when the reliability of other sources of energy is called into question, and that is unlikely to change in the immediate future,” says Carlos Torres Diaz, head of gas and power markets research at Rystad Energy.

While a military escalation in Eastern Europe would disrupt Russian gas flows – albeit the extent of which is uncertain – even without any supply disruption, record-high prices are forcing buyers to explore alternatives. Gas prices in December 2021 hit €182 ($207) per megawatt-hour (MWh), a record high and a staggering 900% year-over-year increase.

Despite soaring prices, European gas demand from the power sector fell only marginally in 2021, by around 3 billion cubic meters (Bcm) to 144 Bcm, as other components of the power mix faced myriad challenges. The continued reliance on gas helped catalyze the widespread energy crisis and sent consumer electricity prices skyrocketing across the continent last year.

Hydro and wind-generated power fell in 2021 for the first time, helping to support fossil fuel dependency on the back of low wind speeds and hydro dam levels in crucial producing countries. While wind generation is projected to increase marginally in 2022 – from 447 TWh to 469 TWh – hydro generation is expected to remain low.

Outlook for this year: 2021 on repeat?

If gas prices remain high or the Russia-Ukraine conflict results in a significant drop in gas-fired generation in 2022, Europe has options to make up the shortfall. Despite decommissioning infrastructure, coal power generation remains the most flexible option, with the possibility to increase supply by 63 TWh. Bioenergy plants and liquids, which currently make up a small portion of the total power generation, could add 77 TWh combined, while new wind and solar PV capacity that is expected to come online this year could contribute an extra 33 TWh.

A ray of hope in 2021 came in the form of nuclear generation, which rose by 6% compared with 2020, climbing to 884 TWh. Nuclear has been the largest contributor to electricity generation in Europe since 2014, but dark clouds may be on the horizon, highlighted by France’s EDF last week downgrading its expected nuclear output in 2022 and 2023.

EDF dropped its output expectations for the second time in a month due to aging reactors, scheduled maintenance and unexpected outages. France’s average nuclear power of 370 TWh will be slashed to between 295 TWh and 315 TWh in 2022 and between 300 TWh and 330 TWh in 2023. This is worrying news for the market, as reduced nuclear generation will extend and exacerbate the European power crunch and continue to put pressure on the already tight supply situation for electricity on the continent.

Reservoir levels in hydroelectric dams across the continent are at worryingly low levels, meaning an increase in hydro-generated power in 2022 is unlikely. As a result of these limitations of other sources of power generation, gas is expected to remain the marginal supplier that can make up any shortfalls. If gas prices remain high – which looks likely – consumers may have to battle with soaring energy prices for some time to come.