London, UK – The freight market for S/R (Handysize) vessels will remain under pressure throughout 2018 on account of strong fleet growth and weak olefin trade, according to the latest edition of the LPG Forecaster published by global shipping consultancy Drewry.

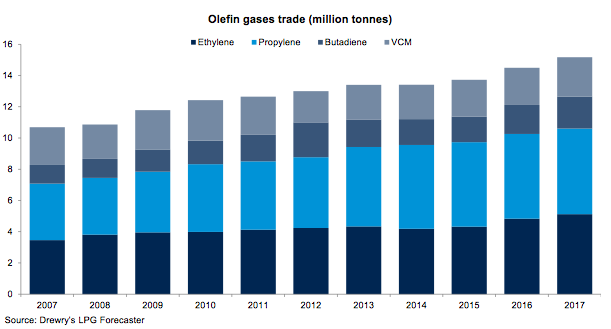

The market has been under pressure since 2017, but olefin trade growth has averaged 3.1% annually over 2012-17, down from 4.0% during 2007-12. Although s/r vessels can also carry LPG, the market is oversupplied with bigger f/r vessels and there is limited employment opportunity in this trade for Handysizes.

Fleet growth in the Handysize segment will remain strong, at 9% in 2018, which will keep the freight market for these vessels under pressure throughout the remainder of the year. “However, as the fleet growth slows down from 2019 and gas trade (olefin and LPG combined) continues to expand around its organic pace of 4% annually, the freight market should start recovering in 2019,” added Sharma.