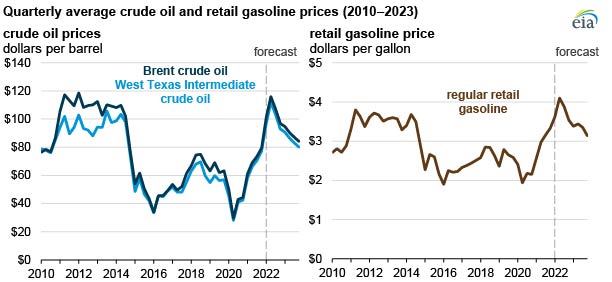

On February 24, 2022, Russia initiated a further invasion of Ukraine that contributed to the recent sharp increase in the Brent and West Texas Intermediate (WTI) crude oil prices. This sharp rise in crude oil prices reflects increased geopolitical risk and uncertainty regarding how announced and potential future sanctions may affect global energy markets. In our March 2022 Short-Term Energy Outlook (STEO), which was finalized on March 3, we increased our forecast price of international benchmark Brent crude oil to $116 per barrel (b) for the second quarter of 2022. We expect gasoline prices to average about $4.10 per gallon (gal) during the second quarter of 2022 and then decline through the rest of the year.

We forecast that the price for WTI, the U.S. benchmark, will average $113/b in March and $112/b for the second quarter of 2022. Our forecast is subject to heightened levels of uncertainty due to various factors, including Russia’s further invasion of Ukraine, government-issued limitations on energy imports from Russia, Russian petroleum production, and global crude oil demand.

On March 8, President Biden announced that the United States would ban imports of oil, liquefied natural gas, and coal from Russia. The United Kingdom announced that it will phase out imports of oil from Russia over the course of 2022, and the European Union announced a plan to significantly reduce the amount of fossil fuels that Europe imports from Russia before 2030. We completed our March STEO update before the United States, the United Kingdom, and the European Union all announced new limits on energy imports from Russia, so our forecast does not include the effects of these announcements on energy markets.

In addition, several international oil companies announced plans to stop their operations in Russia and end partnerships with Russian firms, which could limit future crude oil production in Russia. The new announcements could put additional upward pressure on crude oil prices; however, any international response and the impacts those responses may have on global balances are uncertain.