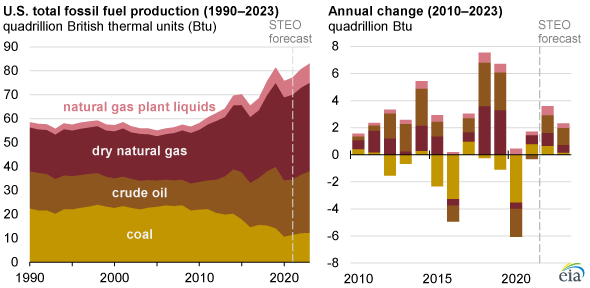

After declining in 2020, the combined production of U.S. fossil fuels (including natural gas, crude oil, and coal) increased by 2% in 2021 to 77.14 quadrillion British thermal units. Based on forecasts in our latest Short-Term Energy Outlook (STEO), we expect U.S. fossil fuel production to continue rising in both 2022 and 2023, surpassing production in 2019, to reach a new record in 2023.

Of the total U.S. fossil fuel production in 2021, dry natural gas accounted for 46%, the largest share. Crude oil accounted for 30%, coal for 15%, and natural gas plant liquids (NGPLs) for 9%. We expect those shares to remain similar through 2023.

U.S. crude oil production dropped slightly, by an estimated 1%, in 2021, but we expect it to increase by 6% in 2022 and 5% in 2023. We forecast that, in 2022 and 2023, crude oil prices will remain high enough to encourage growth in the number of active drilling rigs and continued improvement in drilling efficiency.

U.S. coal production increased by an estimated 7% in 2021, driven by increased demand for coal because of rising natural gas prices. Coal's comparatively lower prices made coal more economical for use in electric power generation compared with natural gas. In 2020, U.S. coal production had fallen to its lowest level since 1964. We forecast that coal production will increase 6% in 2022 as coal-fired electricity generators rebuild inventory levels. However, we forecast that coal production will only increase by 1% in 2023 as demand for coal in the electric power sector declines.

U.S. NGPL production increased by 4% in 2021. We expect U.S. NGPL production to increase by 9% in 2022 and then by 4% in 2023. Because NGPLs are a coproduct of natural gas, our forecast for rising NGPL production is linked to our forecast for rising natural gas production.

Principal contributor: Ornella Kaze