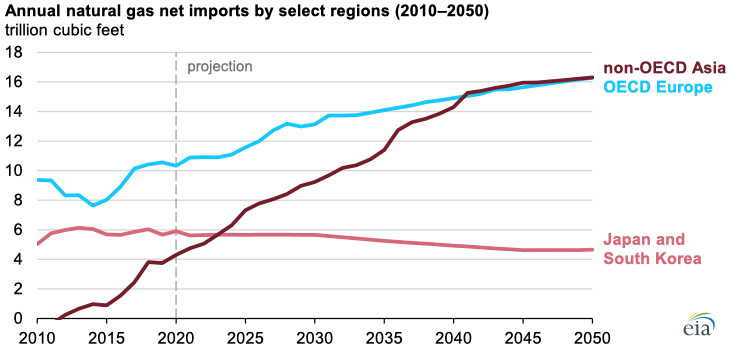

In our International Energy Outlook 2021 (IEO2021), we project that non-OECD countries in Asia will collectively become the largest importers of natural gas by 2050. In 2020, the countries of OECD Europe were collectively the largest importers of natural gas, followed by Japan and South Korea combined, and then non-OECD Asia, which includes China and India.

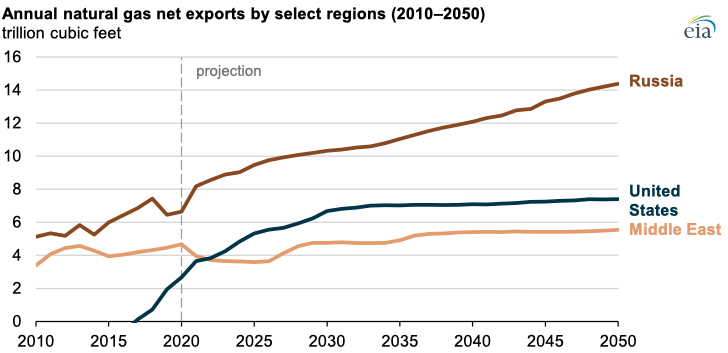

All of these groups of countries import natural gas because their consumption exceeds their domestic supply. We project that continued economic growth in non-OECD Asia, led primarily by China and India, will more than double net imports of natural gas into the region by 2050. To meet the natural gas needs of these growing economies, we project that global natural gas production will increase steadily along with exports from the three largest natural gas producers: the United States, Russia, and the Middle East.

We project that Russia, in particular, will show the largest growth in net exports, more than doubling over the projection period to remain the largest net exporter of natural gas by 2050, at more than 14 Tcf. Close proximity to Europe and Asia will facilitate growth in Russia’s net natural gas exports through established pipeline infrastructure, potential future pipeline additions, and liquefied natural gas exports. During the next 10 years, we project that the United States will see its most rapid period of growth; net exports of U.S. natural gas nearly double as the United States expands its LNG infrastructure and produces natural gas at high volumes.

Principal contributors: Peter Colletti, Max Ober