Almost four months after the invasion of Ukraine began, European nations are still importing huge quantities of Russian fuel.

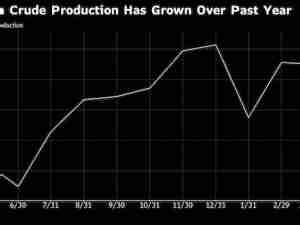

So far this month, the continent has received close to 14 million barrels of diesel-type fuel from countries that used to be part of the Soviet Union, according to Vortexa Ltd. data compiled by Bloomberg. That’s a relatively limited drop-off from pre-war levels earlier this year and the vast majority, if not all, of that fuel originated in Russia.

That may come as a surprise to some, given how many European leaders and oil companies have criticized Russia’s invasion of Ukraine. Less than a week after President Emmanuel Macron and Chancellor Olaf Scholz visited Kyiv in a show of support for Volodymyr Zelenskiy, the data show the biggest buyer of the Russian fuel is France, closely followed by Germany.

To be sure, stripping Russian diesel out of Europe’s supply-chain is easier said than done. The country still remains by far the European Union’s biggest external supplier, even after the war began. Soaring prices and an exceptionally tight global market are also no doubt making it hard to turn away fuel, wherever it’s from.

Europe’s seaborne imports of diesel-type fuel from ports in former Soviet Union countries have steadily dwindled since the war began in late February, down month-on-month, and year-on-year, in March, April and May. But while the drop is steady, it’s not precipitous: Russia was still responsible for more than half of Europe’s imports of diesel-type fuel in May, dwarfing shipments from other suppliers in the Middle East and Asia, according to Vortexa data.

The decline also appears to have found a floor, with Europe’s average daily imports during the first 20 days of June higher than the May average. Imports for that period were about 13.75 million barrels, enough to meet UK demand for roughly three weeks.

The EU has approved a ban from early next year on purchasing refined petroleum products from Russia delivered by sea. Dealing with the fallout of that supply loss shouldn’t be underestimated: Europe’s main diesel futures contract reached a record premium to crude oil on Monday, according to Bloomberg fair value data. And that’s while millions of barrels of Russian fuel are still arriving every week.