Removing import tariff of cobalt metal is unlikely to increase imports in near term

China’s Tariff Commission of The State Council of China announced last week that it will remove the 2% import tariff for cobalt from 2023.

The tariff authority said the main reason is to strengthen the supply and improve industrial supply chain resilience.

The main feedstock for producing cobalt sulfate and tetroxide, which are crucial raw materials for electric vehicle (EV) batteries and consumer electronics batteries respectively, is cobalt intermediates (typically cobalt hydroxide).

Cobalt metal can also be dissolved to feed into cobalt chemical production.

Nevertheless, it is estimated that both cobalt consumers and traders in China are unlikely to increase their import demand since the supply of cobalt minerals is estimated to pick up quickly in 2023 as prices have fallen quickly in the past few months.

The price of cobalt hydroxide, cif China is around $11 per lb in early January this year, compared to $29 per lb in January 2022.

We estimate cobalt mining output will rise to 186,000 tonnes in 2022, up by 17% from 159,000 tonnes in 2021.

In addition, cobalt mining output is estimated to jump further to 235,000 tonnes in 2023.

The amendment of Tesla/Piedmont agreement may suggest spodumene supply remains tight

Tesla and Piedmont Lithium amended their previous spodumene concentrates offtake agreement signed in September 2020.

There have been quite a few amendments in the agreement including the change of sourcing mine, volumes, initial contract length, and pricing.

This may indicate spodumene supply will remain tight, at least in the near term.

Meanwhile, spodumene miners, especially those holding developed mineral resources in countries that have free-trade agreement with the United States, may have an upper hand in price negotiations.

The change in the pricing mechanism of the long-term contract is noteworthy

In the previous agreement, both parties agreed a fixed price for the binding agreement.

In the amended agreement, the pricing will be determined by a formula-based mechanism linked to average market prices for lithium hydroxide.

This change might indicate the miner has got more pricing powers on the negotiation table as spodumene supply remains tight given the moderate output increase in 2022.

Though the global spodumene output is estimated to grow 41% year on year in 2023, the global electrical vehicle (EV) battery demand is likely to leap 75% on annual basis in 2023.

In addition, it is always critical for EV manufacturers to secure steady supply of lithium minerals considering the importance of acquiring more market share as EV penetration is accelerating.

On top of all, US car manufacturers like Tesla are paying certain premiums to secure lithium minerals produced in countries with free-trade agreements with the US to meet the critical mineral requirements for the EV tax credit stated in the recently introduced Inflation Reduction Act.

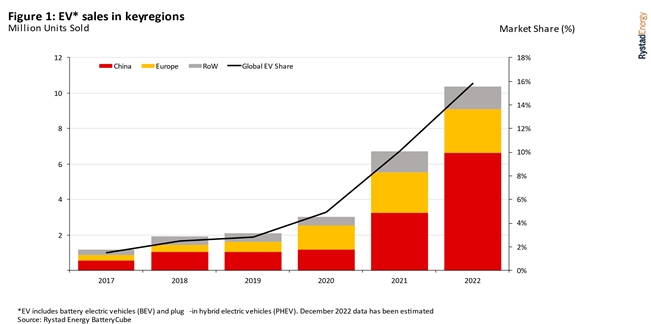

EV sales in 2022 grow by around 56% year-on-year

The global automotive market in 2022 went through a slowdown, marked by inflation pressures, and impacts from the Russia- Ukraine conflict.

The European automotive market contracted heavily from 2021, especially in the UK, France etc., while other global automotive markets saw either a stagnation or slight contractions from 2021 levels.

EV sales, however, increased greatly, up by almost 56% year-on-year.

While December 2022 data is yet to be fully released, we estimate that EV sales will reach around 10.5-11 million units, grabbing a market share of 16% of new vehicles sold in 2022, up by 10.1% from 2021.

This increase comes largely on the back of growing EV sales in China, which accounts for almost 68% of global EVs sold.

EV sales doubled in number, while market share also rose from around 19% to 25%.

The European EV market posed a different story.

While market share in many countries grew, absolute EV sales almost stayed flat.

This was largely due to a declining car market in Europe.

2023 is expected to be another positive year for EVs, and while subsidies are slowly being phased out in different countries, the supply chain is expected to ease up this year.

The EV market share is forecast to reach close to 21% this year, with around 14.5 million units sold.

Tesla and the curious case of discounts

While 2022 saw a massive rise in EV sales, what was more impressive was demand clearly outstripping supply.

Many automotive OEMs reported order backlog times of around 6-12 months, with many also cancelling orders.

A large aspect of this was lower inventories and production not ramping up quick enough.

Tesla also saw record quarter deliveries both in Q1 2022 and Q3 2022.

However, the company saw reduced sales in China towards the end of the year, and this sparked speculation on whether Tesla’s demand could continue at current vehicle costs.

This has further been exacerbated with the company announcing price cuts across all models in different countries.

The price cuts began in China amid weakened demand in an attempt to fight in this increasingly competitive market.

More than 30% of sales comes from Chinese OEMs globally, and a large chunk of this is concentrated in China.

Tesla continued to lose market share to BYD, and began slashing prices across models, with prices dropping by as much as 13.5% for some variants.

This comes as a complete U-Turn given the constant price hikes the company introduced over the last year.

Further, Tesla inventories within China are reported to be only around 1 month time, a record low in the country, indicating further weakening demand.

The story is the same in the US, where Tesla offered discounts up to $7,500, similar to the amount which would be offered for its EVs under the new IRA tax credit system.

While initially thought to dissuade buyers from cancelling orders to instead place them again in 2023 when the tax credit would kick in.

However, Tesla inventory in the US is also around the 1-2 month mark.

There is now great interest to see if Tesla may soon concede ground in the growing EV market, especially with US OEMs ramping up deliveries of electric trucks, and Chinese OEMs continuing to introduce affordable models.

Tesla’s inventory levels and earnings report will be one to closely watch and will determine what is in store for the company in 2023.