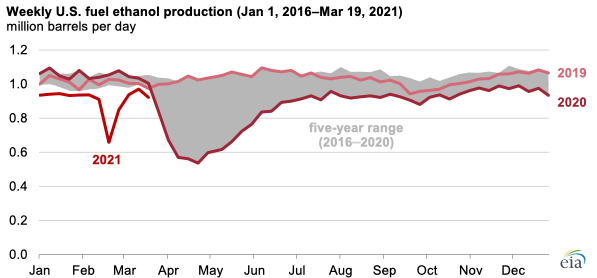

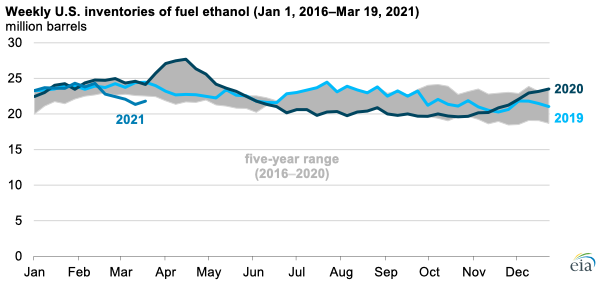

The colder-than-normal weather that affected much of the United States in mid-February and disrupted Midcontinent and Gulf Coast petroleum markets also affected fuel ethanol producers. Fuel ethanol production fell to the lowest levels since the onset of responses to COVID-19 in spring 2020. U.S. weekly fuel ethanol production fell to an average of 658,000 barrels per day (b/d) during the week of February 21, 2021, which was the lowest weekly production level since May 11, 2020, and 38% lower than at the same time last year, according to EIA's Weekly Petroleum Status Report. Production rates have since returned to average levels, but fuel ethanol inventories remain lower than their typical seasonal averages heading into the summer driving season.

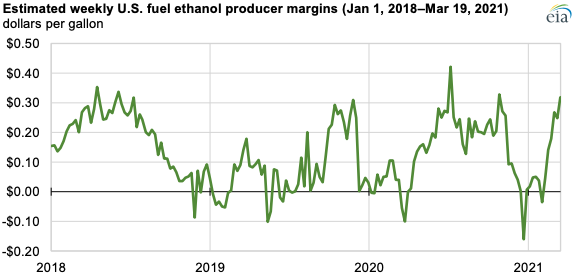

Fuel ethanol operating margins and production rates are largely driven by fuel ethanol, corn, and natural gas prices. Estimated fuel ethanol margins fell to negative levels in February, when natural gas supplies were disrupted and natural gas spot prices approached near record-high levels. As a result, many fuel ethanol producers reduced production rates. Amid record-high natural gas prices, some fuel ethanol producers chose to sell natural gas supplies back into spot markets instead of producing fuel ethanol. U.S. weekly fuel ethanol production has since increased to an average of 922,000 b/d for the week ending March 19, but fuel ethanol inventories have yet to fully return to average levels after the supply disruption.

Principal contributors: Sean Hill, Estella Shi